Jindal Stainless is the first Indian corporate participating in a path-breaking India-Singapore project to make the bilateral cross-border trade paperless and a smooth ride for all parties. Commerce and Industry Minister Mr Piyush Goyal and his Singaporean counterpart, Mr Gan Kim Yong, today successfully kicked-off the first “live” transaction of interoperable e-Bills of Lading (eBLs) from Singapore to India through TradeTrust Framework, during the G20 Trade and Investment Ministerial meeting in Jaipur, India.

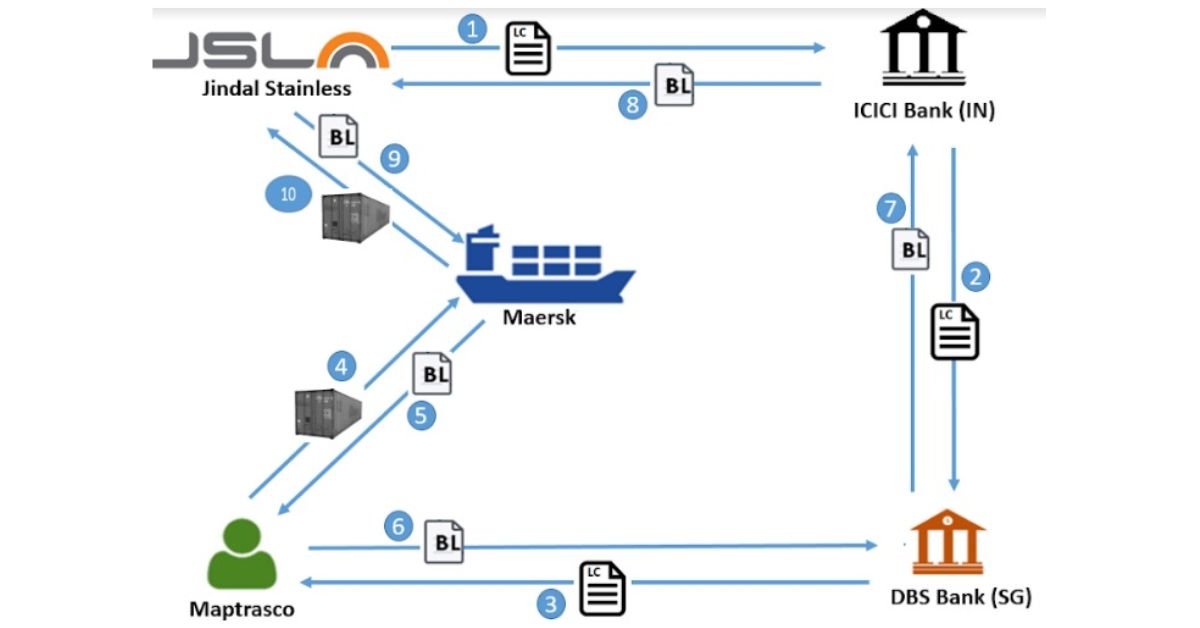

The National Institute for Transforming India (NITI) Aayog and Singapore’s Ministry of Trade and Industry (MTI) have roped in, besides Jindal Stainless, ICICI Bank, Enterprise Singapore, Infocomm Media Development Authority (IMDA), DBS Bank, Maptrasco, A P Moller-Maersk for this project.

Globally, this is the first live transaction under letter of credit utilizing eBLs in this project, powered by blockchain, under which the traders, shippers, and banks are involved in the transaction of an actual shipment that will be fully paperless across geographies and through different platforms.

Expressing his endorsement of the project, Managing Director, Jindal Stainless, Mr Abhyuday Jindal, said, “The TradeTrust Framework will boost international trade by eliminating the massive time consumed in the physical movement of the paper bill of lading (BL), and allows digital transfer of the title of goods from the seller to the buyer. As a major importer of scrap as a raw material, interoperable eBLs will benefit us with speedy release of goods at the port, ensure cost effectiveness and unlock liquidity for business. We are proud to be partnering with the Indian and Singapore government in helping build an ecosystem for efficient international trade which we hope will only become more widespread in the long run.” eBLs have emerged as a promising solution to addressing the challenges faced in international trade by digitising the traditional paper-based process, allowing for faster and more secure transfer of ownership and title documents in the shipping process. Besides minimising the risk of demurrage and detention of goods, the usual pain points for importers, they enhance trade financing opportunities and reduce risk of any damage to or loss of paper documents. eBLs also streamline the documentation process and increase operational efficiency and accuracy besides having a reduced carbon footprint.