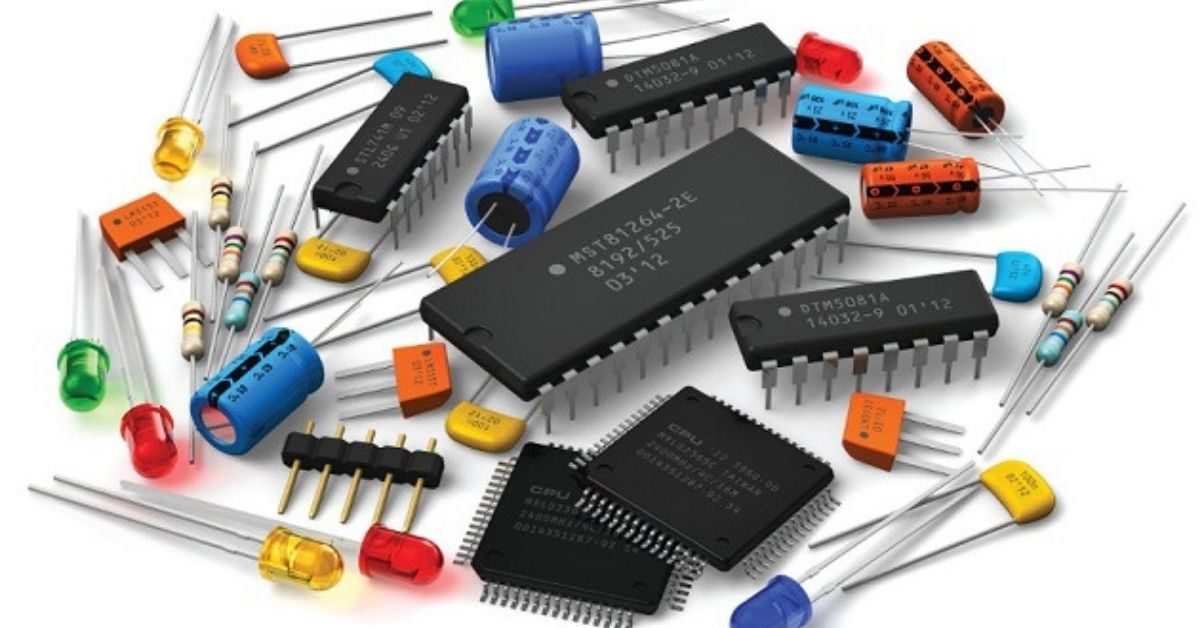

The electronics manufacturing industry is continuing its growth juggernaut and its historic journey to capture its share in the global market.

Electronic goods production in India has more than doubled from $30 billion in 2014-15 to $75 billion in 2019-20.

With adequate support from the government to boost electronics manufacturing and increase exports, it is expected to rise to $250 billion by 2025.

With an objective to become a manufacturing hub of the world, the government has taken several steps to boost electronics manufacturing in India and simultaneously reduce import dependence, bring foreign direct investment and increase exports.

Visionary policies like the ‘Make in India’ program, National Policy on Electronics (2019), various PLI Schemes, SPECS (for incentive on capital expenditure), EMC 2.0, RoDTEP clubbed with incentives offered by different states have all but rolled out the red carpet for the world’s manufacturers to create in India.

The world’s fastest-growing industry, Electronics System Design and Manufacturing (ESDM) continues to transform lives, businesses, and economies across the globe.

Having such massive growth targets in domestic manufacturing of electronic goods will lead to a gradual shift of GVCs to India, low dependence on imports for CBUs, higher exports, infusion of FDI, growth of GDP and employment generation.

India’s strong reform to improve the infrastructure will lift India substantially in the Ease of Doing Business Index and bring even more investment in the country.

The focus on the mobile handset and components industry has thus far had a significant positive impact on the economy. With this continued focus, it is expected that if India continues in this direction, then the sector has the possibility to contribute as much as $250 billion to GDP in the next 5-7 years.

