[vc_row][vc_column][vc_column_text]

Consumer demand is no more restricted to Tier-I cities, hence it has created the need for warehouse and distribution centers at strategic locations to serve the buyers in a cost-effective and timely manner. Nestled at the heart of India, Nagpur was named as the Zero Mile city during the British era for its even distance to all major commercial hubs in the country. Over a period of time modern age warehouses spearheaded by e-commerce boom at locations like Bhiwandi and Bengaluru hogged the limelight; however as the economy gears up to embrace GST, the limelight is back on Nagpur. Future Supply Chains, the storage and distribution arm of Future Group, has made Nagpur as the hub for import cargo and to serve as the central warehouse and distribution centre for the mega retail chain. A lot has changed in the last couple of months, from a non-starter Every major supply chain company is planning to have a base in Nagpur making it the future nerve centre of cargo movement THE FUTURE HUB? now almost all major supply chain companies have a presence here or planning to come here. The likes of Patanjali Group has acquired land to set up a manufacturing unit to serve domestic and export market. The city with decent roads and hardly any traffic congestion is building maiden metro rail corridor to get future ready. A walk around the city and one can find cargo carriers bearing license plates from all over the country plying around.

The Mihan factor Multi-modal International Cargo Hub and Airport at Nagpur, more popular as Mihan, was developed as a multi-product SEZ by Maharashtra Airport Development Company Limited (MADC) to attract investment in the Vidharbha region. However, the SEZ policy played spoil sport for the project. Though the tax benefits prompted exportoriented software and pharmaceutical companies set up shop at Mihan, but slump in export market and growing domestic demand didn’t attract big ticket investments in manufacturing space in the initial days. Furthermore, the ambiguity in the timeline for tax benefits to SEZ dented the sentiment of potential investors. Dr. Prakash Khemka, Past President, Nagpur Custom House Agents’ Association and EC-Member, FFFAI, said, “Mihan authorities are selling land at `1 crore/acre, which is too high for an investor. Now government is taking effort to attract investors.”

Being the home town for the Maharashtra state chief minister and Union minister for transport and highways acted as a trigger for Mihan. The project could only be revived in recent times when some land outside the SEZ zone was allocated to industries, including logistic companies for warehousing among which largest land bank of about 214 hectare has been acquired by Sical Logistics. Pramood Dhiran, Director, SSS Sai Shipping Services said, “The development commissioner in the initial days of the project had allocated only three companies, including ours to handle cargo at Mihan. Currently, only Boeing, Lupin and Diet Food are active and an average 100 containers per month are shipped from Mihan.” Hinterland

Nagpur and nearby regions generate a mix of industrial and agro commodities. Due to which even at times of economic downturn for any particular commodity is neutralized by other sector. Though Nagpur is majorly known as the trade center for pulses and agro commodities, it also has a heavy concentration of saw mills. Lakadganj, derived from Hindi word ‘lakdi’ is known as the one of major hub for timber where imported and indigenous teak woods are brought for sawing, and then about 90 per cent of it distributed to different parts of the country. However, this trade is not flourishing. Prabhudas Patel, President, The Nagpur Timber Merchants’ Association and Vice President, Maharashtra Timber Laghu Udyog Mahasangh clarifies the reasons, “Nagpur was Asia’s largest timber market at a point in time, but due to tax rebates Kandla has become a major timber processing hub which has affected Nagpur’s trade. Nagpur timber market has 30 per cent import consignments and 70 per cent of timber is sourced from domestic market, of which largest volume is moved from various parts of Madhya Pradesh. The processed timber logs goes to all states except Gujarat. Nagpur timber traders import about 250 containers in a month. Though there is a potential for export, but due to shortage of customs and excise officials, factory de-stuffing is not allowed in Nagpur. Hence, export can only be done from Mumbai which is not convenient.

Another major centre that generates EXIM cargo is Mandideep which is known for fiber, yarn and spinning mills, and home to major exporter-oriented industries like Vardhman Group.

Furthermore, country’s one of the single largest rice procurement hub Gondia is located just about 166 km from Nagpur. Rice is also procured from nearby regions like Raipur, Telangana, Andhra Pradesh, and Western Odisha, and it is single largest export commodity from Nagpur. Concor ICD at Nagpur has handled 712 teu of rice in October. Since Concor ICD Nagpur handled majority of EXIM cargo, we would take its cargo volume for the latest available month (October) as a reference to understand other major export commodities from the region which are Whisky (128 teu), yarn (448 teu), transmission parts and galvanised steel structure (157 teu), steel (69 teu). Major import products include scrap (305 teu), teak wood (235 teu), newsprint paper (178 teu), waste paper (134 teu) and furniture (103 teu). Domestic commodities include rice, agricultural products, steel, paper, and white cement. The districts Chandrapur, Bhandara, Jabalpur, Raipur, Sansur, Yeoatmal, Bhilai, Satna, Akola, Amrawati, Gondia, Siltara and Sambalpur, among others are part of its hinterland. Though containerised rail is mainly used for cargoes destined to JN Port, road transport is increasingly used since last couple of years particularly for the east-bound cargo to be shipped through Visakhapatnam. This is due to several advantages this mode offers: convenience of sending even lower volume of cargo, flexibility in terms of timing and lower freight rate offered by inbound truckers from south Indian cities to Raipur which otherwise would return empty. Though rail has a cost advantage of about 30 per cent as compared to road freight rates from Raipur to Visakhapatnam, it is neutralized due to multiple handling involved in rail movement.

who have shipped some cargo through Krishnapatnam Port, which is located about 976 km from Nagpur, found freight cost is almost half as compared to JN Port. Concor is looking forward to tap the market by starting container rail service between Nagpur and Krishnapatnam in January but a regular train service is expected to start by June next year. Concor is also in discussion with Dhamra Port to give an alternate port for exporters in Raipur.

