It’s one year past since Cabotage has been relaxed and Indian ports have posted some significant growth in transshipment volumes, while transshipment at foreign hub ports has also grown unabated. But have the benefits of this major policy change been passed on to the trade?

It’s one year past since Cabotage has been relaxed and there are visible signs of growing transshipment through Indian ports. Sailing against the winds and making a departure from the centuries old tradition of routing cargo through hub ports, ports on either coasts of India have proven their mettle in posting a decent growth in transshipment which clearly underscores their capability to snatch away significant volumes of cargo from the teeth of traditional transshipment hubs. More container liners are using this opportunity to reposition empties in deficit locations, optimise ease of doing business for exim community and increase transshipment through ports in India.

While Mundra has emerged as the shining star outperforming all the ports on the west coast in terms of transshipment volumes, on the east coast Krishnapatnam Port is leading from the front. It should be noted that Chennai port, which had no domestic transshipment business previously, saw more cargo movement on direct connections and fewer containers through foreign transshipment in fiscal 2018-2019 compared with the prior year.

Foreign container liners have been taking full advantage of this policy, as Steven Mark Felder, Managing Director (India, Sri Lanka, Bangladesh, Nepal, Bhutan and Maldives), Maersk, reveals, “A year into the implementation, there has been a meteoric increase in transshipment volumes in India by shipping lines with foreign flags. We are using this opportunity to increase transshipment at ports in India, position empty containers in deficit locations, and optimise the ease of doing business for importers and exporters. We see a greater opportunity for growth in transshipment on the east coast, as it is predominantly served by feeder services, and is thus fragmented. The scope for one of the ports to act as a transshipment hub relatively is higher on the east coast.”

