Seafarer wage rates are set to accelerate in the face of worsening officer supply / demand imbalance. Sustained fleet growth will lead to the highest shortfall of officers to crew the world’s merchant fleet in over a decade by 2027, with important implications for both hiring and future manning cost inflation, according to the latest Manning Annual Review and Forecast report published by global shipping consultancy Drewry.

The current officer supply shortfall is estimated to equate to around 5% of the global pool, which is broadly manageable in practical terms for vessel operators. But there is heightened risk with regard to the Russia / Ukraine conflict potentially further limiting the supply of a large number of officers.

Looking ahead to 2027 the supply / demand gap is expected to widen to a deficit equating to over 8% of the global officer pool. This is despite a slight anticipated uptick in the rate of growth in supply as training rates increase now that Covid restrictions are much less significant. While ratings supply has also been slowing, this poses less concern to employers as it remains broadly elastic to increases in demand as the global fleet expands.

“Recruiting and retaining quality officers with experience on sophisticated vessel types is likely to be the first pressure point in a tightening supply pool,” said Drewry’s head of manning research Rhett Harris. “Employers need to ensure that a career at sea is an attractive career option for ambitious and well-educated people.”

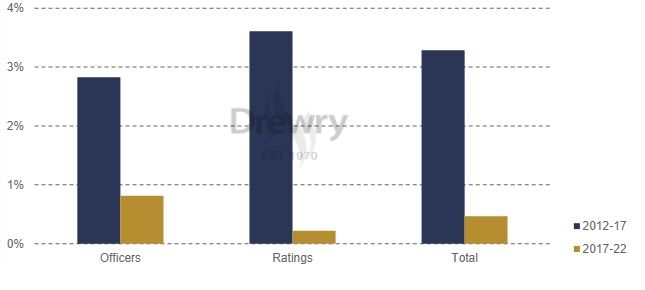

Changes in seafarer supply (2012-17 Vs 2017-22, % CAGR)

Source: Drewry’s Manning Annual Review and Forecast 2022/23

Worldwide consumer price inflation is forecast to be over 7% in 2022 before falling back to around 3% for the forecast period to 2027. In the face of this seafarer wage rates are expected to increase by around 2.5% each year, in average terms, from around 1.5% in 2022. There will however, be increased volatility by rank, nationality and vessel type outside of these averages.

“Accelerating manning costs are being driven by inflationary macroeconomic pressures and rising officer shortfall,” added Harris. “Together with higher insurance and supply chain costs, these pressures will further fuel higher vessel operating costs over the medium term.”