The shipping industry is putting its best foot forward in compliance with IMO 2020 regulations. While the oil majors are busy in making available the compliant fuel, shippers can keep their fingers crossed as they calculate the Bunker Adjustment Factor that will add to their freight cost

Come January 1, 2020 and the winds that blow over the oceans will become a lot more cleaner, thanks to the IMO 2020 regulations that will reduce the amount of sulphur emitted from maritime shipping to 0.5 per cent, from the current emissions cap of 3.5 per cent. In fact, a major environmental damage caused by the shipping industry has been the release of SOX into the atmosphere. An interesting fact to be noted here is that the 15 largest ships in the world produce more sulphur emissions than all of the world’s cars combined. But before we proceed a quick flashback – The IMO is the United Nations agency responsible for implementing global maritime regulations after they are ratified by a number of member states. On October 27, 2016, its Marine Environmental Protection Committee (MEPC) had agreed to implement a global 0.5 per cent m/m Sulfur Oxide emissions limit, effective January 1, 2020. This new limit makes the emissions approximately 85.7 per cent lesser compared to the current 3.5 per cent m/m limit.

“This is a regulatory game changer with significant implications for the economics of shipping and there are even more reflective changes in the future with the introduction of low-carbon fuel followed with the arrival of commercially viable zero CO2 fuels suitable for global application. The industry is gearing up towards compliance and bunker suppliers have confirmed availability of compliant fuels. Owners are currently working on preparing their implementation plan. One of the important aspects of this new regulation is getting the crew up to speed with the changes and therefore awareness on board is critical to successful implementation,” informs Arun Sharma, Executive Chairman, IRCLASS.

- Shipping lines can meet the exhaust limitation in various ways:

- Switching from high-sulphur fuel oil (HSFO) to marine gas oil (MGO) or distillates

- Using very-low-sulphur fuel oil or compliant fuel blends (0.50% sulphur)

- Retrofitting vessels to use alternative fuels such as LNG or other sulphur-free fuels

- Installing exhaust gas cleaning systems (scrubbers), which allow operation on regular HSFO

Carriers will use these options individually or a combination of them whichever best suits their needs in the short and long term. A combination of factors such as fuel availability, fleet age and makeup, charter versus ownership, capital cost, shipyard capacity, and implementation time will be considered in making this critical decision. And further, shippers will need to understand the strategy of the shipping lines they use, in order to get an insight on how these costs will manifest into their fuel surcharges.

Anil Devli, CEO, INSA does shed some light on the merits of each option, he says: “LNG as a ship fuel can lead to a significant reduction of SOX, NOX, CO2, particulates (PM) and black carbon. LNG is reported to on ‘well to wake’ basis reduction of CO2 emissions by at least 20 per cent. Installation of scrubber is related not only to the cost of scrubber but also other parameters such as availability of scrubbers, space and time at yards for fitting of scrubbers. The pay back and feasibility is directly linked to the difference in price of Very Low Sulphur Marine Fuel Oil (VLSMFO) and 3.5 per cent Sulphur fuel.”

Let’s evaluate each of these options:

Low sulphur oils and blends

This is the most straight forward option requiring the least upfront capital investment or technical modifications in the carriers. “MGO is the most costly fuel option but will require little operational change,” says Capt. Rahul Choudhuri, MD – Asia, ME & Africa, Veritas Petroleum Services. Even the crews will be able to accommodate this switch in fuel more comfortably. But this comfort comes at a cost – MGO has the highest cost and will further increase the lube oil cost. The caloric content of MGO is higher than HFO, thus its consumption will be about 5 per cent less by weight compared to HFO, slightly lowering the price gap. During the initial compliance period, lack of scrubber installations will translate to most ships shifting to MGO use. Consumers can expect at least during the first period post 2020, most of their containers will be carried on ships consuming MGO.