Growth in transshipment volumes

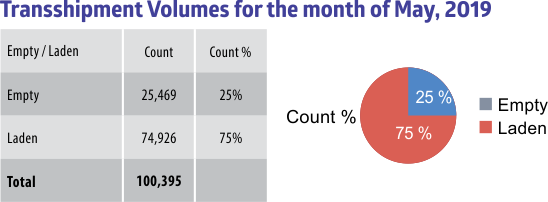

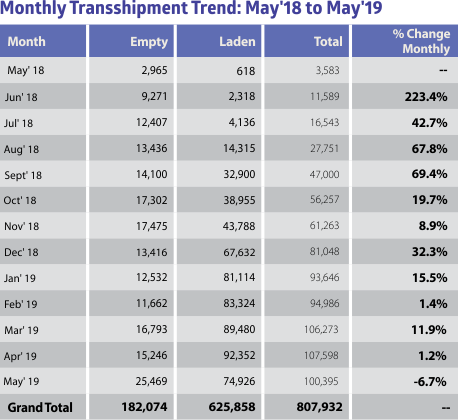

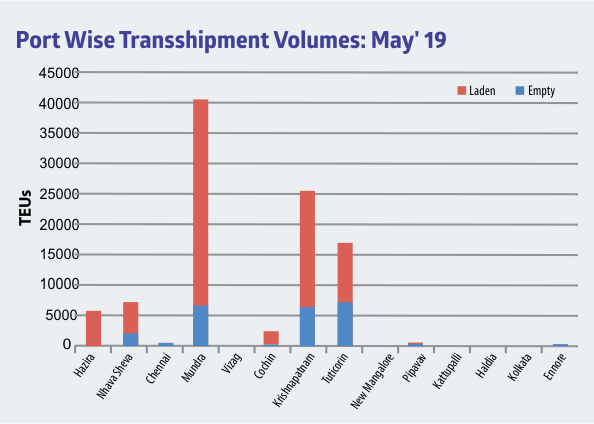

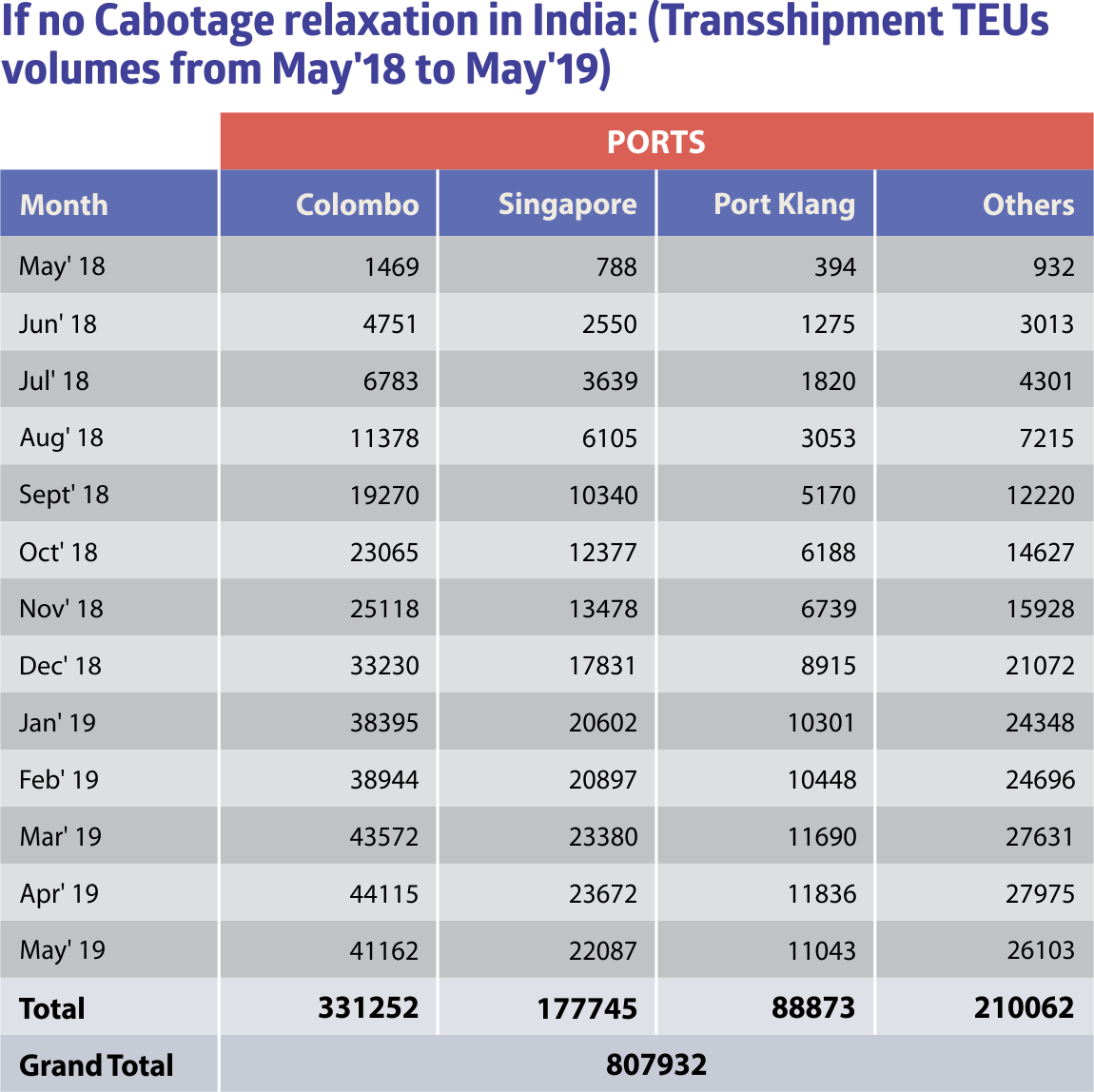

In May 2019, transshipment at Indian ports totalled 100,395 teus, of which 25,469 teus (25 per cent) were empty containers and 74,926 teus (75 per cent) were laden containers. Now compare this with 3,583 teus transshipped through Indian ports in May 2018, of which, 2,965 teus were empties and 618 teus were laden containers. During the twelve months period (May 2018 –May 2019) a total of 807,932 teus were transshipped through Indian ports, of which, 625,858 teus were laden and 182, 074 teus were empties.

