The seventh edition of Indian Container Market Annual Report delves deeper into the logistics cost which has been a major stumbling block in container trade. It maps the cargo centers distributed across the country, tracks the partners in international trade and is a ready reckoner for the latest data on Indian container terminal infrastructure, efficiency, rankings and performance

In 2018, India has become the world’s fifth largest economy by leaving France & the UK behind in World Bank ranking.

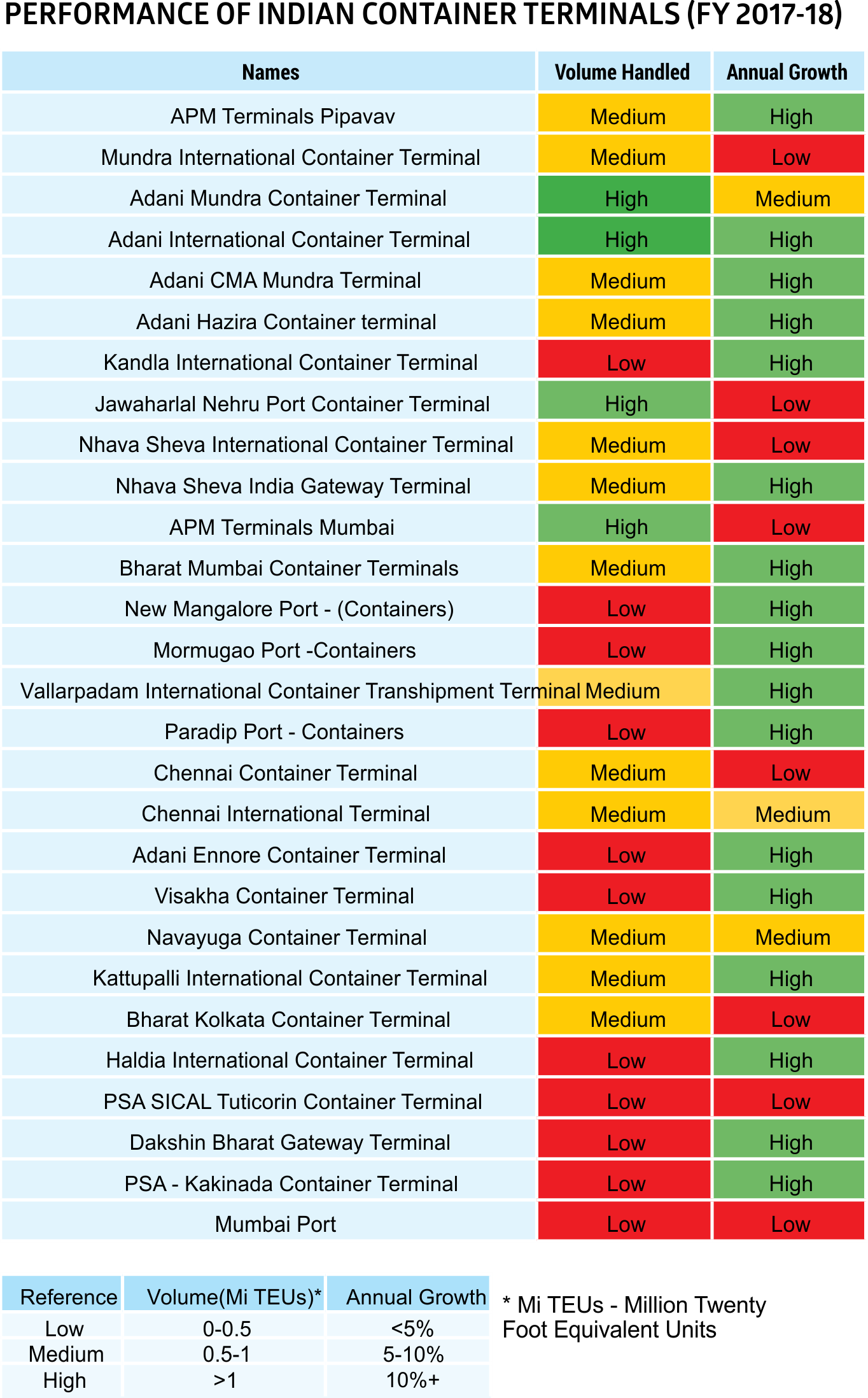

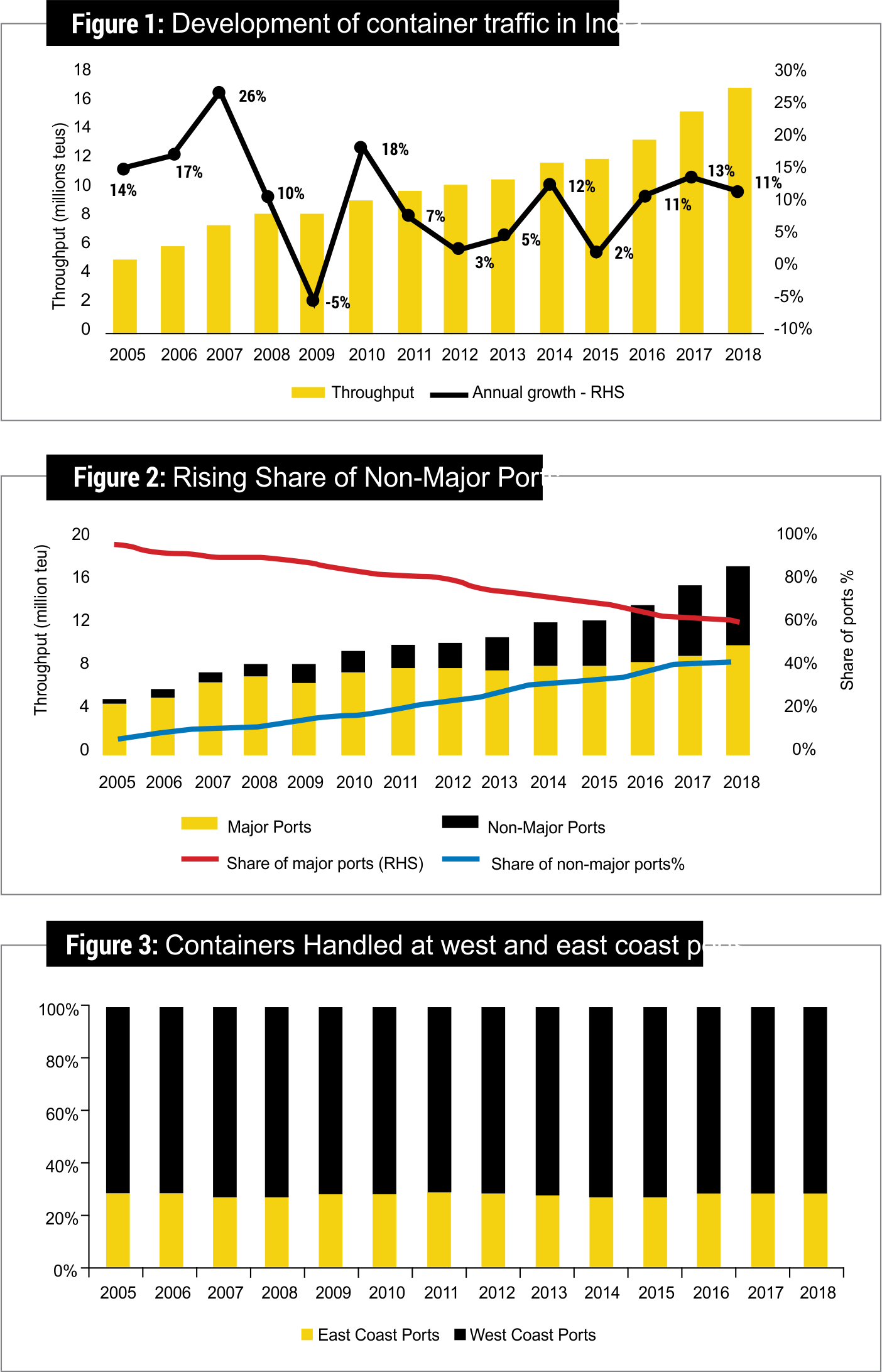

Although China registered single digit growth in container throughput in last three years, India’s container throughput grew by 11.4% in 2018. All Indian ports registered positive growth during the year except one or two unfortunate ones. Overall, India’s container traffic in last four years has grown significantly with a CAGR of close to 12%.

Market Segmentation – 2019

Major Vs Non-major ports Major ports have continuously lost a significant share of container traffic to non-major ports in last decade. The market share of non-major ports has increased by more than five times in last 14 years (since 2005). The market share of major ports declined from 92% in 2005 to 58% in 2018. Rapid expansion of private terminal operators in the non-major ports diverted significant chunk of cargo. The market share of non-major ports collectively rose to a whopping 42% in 2018 from a paltry 8% in 2005. Krishnapatnam and Katupalli on the east coast of India have amassed significant volume in last four/five years and they are adding to the growth story of non-major ports which were driven previously by Mundra and Pipavav. The largest Indian port JNPT registered a healthy close to 8% growth in 2018 which is the highest y-o-y growth in last four years. Nevertheless, its share has been reduced to almost half in last 15 year. Mundra is rapidly approaching to become the largest shareholder of total container traffic and handled 11% more boxes in 2018 over the previous year. Mundra’s share was just 3% less than the largest port JNPT in total container traffic.

East coast ports Vs west coast ports

Ports on the west coast will continue to dominate in total container throughput, so as in the container infrastructure. Around 72% of the country’s container throughput is handled by the west coast ports.

