Shipbreaking yards in the country imported a total of 114 vessels between January and September, down by about 49 per cent from 225 during the same period a year ago.

As such, the amount of scrap procured from dismantled ships dipped by around 56 per cent year-on-year to 9.34 lakh tonnes at the same time, according to the Bangladesh Ship Breakers and Recyclers Association (BSBRA).

“We are facing difficulty in opening letters of credit to import scrap ships as banks are not showing interest in doing so,” said BSBRA President Md Abu Taher.

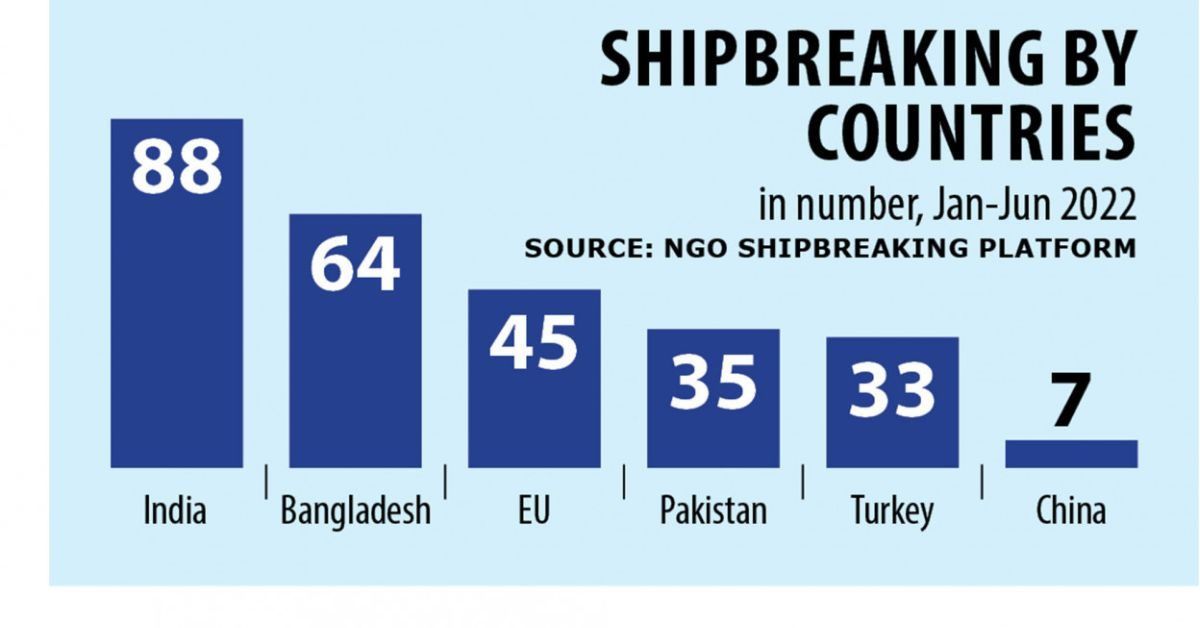

And although just 45 of the 158 shipbreaking yards in Chattogram are currently operational, Bangladesh topped the list of ship dismantling countries ahead of India and Pakistan in 2021, according to data from the NGO Shipbreaking Platform.

A total of 763 commercial ocean-going vessels from across the globe were sold to scrap yards that year. Of them, 583 large tankers, bulkers, offshore platforms, cargo and cruise ships were broken down on the beaches of Bangladesh, India and Pakistan, amounting to almost 90 per cent of the gross tonnage of scrap procured worldwide.

Bangladesh dismantled 280 of these ships to get 27.28 lakh tonnes of scrap.

Between January and June this year, shipbreaking yards in South Asia collectively dismantled around 272 ships with Bangladesh becoming the second-biggest demolisher after India.

The NGO Shipbreaking Platform is a Belgium-based global coalition of organisations that works to reverse the environmental damage and human rights abuses caused by shipbreaking practices.

Local shipbreakers and recyclers said scrap from vessels is mainly used by steel re-rolling mills and shipbuilders that make barges.

Meanwhile, many shipbreaking yards in the country are suffering losses this year as they had to count high costs for the hike in US dollar prices amid the depreciation of the taka, the local currency.

Kamal Uddin Ahmed, senior vice president of the BSBRA, said shipbreakers import scrap vessels on deferred payment for up to one year. Besides, they have to count an additional Tk 20 per dollar when clearing import bills.

“Numerous yard owners have gone bankrupt because of the high cost of the greenback,” he added.

Alongside the dollar shortage and subsequent lack of interest among banks to open letters of credit for purchasing scrap ships, the demand for re-rollable steel plates used to make rods has also dropped. In addition, a rise in sea freight has reduced the availability of ships for scrapping globally.

“Overall, businesses are not willing to take risks,” Ahmed said.

Mohammed Ali Shahin, the coordinator of the advocacy unit of Young Power in Social Action, an NGO which works on the shipbreaking industry and workers’ rights, said falling scrap vessel imports have reduced the employment scope for workers.

He also said most shipbreaking yards are run by hiring workers on a contractual basis while some have started hiring workers permanently.

“We have engaged with owners and some of them are supporting workers from their welfare funds. But if the situation prolongs, there will be an adverse effect on workers,” Shahin said, adding that the livelihoods of 30,000 workers would be threatened.