The ports on the west coast alone recorded 63,816 teus in transshipment during FY-2018-19, of which 52,613 teus were laden and 11,203 teus were empties. This was a marginal increase over 62,446 teus transshipped during FY-2017-18, of which, 56,220 teus were laden and 6226 teus were empties. Mundra clearly stands out in port-wise comparison with a transshipment volumes of around 40,000 teus in May 2019, of which, around 7,500 teus were empties and the remaining 32,500 teus were laden containers. In FY-2017-18 Mundra posted transshipment volumes of 6,07,000 teus, of which, 4,48,000 teus were laden containers and 1,59,000 teus were empties. Now compare this with the performance in FY-2018-19 wherein total transshipment volume increased to 7,38,000 teus, of which, 5,80,000 teus were laden containers and 1,58,000 were empties.

The jewel on the east coast, Krishnapatnam Port was the runner up with transshipment volumes of about 26,000 teus, of which around 7000 teus were empties and the remaining 19,000 teus were laden containers.

Tuticorin Port notched the third slot with transhipment volumes of 17,000 teus, of which, around 8000 teus were empties and the remaining 9000 teus were laden containers. Chennai, Cochin, Pipavav and Ennore Ports grouped in the below 5000 teus category. Hazira Port moved approximately 6000 laden containers and Nhava Sheva posted transhipment of about 7500 teus, comprising of about 2000 teus of empties and the remaining 5500 teus were laden containers.

In FY-2018-19, Kolkata Dock had 168 coastal calls for container vessels from and to the upcoming transhipment hubs on eastern coast and Bangladesh. About 47 calls were to Bangladesh Ports of Chittagong and Pangaon. 101 calls were from/to Krishnapatnam Port and the rest were to/from Vizag Port. Kolkata Port has seen foreign vessels doing coastal runs after the Cabotage relaxation. Presently about 4 services performed coastal runs on foreign flagged vessels per month to other eastern ports from Kolkata Port. Overall in FY 2018-19, 57 coastal calls were made on foreign vessels to/from Kolkata Port.

The total number of containers (both coastal and exim) carried by both foreign carriers and Indian flag from and to Kolkata Port in FY 2018-19 was 99,284 teus. Out of these 33,432 teus were coastal containers and rest were exim containers.

The biggest gain this policy change has brought is the reduced time for a vessel to complete a voyage, avers Kolkata Port Trust. In a call to eastern transhipment Ports the vessel completes a voyage in a week’s time to return to Kolkata compared to 9/10/14 days if the transhipment had been through Colombo/Port Kelang/Singapore. This means that a vessel deployed in coastal sector performs more voyage during a month compared to those engaged with foreign transhipment hubs. Reduction in voyage time has enabled the feeder operators to optimize the fleet size and achieve the same volumes with lesser number of vessels in the fleet.

If Cabotage was not relaxed?

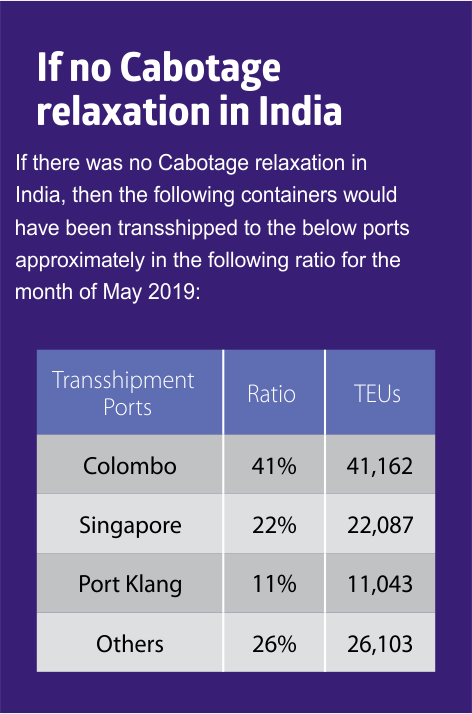

If Cabotage had not been relaxed then it is estimated that in May 2019 about 41,162 teus would have been transhipped through Colombo, approximately 22,087 teus would have been diverted to Singapore, no less than 11,000 teus would have been transhipped through Port Klang and about 26,000 teus would have been transhipped through other ports.