Major containerised/ containerisable exim cargo

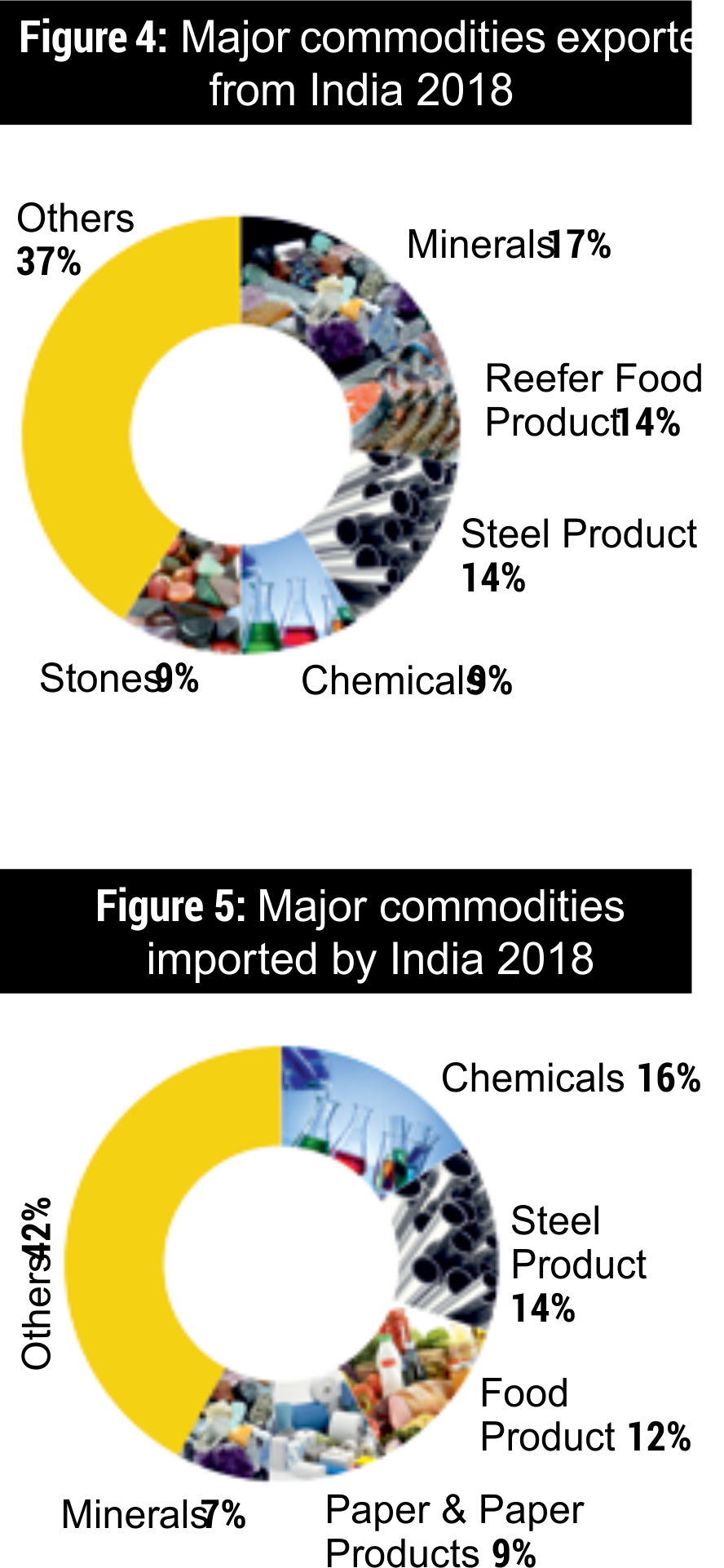

For analysis, we have divided all traded commodities into 33 major categories, such as Pharmaceuticals, Fabric/Yarn, Steel Products, Reefer Food Products and Readymade Garments (RMG)/Textiles. As we do not have precise definitions of containerised and non-containerised cargo from any authoritative source, the data has some subjectivity built in.

In this year’s report we have used the volume of cargo (tonnes) as our basis of analysis in contrast to trade values which was reported in 2018 edition of Containers India report.

In terms of volume, various mineral products which are either containerised or containerisable are the major product group being exported from India. In 2018, this product group constituted 17% of the total containerised or containerisable exports of India. This product group’s export volume has increased from 4.5 million tonnes in 2008 to 19.8 million tonnes in 2018, nearly 20 times over the decade.

Reefer food products follow the minerals and constitute 14% of India’s total exports. Rising demand for fish and meat has increased the commercial farming of fish and livestock in India over the years. As per the data available to us, export volume of reefer foods increased five times over decade from 4.6 million tonnes in 2008 to 15.6 million tonnes in 2018.