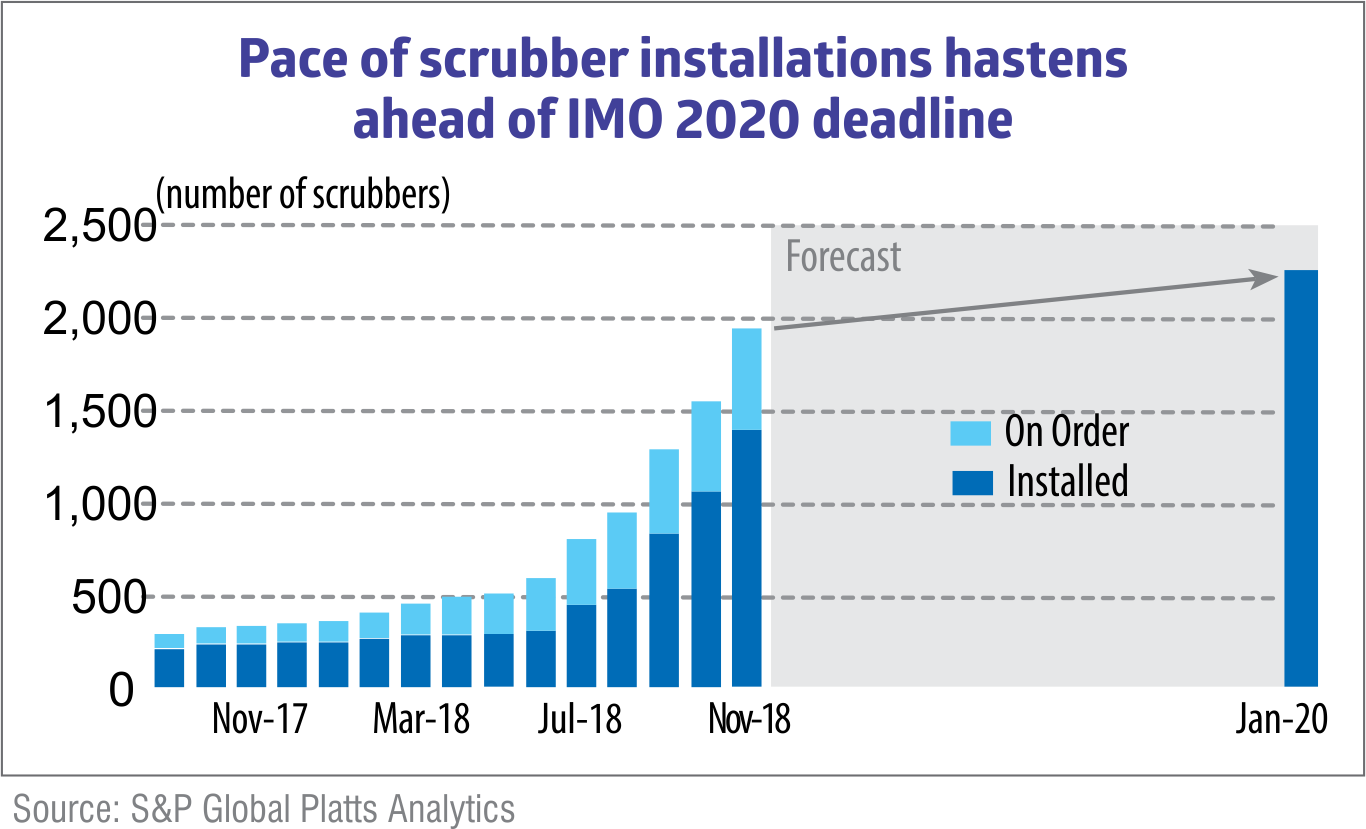

Approximately 2000 ships that will continue to use HFO will resort to installing scrubbers. As the consumption of low sulphur fuel blend (ULSFO) increases it will replace MGO, but in future as more ships get scrubbers fitted, demand for HFO will again increase. ULSFO is expected to lower the burden of Bunker Adjustment Factor (BAF) that shippers are required to pay.

“From what we see so far, the majority of ship-owners will go for low Sulphur compliant fuel oil as this is the most easily available. Scrubber installations are picking up and most ship-owners are looking at fitting some scrubbers in their fleet now although exact numbers will vary. LNG is too specialized to be an immediate solution for IMO 2020, with marine industry demand for LNG anticipated to be only 2-3 per cent of the total marine fuel demand in 2020,” clarifies Capt. Rahul Choudhuri.

Bunkering

While there is still time to debate on the ultimate fuel for compliance, the Indian industry seems to have some serious preparations going on. “We have been informed by the oil PSUs and other product traders that low sulphur fuel would be available at all major Indian ports. IOCL has arranged the availability of 0.5 per cent sulphur fuel and owners are confident of using low sulphur fuel. However bunkering as an industry will only grow if the supply price of bunkers is competitive. Additionally, the legal infrastructure and procedural aspects of bunker supply will also need to be specifically addressed if bunkering has to be encouraged to grow in India,” shares Anil Devli.