Is the purpose fulfilled?

But before we proceed any further and analyse the situation, let’s take a quick flashback at the aim of Cabotage relaxation. Anil Devli, CEO, INSA is quick to recall that the circular was issued for two purposes:

- Reduce transshipment of cargo over Colombo

- Increase movement of fertilizer and other products by foreign ships Further, when the government had aired its intention to relax Cabotage, both supporters of Indian tonnage and foreign carriers placed forward their respective viewpoints in favour and against the policy change.

Anil Devli pulled out the flaws in the government policy as he said, “There is no Cabotage Law in India for shipping sector and if we take the example of domestic airline sector the passengers don’t have the privilege to go for a foreign airline flying between two Indian cities as a result domestic airline operators in many instances charge exorbitantly. Even in case of railways, a foreign rail operator has to have an Indian registered company to move cargo in India. But Indian flagged vessels couldn’t have a monopoly like domestic airlines or railways. For an exporter or importer if there is no availability of Indian flagged vessel, then the exporter has the option to charter a foreign flagged ship and transport cargo on the Indian coast.

There are enough Indian ships to take care of Indian cargo and transshipment because Indian container vessels have grown by 100 per cent in past 2 years. Shreyas, Sima Marine India, and TCI are the three coastal container vessel operators that connect to 18 Indian ports, including all major ports. But despite that Indian vessels are not getting enough cargo and on many instances vessel slots are not getting utilised and have to run empty.”

Bringing out the disparities in right of first refusal (RoFR), Anil Devli had said, Indian vessels have to match the rate quoted by a foreign vessel, whereas Indian operators didn’t stand on a comparative ground as domestic vessels have to incur much higher expense on each sailing due to taxes and other statutory requirements, such as IGST and expensive bunker fuel, which are not applicable to foreign flagged vessels.

Foreign container liners had stood in favour of Cabotage relaxation, Capt. Deepak Tewari, Chairman, CSLA had said, “Cabotage should be relaxed completely along the Indian coast. Because it will facilitate clearing and shipment of exim cargo at Indian ports, and it will also ease the movement of empty containers. As a result it will translate to savings for the shipping lines and Indian trade as well. If we make a peer-to-peer comparison, there will be an average savings of 28- 30 per cent in operating cost.”

Cabotage was relaxed in May 2018 and one year down the lane data from the ports reveals that transshipment at Indian ports has increased, but transshipment of Indian cargo through Colombo has not reduced. Further, movement of fertiliser and agriproducts continues on Indian flagged vessels, which clearly defeats the primary aim of the relaxation.

Has transshipment through foreign hub ports dropped?

Not necessarily, says Capt. Vivek Singh, MD, Shreyas Shipping and Logistics Ltd. “Coastal shipping as well as transshipments through Indian ports continued as usual. Domestic container volume grew by 21 per cent during the year where the contribution on account of Cabotage relaxation was virtually not there. Even for the transshipment we have not been able to divert any cargo from neighbouring foreign transshipment hub ports.”

Indian National Shipowners’ Association (INSA) coincides with the views of Capt. Vivek Singh – transshipment of Indian cargo through foreign ports continues at the same pace as in the past and the exim community has not been able to realise any decrease in freight charges due to participation of foreign carriers in coastal trade. Moreover, unfavourable operating conditions and a complicated tax regime have hindered the growth of Indian tonnage – the Indian fleet saw a 2 per cent growth in 2018, compared to 10 per cent in 2017. “Noticing that there is no need of an Indian flag vessel to do this business, Indian companies chose to in-charter foreign flag vessels rather than buying ships under the Indian flag. India therefore lost tonnage, this has led to loss of jobs of Indian seafarers, loss of revenue by the exchequer in terms of GST and direct tax, and loss of training slots for Indian cadets,” says Anil Devli. The exim transshipment cargo that Indian flagged vessels were carrying to Krishnapatnam, Mundra and other Indian ports, is now being carried by third party foreign flag vessels. India, as an economy, lost revenue to that extent.