Major trade partners

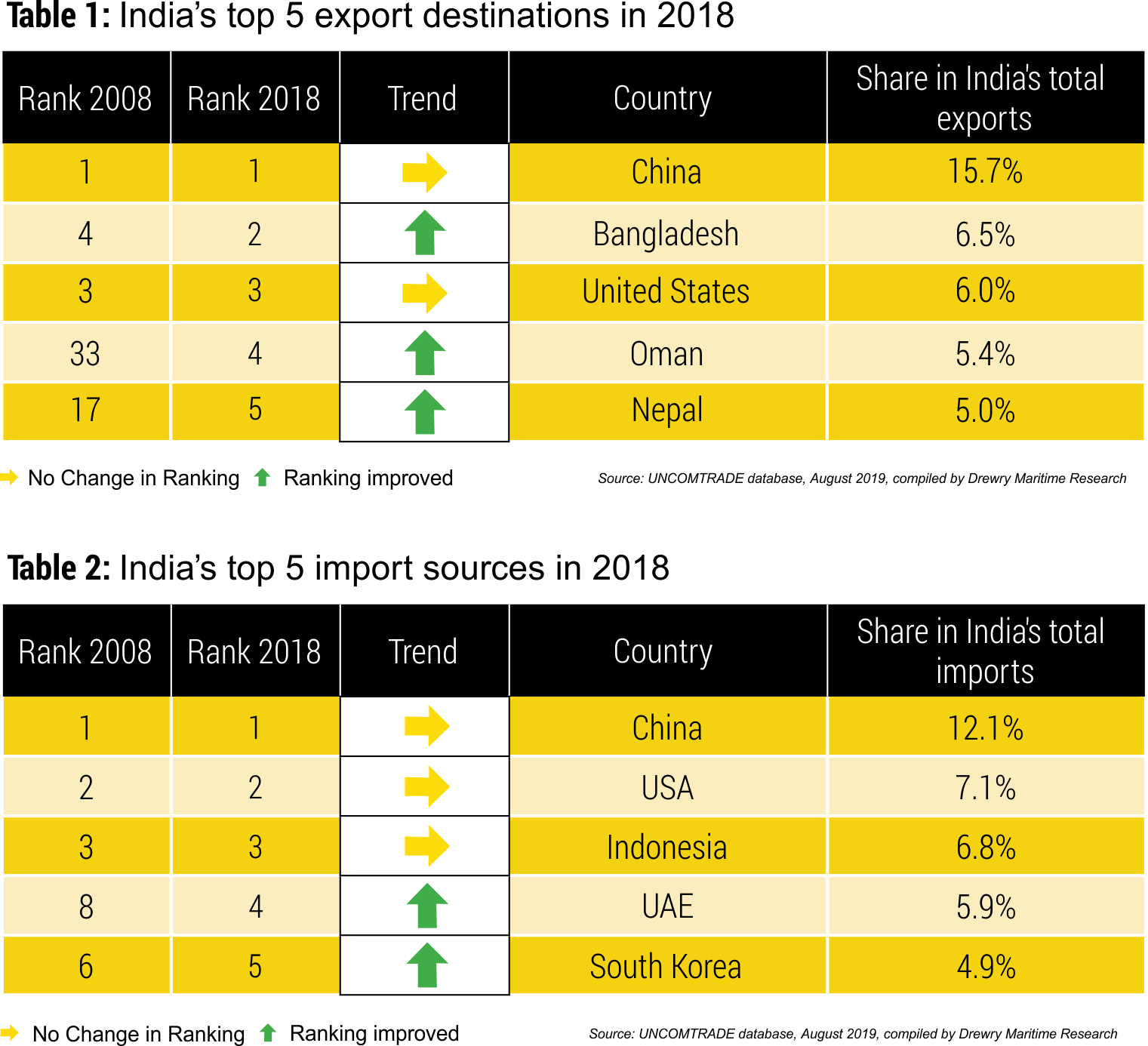

China dominates as a partner on both export and import side when analysed by trade volume (million tonnes). Although the US is the top export destination of Indian exports in value terms, it ranks third when export volume is concerned.

China had 15.7% of market share in India’s total containerised or containerisable exports in 2018 and has been consistently on the top position over the last decade. Bangladesh however, has increased its ranking in India’s export from 4th position in 2008 to 2nd position in 2018.

The US has consistently remained at the third position in India’s export market while export to Oman has increased in last decade. Oman was at the 33rd position in 2008 and reached 4th position in 2018.

On the import side, China, USA and Indonesia retained their position at first, second and third respectively over the last decade. In 2018, India sourced 12% of its requirements from China followed by the USA (7.1%) and Indonesia (6.8%).

A noteworthy trend is that the country has started to import more from Southeast Asian countries over the past decade. For example, Malaysia, which stood at 10th position in 2008, increased its position to 6th in 2018. Singapore increased its rank from 17th position in 2008 to 8th in 2018. Similarly, Thailand increased its rank from 19th position in 2008 to 9th in 2018.