Fitting scrubbers onboard ships

Scrubbers basically clean the sulphur and particulate matter from the ship’s exhaust. They are already in use widely on land in power plants so it is not an alien technology. However, the harsh marine environment does pose some difficulties when designing the systems for use on ships. Scrubbers allow a ship to continue burning lower-cost HFO, removing the harmful substances on the ship as opposed to at the refinery stage.

Scrubbed HFO is considered cleaner than ULSFO or MGO because of the lower particulate matter present in it. Using a scrubber results in an increased fuel consumption of about 1.5 per cent-2 per cent. Presently price of scrubbers varies from $1.0 million and up to $6.0 million for the largest ships with complex engine setups. Its price depends on the manufacturer, type of scrubber, size of ship and engine configuration. Installation cost is a major factor as for small to mid-sized ships the installation cost may even exceed the cost of scrubber, bringing total costs to around $2 million-$8 million per ship. But as the shipyards gain experience in installing scrubbers the retrofitting cost may come down.

Liquefied Natural Gas (LNG)

In the short term, LNG is just not capable of supplying 50,000 ocean going vessels that presently operate on the high seas because these vessels are not ready to use such alternative fuel. At this point LNG supply and infrastructure looks limited in scope. But it has an important future.

Enforcement

Monitoring for non-compliance and enforcement of penalties will be done by flag and port states. Flag states will issue vessels an International Air Pollution Prevention (IAPP) certificate. The IAPP obligates carriers to uses fuel oil with a sulphur content that does not exceed the applicable MARPOL limits, documented by a bunker delivery note. Audits of bunker delivery notes, vessel documentation will be done by authorities to validate use of low sulphur fuel and bunker sampling will be done where infractions are suspected.

Compliance by shipping lines

Shipping lines are well down the path in planning and implementing for compliance. Let’s start with examining our home pitch first. “The Indian shipping industry has been in the forefront of working along with the government of the India in respect of its commitment in ensuring compliance on this issue including vessel engaged in providing coastal services. Various discussion groups, seminars and workshops have been held under the guidance of the DGS in order to have clarity on the subject and spread the awareness in respect of compliance. The Oil PSUs have been a willing partner in these efforts. Indian shipping lines are happy to be assured by Indian refining companies to make available VLSMFO adhering to ISO 8217-2017 standard. This fuel would be available w.e.f. October 2019, well in advance of the intended date of commencement of the convention,” reveals Anil Devli.

“IRClass is already working with various stakeholders to ensure compliance for ship owners. We have held a stakeholder meeting recently in which shipowners, engine makers, bunker suppliers, ship managers all participated to discuss various aspects and challenges related to compliance,” reveals Arun Sharma. IRClass has taken below initiatives to assist owners in achieving compliance:

- Advise to shipowners in preparation of ship implementation plan

- Liaison with engine manufacturers and shipowners on impacts on engines and compatibility with 0.5% fuel

- Represented IACS in Joint Industry Project on potential safety and operational issues related to the supply and use of 0.50% max Sulphur fuels

- Classification notes prepared to provide guidance on fuel oil treatment system

- Developed rules for use of methanol as fuel

“Maersk line is gearing up to use low sulphur fuels, while scrubbers will also be installed on some of our vessels. The increase in cost for the container shipping industry to comply with the new regulations could run up to $15 billion annually. For Maersk alone, the cost of compliance could exceed $2 billion in additional fuel cost a year. We plan on introducing a bunker surcharge for our long-term contracts and a surcharge for our spot and short-term contracts,” declares Steve Felder, Managing Director, Maersk South Asia.

COSCO Shipping Lines has made plans to install scrubbers on 23 containerships in its fleet. CSIC No.711 Institute will supply scrubber systems for five 19,000 teu ships and eight 14,000 teu ships, while a Finnish company Valmet will supply scrubbers for ten 4,250 teu ships. All the scrubber systems will be installed before the end of this year.

Marine fuel market

Fuel cost accounts for about 50 per cent of the total operating cost for a ship and will gain more significance as carriers struggle to gain market advantage. The current global marine fuel demand is estimated to be around 400 million tonnes and by 2020 it is expected to exceed 500 million tonnes. Ships with 4000 teu and more capacity account for approximately 20 per cent of the total marine fuel demand. “At present shipping industry consumes 3.2 million barrels per day (bpd) of HFO and 700,000 bpd of MGO. From 2020, this proportion will change to 700,000 bpd of HFO and 3.4 million bpd of MGO,” predicts Container Shipping Lines Association (CSLA). “By 2020, there will be around 900,000 bpd of ULSFO made available to the market. We expect the MGO demand could increase from 1.3 million bpd in 2019 to 3.4 million bpd in 2020.”