No boost to coastal shipping

Coming to coastal shipping, the realm of Shreyas Shipping, Capt. Vivek Singh says, “Indian flag vessels continue to operate on coastal services as per the trade requirement. In the absence of required container volume on the coast, few of the Indian container vessels were even chartered out in the international market. This clearly indicates that the growth in coastal shipping was never hampered for the want of capacity, the issues are elsewhere.”

The government needs to provide cargo support by industrialising coastal zone as per Sagarmala project and helping modal shift of cargo. Coastal shipping is economical for port to port service, but cargo necessarily moves on door to door basis where cost increases due to first and last mile handling as well as multimodal handling. Since coastal shipping is not the right solution for all cargo hence suitable cargo need to be diverted from other transportation mode.

“There is actually not much disparity when both Indian and foreign vessels are operated on coastal service since they follow similar norms but there is cost disparity when Indian vessels operate on coastal service while foreign vessels operate on foreign service but compete for same exim transhipment cargo between two Indian ports as both follow different norms and have different cost parameters. Since Cabotage has been relaxed, coastal vessels should be permitted to use similar norms like a vessel operating on foreign service and handling cargo between ports in India,” opines Capt. Vivek Singh.

In coastal shipping the Customs procedures are still lengthy and combined with high import duties on bunker oil and spares and high manning scales are still retarding the attractiveness of coastal shipping prospects. Another factor is the availability of quality officers on Indian coastal vessels compared to International mariners due to personal income tax liabilities.

Repositioning of empties

Empties which were once moved by coastal carriers between ports are now being moved by mainlines. “Mainlines have been able to move empties on their own ships between Indian ports which must have resulted in cost reduction for them, but the advantage has not been passed to shippers and trade. On the contrary, Indian coastal shipping has lost the volume and revenue resulting in higher logistic cost for laden cargo,” reveals Capt. Vivek Singh.

TRANSHIPMENT GROWTH UNHINDERED AT COLOMBO

In the first nine months of 2018, the Port of Colombo witnessed its highest ever growth in transhipment container traffic, with numbers up by 19.4 per cent year-on-year to 4.207 million teus. During the first half of 2018, the port witnessed tremendous year-on-year growth of 19.8 per cent in transhipment, handling 2,733,906 teus, as against 2,281,636 teus handled in the corresponding period in 2017. Following on the heels of India relaxing Cabotage Colombo had dropped its transhipment rates by 9.5 per cent.

Has the shipper benefited?

Since Cabotage has been relaxed no reduction in freight rates for exim cargo has been noticed, while services moved from Indian owned tonnage to foreign chartered vessels. “We do not see trade community have been benefitted in any manner by such relaxation. Cabotage relaxation has only helped few foreign shipping lines and few private terminals for their own cost rationalization and not even helped the major ports. The benefit gained has not been passed to the trade and on the other hand trade has suffered since direct cargo changed to transhipment which increased the transit time,” informs Capt. Vivek Singh. Cabotage relaxation has also resulted in revenue loss to the government as billing is not being done in India or contracts are being entered outside India, resulting in loss of GST for services rendered.

How can Indian tonnage be made competitive vis-à-vis foreign ships

- Indian ships pay 5 per cent IGST on the first entry of an Indian flag ship. Foreign ships do not have to pay this.

- The bunkers sold to Indian ships are at almost 15 per cent higher prices than what foreign ships have to pay.

- Indian companies must, by law, apply TDS provisions on salaries paid to seafarers while operating on the coast. Foreign shipping companies give this the go by and do not apply TDS on salaries.

These issues need to be resolved, if Indian ships are to be made capable of competing with foreign ships. Either apply all these to foreign flag ships or remove these responsibilities on Indian flag ships. This will make Indian ships competitive vis-à-vis foreign ships.

As regards, market share of India’s cargo on Indian ships, the same can be increased if access to Indian cargo is linked to flagging in India and, if FDI is encouraged, making it attractive for foreign shipping companies to flag in India. Operating a foreign ship in Indian waters is cheaper than an Indian ship by 26 per cent! So, once this disparity is corrected, it will encourage foreign companies to flag in India.