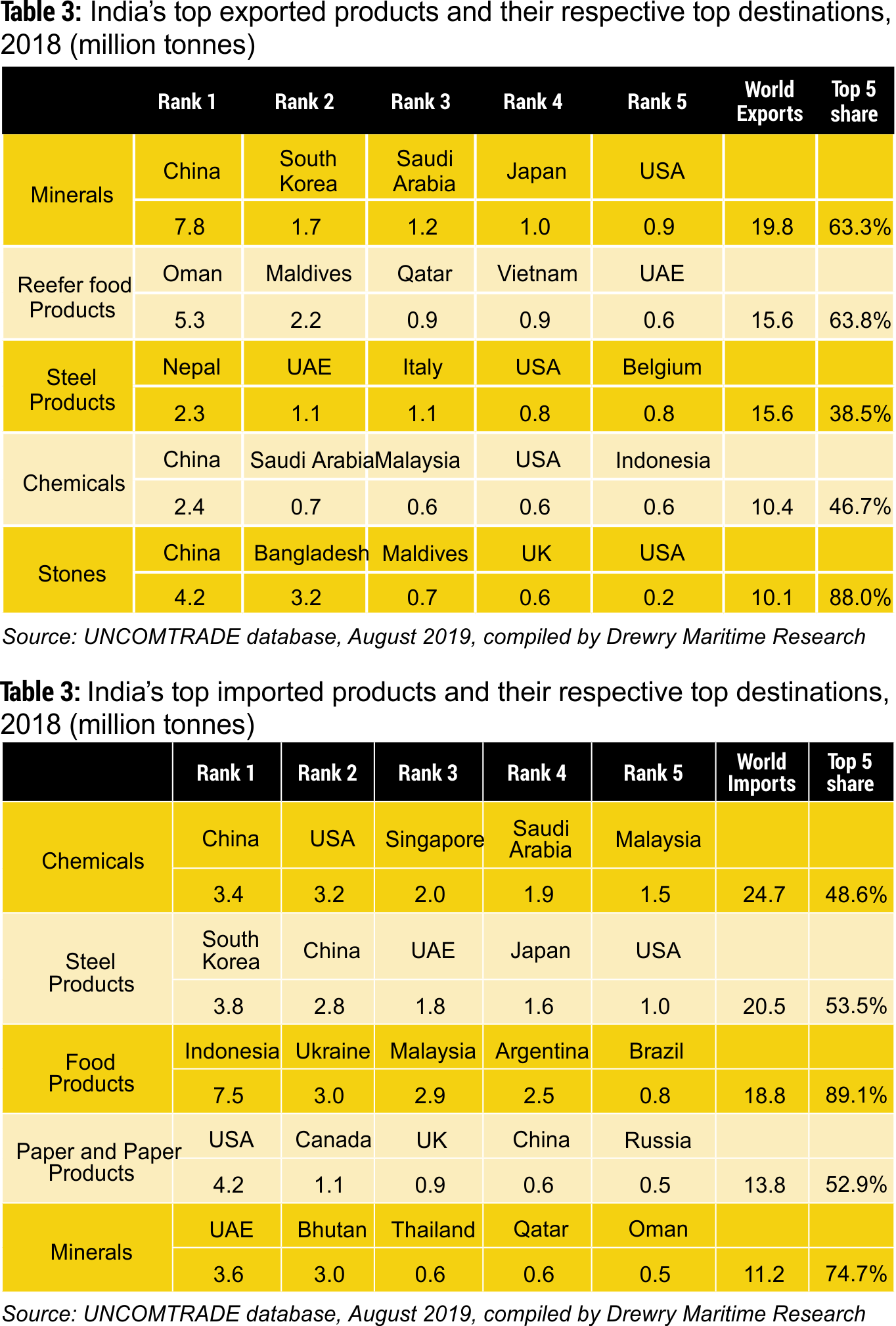

Top commodity-partner matrix

As discussed above, Minerals is the product group which has the highest share in India’s exports. More than 63% of the total mineral exports are concentrated to top five countries. They are: China, South Korea, Saudi Arabia, Japan and the USA.

Reefer food products are the second largest exported product. Middle East and North Africa regions are the major demand drivers for Indian meat. They import more than half of the reefer products that India exports, Oman being the largest consumer.

Among counties in other regions, Maldives is the major consumer of India’s reefer product.

India’s top imported products and their respective top destinations, 2018 (million tonnes)

On the import side, Chemical products are the top most cargo being imported by India. In 2018, the country imported 24.7 million tonnes of chemicals out of which half of the quantity was from its top 5 import sources. They are China, USA, Singapore Saudi Arabia and Malaysia.

Steel products are the second major commodity group which India imports. In 2018, more than half of the import requirements were sourced from top 5 countries with about 18% being imported from South Korea alone followed by China (13%).