Till date, residual/heavy fuel oil (HFO) dominated the bunker market, followed by distillate marine gas oil (MGO). MGO contains 0.1 per cent sulphur, is a lighter fraction and has better quality than diesel fuel. It is typically one of the highest marine fuel grades and is more expensive. HFO is the lowest cost fuel, while MGO typically is offered at a 40-50 percent premium.

Global bunkering hubs are pulling up their socks to supply the shipping lines the most compliant fuel of choice. “The Maritime & Port Authority of Singapore (MPA) has categorically stated that Singapore will be ready for any compliant fuel choice. It is likely that other key bunker ports will do the same. The bigger challenge will be for the larger number of smaller bunker ports to cope. Singapore is supplying some commercial 0.5 per cent Sulphur fuels already,” informs Capt. Rahul Choudhuri.

As recorded on February 8, 2019, global top 20 ports had a price average of $420 per tonne for HFO and $647 per tonne for MGO. Forward price projections and general market consensus indicate at a price differential upwards of $180 per ton based on recent crude oil prices. Capt. Rahul Choudhuri’s maths suggests that the market price for MFO (Residual) 180 & MGO (Gas Oil) is around $450 & $650 per ton respectively. The new IMO 2020 compliant fuel will be priced lower than gas oil but the margin remains to be seen. Forecasters are anticipating a difference of $400/mt between residual and MGO in 2020, due to increase in MGO demand and falling demand for HFO. There is talk of a 3million barrel/day switch from HFO to MGO in 2020.

Oil major and refiners are already on the job creating new low-sulphur fuel blends (ULSFO) which will typically be cheaper than MGO and have physical properties closer to those of HFO. These ULSFO can be developed by blending MGO and HFO with an expected price which is between the costs of these two options. But the ride is going to be adventurous cautions Capt. Rahul Choudhuri. “The new IMO 2020 compliant fuel will be a blended fuel with insufficient working experience. Our fuel testing experience so far with these new low Sulphur fuel oils shows that these have wide variations in viscosity, total sediment, aluminium & silicon (cat fines). These are quality indicators of these complex blends and show that compatibility and stability issues will be there. Problem issues with cold flow properties and chemical contamination will also need to be addressed. So, effective fuel management for ship-owners will get extremely important for 2020 and beyond.

The demand – supply dilemma

Shipping industry will need to fork out an additional $60 billion annually by 2020, based on an expected rise in MGO and ULSFO demand and their premiums over HFO, reveals CSLA. If refiners see higher margins in selling MGO and cut down on production of HFO, then scrubber users will be in a catch-22 situation. The dilemma for refiners is that any extra production of MGO will go unsold if more ships fit scrubbers and seek to purchase less costly HFO.

The impact on coastal shipping

While availability of low sulphur fuel oil will ensure compliance by Indian shipping companies, concerns have been expressed on the impact this could have on the cost of transportation of cargo using coastal shipping. Modal shift of cargo could get impacted depending on the impact of the cost of VLSMFO on the final freight. INSA has already requested the ministry of shipping to take steps to correct any adverse impact this may cause to movement of cargo on the coast of India, assures Anil Devli.

Shippers’ apprehensions

Several users of the container trade have expressed fear of a disproportionate increase in fuel surcharge arising out of the use of VLSMFO. The actual impact of the increase of cost of bunkers on the cost of operation of a container ship can easily be arrived at once the selling price of VLSMFO is known. Basis consumption data, it is not difficult to ascertain the total impact of the increase in cost of operations of a vessel.

“The fears and concerns on this issue can easily be addressed by shippers bodies requesting container shipping companies for the detailed computation of costs and thus satisfying themselves of the impact that is being passed on to the trade. I feel that the container shipping lines would be happy to provide the requisite information to shippers, consignees or shipper bodies thereby making this process transparent and acceptable to the users of the services,” suggests Anil Devli.

“Maersk has already informed its customers and kept the surcharge calculation transparent. The BAF has generally been well received by our customers and they have appreciated the transparent and simple formula and predictable tariff,” ensures Steve Felder.