It is expected that by 2025-26, 10 million additional jobs (direct as well as indirect) would have been created especially among young women who are well suited to the assembly type of operation in electronics manufacturing.

The impact of increased jobs will also have a bearing on taxes. It is estimated that electronics components manufacturing will contribute direct and indirect taxes to the tune of $150 billion.

Most importantly, their manufacturing will take the entire forex burden off the country. A vibrant component ecosystem fosters skills in design and innovation as a spill-over effect tapping local talent to move up the value chain on the lines of Taiwan and Japan.

While import substitution is not the goal, it is a huge advantage with many benefits. The aim behind pushing domestic electronics manufacturing is to have a greater share of the global economy – with export dominance as the main objective.

In the current era, electronics manufacturing is as strategic as a nation’s gold deposits, if not more. The electronics design and manufacturing ecosystem aims to safeguard the nation’s interests not only by reducing imports but also by helping develop resilience in the value chain.

With a strategic intent and highly calibrated approach from both the government and the industry, the Indian economy can see a massive reduction in its trade deficit but also kickstart a long-awaited boost of fresh private sector investments.

Perhaps this can be the start of the implementation of the ‘Atmanirbhar Bharat’ campaign envisaged by the government.

With the NPE 2019, India has a paradigm shift. The document lays down a high-level vision to promote the domestic manufacturing of electronics and components.

NPE 2019 has set a target of $190 billion turnover for mobile phones – $80 billion from the domestic market and $110 billion from exports.

In order to gain long term competitiveness and address the cost of disabilities vis-à-vis other major manufacturing economies, the government has come up with suitable policies (e.g. – PLI, SPECS, EMC 2.0, RoDTEP, etc.) which makes India one of the more attractive destinations for investments globally.

In order to reduce the dependency on imports, significant progress has already been achieved on the sub-assembly localisation front and efforts are now being made to accelerate the localisation of components.

The need of the hour is to have vigorous engagement with the stakeholders from various supply chains to develop the industry in India.

This requires persistent and continued efforts backed by the government through appropriate empowerment and allocation of adequate resources, for the development of thrust areas in core industries like the semiconductors & ATMP, display & display assembly, capital Goods etc., in India.

The attaining of the set targets for domestic electronic manufacturing will increase the government’s revenue by 3-4 times. Such increased revenue should necessarily be used for skill development of the existing workforce, support to small scale entrepreneurs and MSMEs to become champions by providing them extended credit guarantee and interest subvention.

The establishment of Centre of Excellence in diversified fields will also pave the path for having design capabilities in India in the long run.

The global display industry has surpassed a hundred billion dollars (USD) in size while the display-leveraged consumer electronics hardware industry is currently driving a trillion-dollar (USD) global economy.

In 2019, the display industry reported revenues of $111 billion, however, due to the worldwide economic impact of the pandemic the 2020 forecast has been revised down to projected revenues of $104 billion.

However, the industry is expected to revive by 2024 to projected revenues of $126 billion. The five major product categories for display demand in India are smartphones, TVs, notebooks, tablets and monitors.

The fastest growing segment is the smartphone display segment. To meet the display demand in various categories and keep technology adoption rate and price sensitivity in consideration, the display manufacturing plan for India should focus on two types of display fabs, namely, Gen 6 fabs for smartphone displays; and Gen 8.5 fabs for all other product categories.

The key factors that drive the sizing of a display factory are mother glass size, product size, panels per sheet, process yield and operating efficiency.

The creation of a display industry will require the confluence of capital, know-how and market pull. India is already a leading consumer of displays, hence there is already a strong domestic market pull.

The challenge for India is to bring together capital from the government, industry and the advanced nations and the know-how to trigger the growth of the domestic display industry.

While the impact of India becoming a hub for electronic components manufacturing is far-reaching and significant, the window of opportunity is fast closing.

The time to act is now and if we are to attain the goals in the DPE, the government and the industry must continue to work closely as the goal is the same – India leading the world.

Source : Business Today