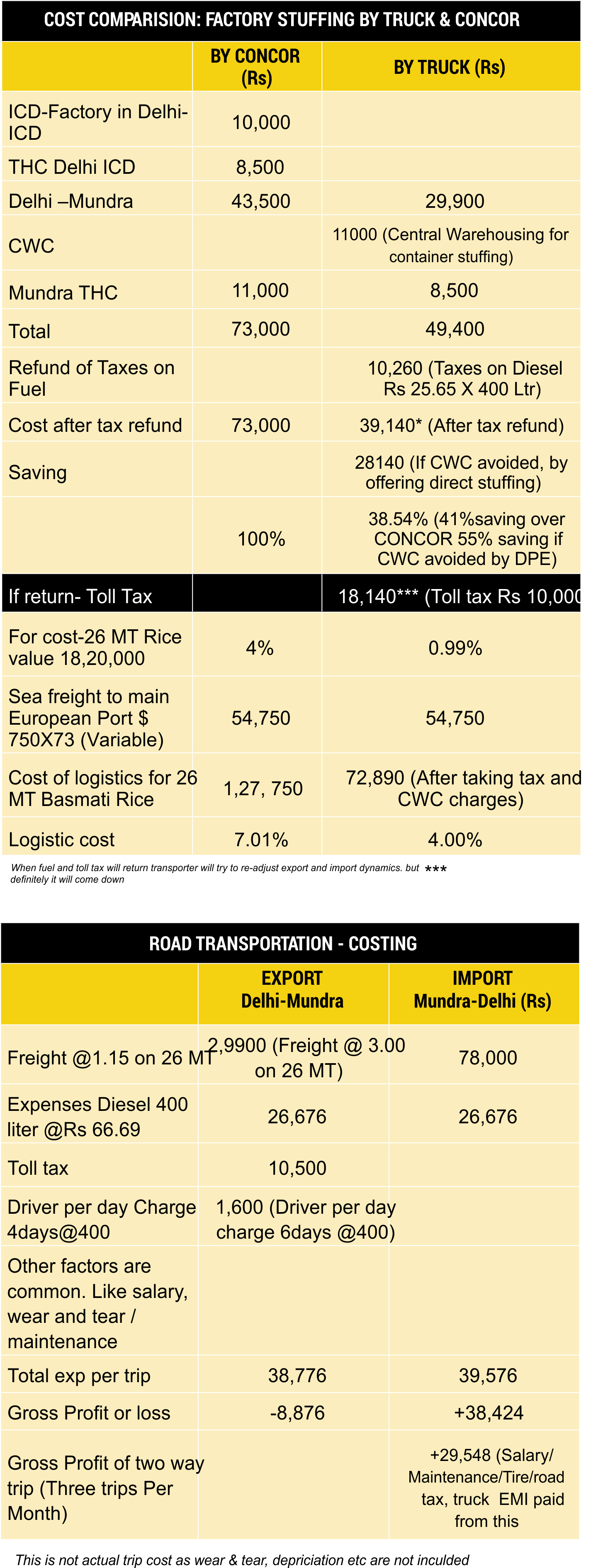

The dilemma of high logistics cost

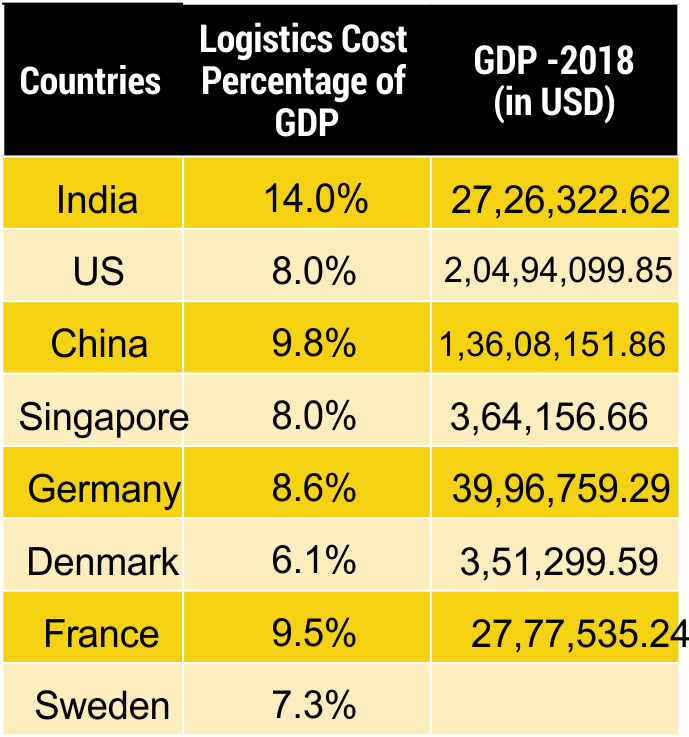

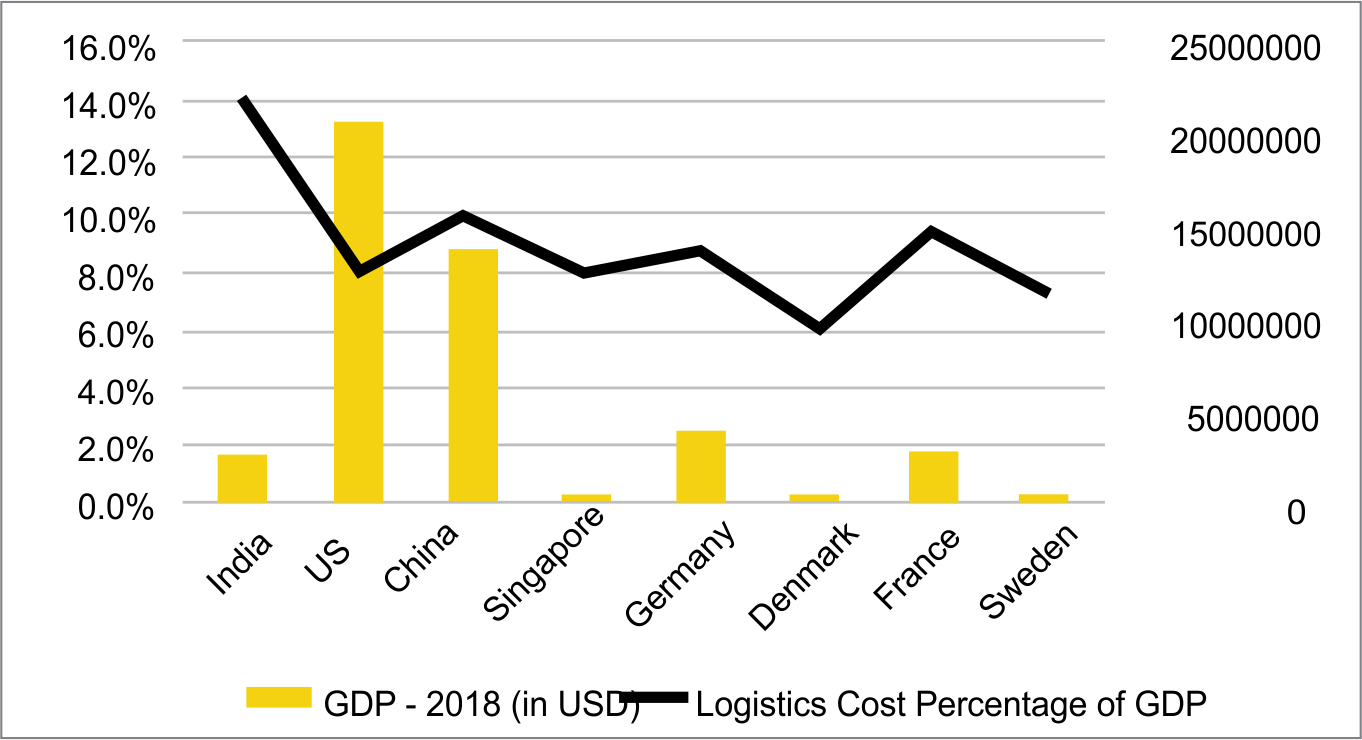

Even though the government has granted Infrastructure status to Logistics, still industry is chasing to find the actual logistics cost which is high for both imports and exports making them uncompetitive in the global markets. Government is aiming to reduce logistics cost to less than 10 per cent by 2022 but until digitalization gets implemented at every vertical of the Logistic value chain along with elimination of unnecessary intermediaries, it will be a herculean task to achieve. However, India’s logistics cost has been standing high, making products costlier.

The reason behind different views and approaches in calculating logistic cost value is the many intermediaries involved in moving cargo. It could be difficult to bring together for calculating all the variable cost components involved in it. The industry has given such enormous impetus to the intermediary service providers who impose high charges that ultimately need to be borne by shippers. Deriving the logistic cost from many unorganized players across the value chain of EXIM cycle is arduous. The value always varies based on many variable components like terminal handling charges, customs charges, sea freight charges, cargo consolidation charges, forwarder & CHA charges, storage charges, haulage charges, dry port charges, land transportation, mode of transportation, intermediary charges…etc.