Central India is hub to many steel plants but these units move even their west bound cargo by road due to unavailability of rail containers. The reason is steel coils come under Iron & Steel, which is a notified commodity and as per the ruling of Railway Board when a notified commodity is loaded in more than 30 containers (teu) of a rake, haulage charge for such containers will be levied as per Container Class Rate. While the Railway Board has removed 42 items from the list of notified commodities, steel coil still remains in the list. If the Railway Board considers to allow movement of minimum 50-55 containers in a rake, then this cargo can be converted to rail containers. Since these are high value commodities, steel plants don’t prefer to transport it by rail wagons. Moving 30 containers in a rake is not financially viable for the rake operators and the steel units.

Export of food grain is also expected to grow from the region in the coming six months. Imported dal and wooden logs have been released at JN Port which would increase cargo movement from the port to the central parts of the country. Furthermore, restriction on import of heavy melting steel has been revoked, hence the cargo movement will grow in Aurangabad, Raipur and Bhopal.

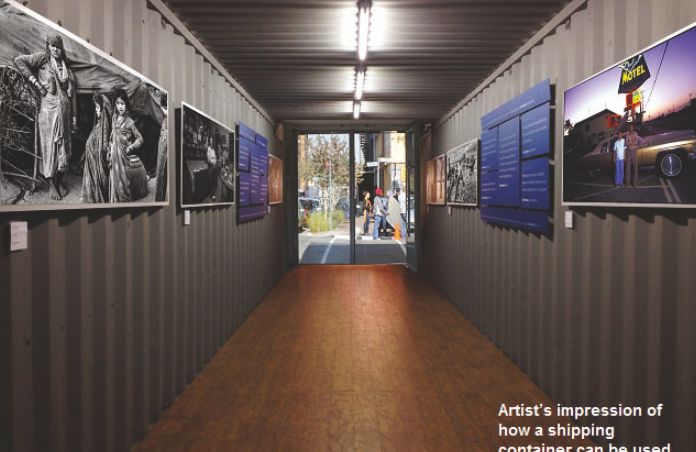

Large capacity warehouses are coming up at Mihan to cater to the demand for large scale storage space in these region in the Post-GST scenario. Chhattisgarh government is also developing its new capital and investment hub at Naya Raipur. Hence, there will be opportunity for private players to use them.

Concor operated ICD handles the major volume of the cargo, but recently it is facing competition from private players. Distribution Logistics Infrastructure (DLI) has set up an integrated logistics park at Borkhedi, about 35 km from Nagpur. DLI started operation only in August but it has been able to gain cargo from Indorama Industries, a major volume exporter from Nagpur. Though the company still ships some cargo from Concor but the competition has heated up between Concor and DLI. Udai Singh, General Manager (Operations), DLI said, “Steel coils by JSW and Uttam Galva are major commodities handled at the terminal. Nagpur doesn’t have large-scale industries, hence there will be more movement of domestic cargo than EXIM.” Glocal Asia Group is another private operator of an ICD at Butibori Industrial region but it has only road freight movement. Though users of Concor are positive about the facility, but there are some grey areas. Highlighting some key areas for improvements, Haldirams Food International, Head of Exports, Ms. Suvarna, said, “While proximity of our factory to the ICD is an advantage but the transportation cost is higher for shipment to JN Port. While export consignments from Mumbai are moved on board a vessel within 2-3 days, our consignments gets on board the vessel after about 15 days. Though frequency of trains has improved, trains from the ICD run for different terminals of JN Port on different dates, and since loading date for a container is not declared in advance, many times containers get stuck at the terminal. We are one of the few reefer container users in Nagpur, for which I have to bear additional cost to bring empties from Mumbai. There are also uncertainties about the surety of temperature maintained by the transporter.” Highlighting some of the shortcomings in logistics in the region, Pramood Dhiran, Director, SSS (Sai Shipping Services) said, “Availability of trailors is an issue as 40” are not available between 15th to 30th of every month.” Kirti Shah of Reliable Logistics further adds that a major volume of cargo which consists of rice has shifted to Visakhapatnam, and some agri commodities like cotton and soya are not doing good for the last couple of seasons. It is a major challenge for logistics sector in Nagpur.

Crossing, a local interpretation of cargo aggregation and distribution, also fuels domestic cargo movement at Nagpur. The practice is cargo from various nearby regions are brought to Nagpur, from where it is aggregated and transported to respective destinations. This is a thriving business in logistics space in Nagpur, and a lot of unorganised players control it. Manohar Bhajwani, President, Mihan Industry Association and Director, Nagpur Dal Millers Cluster says, “There is a need to bring in innovation. Nagpur has been the leading hub for pulses trade and processing and the demand is going to grow. About 42 dal millers have developed a common facility in Nagpur. There is a need for modern and bigger warehouses in the region.”

[/vc_column_text][/vc_column][/vc_row]