Logistic cost is being calculated till now based on the percentage on total GDP. Another argument raised in the industry is that it should be calculated on the basis of consignment. Logistics cost to the GDP in the US (9.5 per cent) and Germany (8 per cent). If Logistic cost need to be calculated on the basis of GDP then services industry alone contributes more than 50 per cent to the GDP, which cannot be the best practice to follow.

Industry has been under the assumption that it could be anywhere in between 13-18 per cent based on the value that is floating around in the trade without any strong base. The global average is hovering in between 6-9 per cent. Estimated logistic cost for some bulk cargoes like coal and cement is 17-18 per cent. In case of agri produce logistics cost is in between 25-30 percent, and for electronic goods it is 13-17 percent. Pharmaceutical and biotechnology industries logistic cost is always on upside as the majority of the pharma hubs and clusters are located in southern part and cargo moves by truck to western ports with empties in return. Similarly in terms of domestic cargo movement in India, automobile manufacturing zones are in northern part of India and consumption centres are in southern India. In terms of exports, cargo generating centres location plays vital role in some cases in determining the logistic cost as if the distance between hinterland and gateway port is high, thus keeps logistics cost on higher side.

Also, the logistics division is likely to map out the most cost and time effective modes across India through a digital platform. After all, why should the costlier roadways be allowed to capture 60-70 per cent of India’s freight, where in the Indian Railways handles less than half of the road traffic with 20-30 per cent, or 1.1 billion tonnes of freight, even though the rail is a cheaper mode of transport for journeys beyond 500 kilometres. cargo movement from NCR Delhi region to Mundra by road costs double inland transportation costs when compared to exports.

There is a dearth of digital platforms which can allocate the import boxes to the nearest exporters as and when demand arises to reduce the cost of repositioning empties to the exporters. In most of the cases, shipper need to bear empty return charges of the truck which is indeed an unnecessary expense that makes logistics expensive. It results from inefficiency on the part of multiple parties, and a lack of location-based planning. The current wastage or value loss in India’s transport ecosystem is around $80 billion, and it is expected the inefficiencies will go up, because 90 percent of the logistics business in India is unorganised, and is run by truckers who own one or two trucks.

Even after implementation of GST to facilitate cargo manufacturers to ease taxation it is not helping as expected. The costs are not going to come down until there is an organized single window platform created for the benefit of trade to track and ensure the entire spectrum of cargo supply chain.

However, the logistics industry is on its way to becoming a $200-billion opportunity by 2020, and is expected to have eight primary warehouse hubs across India. Organised logistics ecosystem could lead to a boom in manufacturing, e-commerce and agriculture. However, this would first require estimating demand and organising the road and rail network. The railways is stepping up its act by doubling its capex plan. But the bulk of goods continue to move by road and the logistics industry continues to be dependent on small-time agents and truckers. There is a need to estimate the demand from one city to another, so that trucks and rail racks do not have to ply empty.

Factors affecting logistic cost and time

The logistic cost can be derived from direct and indirect costs involved in carrying cargo. Direct cost is incurred in the process of moving goods, such as sea freight, inland transportation cost, warehousing cost, storage cost, and value-added services. Indirect costs are hidden charges which include inventory carrying costs, theft, pilferage, damages and losses in transit which account for 30-40 per cent of India’s total logistics costs. Indirect costs are caused by inefficiencies in the supply chain, which will be less than 10 per cent of the total in developed countries.

Total inland transit time till loading on vessel can vary from 6-14 days for an export container from NCR Delhi to nearby ports, while the same for a similar route in China would be 4-6 days. Even though transit time and cost is high in India, this directly increases inventory carrying cost. Improvement in supply chain procedures and increasing the transparency can cut inventory costs up to 40-60 per cent.

The logistic cost for agriculture produce is about 25-30 per cent due to inefficiencies in the supply chain, such as insufficient transportation, warehouses, cold storage.

Another major challenge that adds cost in road transportation is the poor quality of roads, trucks and drivers. Road transportation accounts more than 60-70% of inland cargo movement, hence better roads can decrease logistic cost significantly. There is a shortage of around 20% in commercial drivers. Low skill levels can create more delays and damages which increases indirect costs.

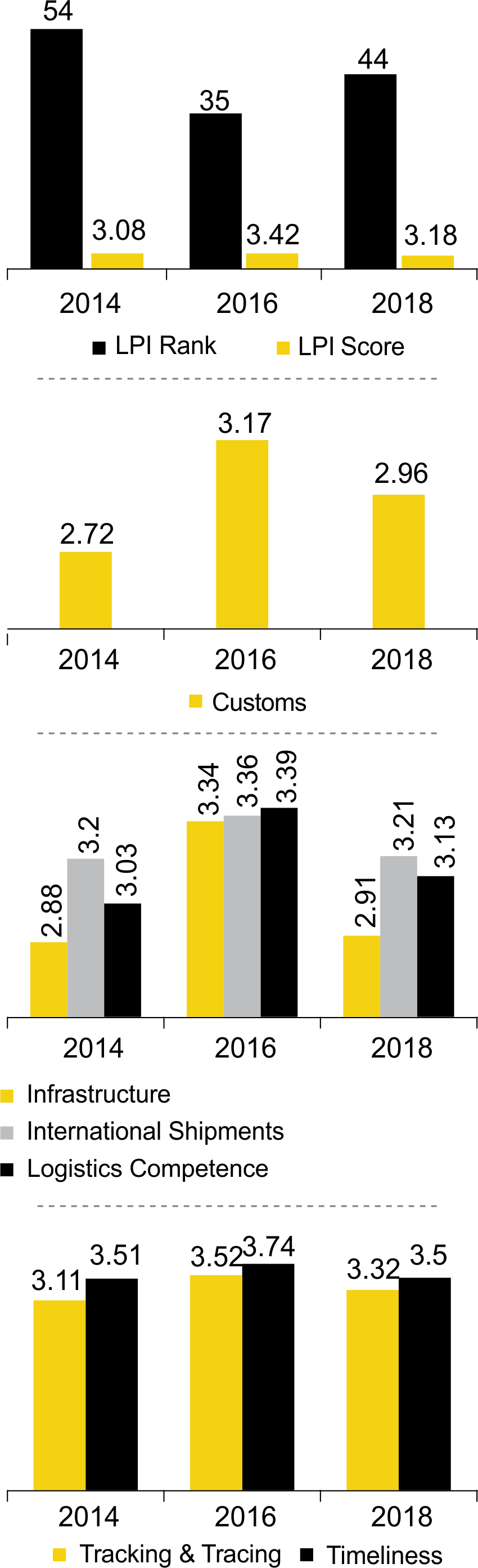

Indian Logistic Performance

India jumped to 44th rank in 2018 from 54th rank in 2014 in terms of overall logistics performance based on 6 predefined parameters defined by World Bank.

Under National Logistic Index Gujarat and Punjab in west coast and Andhra Pradesh in east coast are best performing states based on parameters such as the competitiveness of pricing, timeliness and availability of infrastructure and that of services, among others.

Sagarmala Projects

Under this programme, government is going to invest `8.8 lakh crore in more than 605 projects. Out of these, 89 projects worth ` 0.14 lakh crore are completed and 443 projects worth `4.32 lakh crore are under various stages of implementation and development. Sagarmala Programme aims to promote port-led development with a view to reducing logistics cost for EXIM and domestic trade.

Reduction in Logistic cost between India & Bangladesh trade

India and Bangladesh agreed to find out the technical feasibility to operate Dhulian – Rajshani protocol route up to Aricha and the reconstruction and opening up of Jangipur navigational lock on river Bhagirathi subject to the provisions of the Treaty between India and Bangladesh on Sharing of Ganga Waters at Farakka, 1996. This move has the potential to reduce the distance to Assam by more than 450 kms on the protocol routes.

To bring about significant reduction in logistics cost and faster delivery of Bangladesh export cargo, Indian side raised the point regarding permitting ‘Third country’ EXIM Trade under Coastal Shipping Agreement and PIWTT by allowing transhipment through ports on the East Cost of India. Bangladesh agreed to hold stakeholder consultations and revert on the matter.

The following Agreement/Standard Operating Procedure (SOP) were signed by the two countries.

- To facilitate connectivity to North Eastern States through Kolkata and Haldia ports, movement of EXIM cargo and reduce logistic costs, an agreement on the use of Chattogram and Mongla Port for movement of goods to and from India between the people’s Republic of Bangladesh and the Republic of India.

- To open up connectivity for passengers and tourists from the two countries through Indo-Bangladesh Protocol route, a Standard Operating Procedure (SOP) of MoU on Passenger and Cruise Services on the Coastal and Protocol route between India and Bangladesh.

- To add Pangaon from Bangladesh and Dhubri in Assam as new Ports of Call, an Addendum to the Protocol on Inland Water Transit and Trade (PIWTT).

Cost variations – service providers

Shipping line charges

- Sea Freight

- THC

- IHC yyDocumentation Charges

- Survey Charges

- Repairs, Washing & Cleaning

- Imbalance Costs

Shipping line (conditionality charges)

- COD Charges

- Detention

- IGM Amendments

- Port Congestion

- Winter Season

- VTMS Charges

- ENS Charges

- Do Revalidation Charges

Intermediaries charges

- sea Freight Mark up

- Documentation Charges additional

- Congestion Charges

- LOLO Charge

- CBL Pass thru Charge

- Detention Invoice Release Charge

- Warehouse Special Charge

- Urgent Examination Expenses

- CFS Nomination Charges

- Empty Yard offloading

- Cost Recovery Charges

- Late DO Charges

- CFS Receiving Charges

- Supply Chain Security Charges

- Transport Union Charge

- NOC For HBL’s

- Custom Clearance and duty

- Agency Charges

- Energy / Power Charges for Reeder Containers

Recommendations based on Shipper’s perspective

- Removal of repositioning cost of containers

- Increasing the share of DPE similar to DPD can save approximately `11,000 per FCL

- TOLL TAX: Further, trucks from Delhi to Mundra can reach within 24-36 hrs (with two drivers) or average 48 hrs (With two drivers) from North India leaving hill states aside. With the fast track tags, now trucks normally won’t stop at Toll Plaza’s for much time. It is surprised to note that on 1200 KM route (Delhi to Kandla/ Mundra), one side Total Toll Charges are said to be `10,000-11,000 (`8.33/KM).

Trucks make their profit on import cargo & lose money on export cargo to catch next import cargo as early as possible. For example Delhi –Mundra rate is `1.15 per kg (26000 kg Rice X `1.15=29900) , while returning it will be `2.5- 3.00 per kg (`65,000 – 75,000 for same load)

Approximate saving:

Any oncession/refund on TOLL TAX up to `10,000 In the present scenario, exporters are trading on paltry margins of 2-3% whereas service providers and intermediaries including Government agencies are betting on high profits.