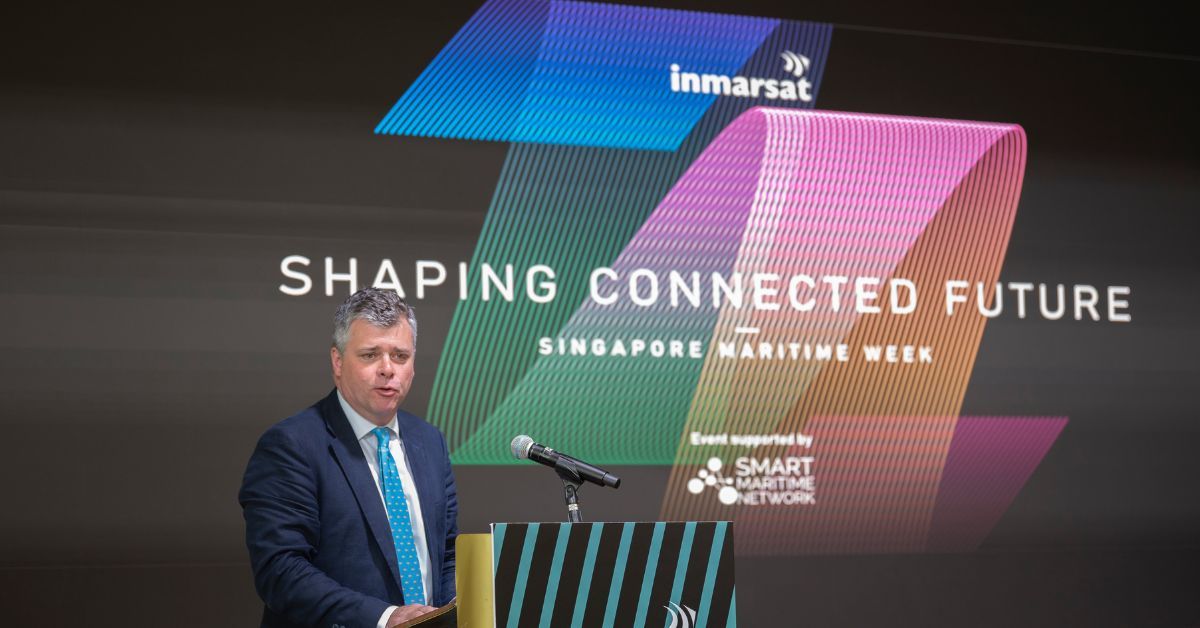

At this year’s Singapore Maritime Week, the Inmarsat Seminar, Shaping Connected Future, examined the maritime industry’s responsibility to drive sustainable and profitable business models through collaboration and technology. Inmarsat Maritime president Ben Palmer’s thought-provoking keynote addressed how the maritime industry can drive sustainable and profitable business models through collaboration and technology use.

Punit Oza, Maritime NXT founder and moderator of the Enabling Connected Supply Chain through Technology panel discussion, outlined the challenges facing the global supply chain, stressing the need for “solutions for end-to-end supply chain digitalisation and highlighted the vital role the maritime industry can play in providing these solutions.

Invited to contribute their expert insight to proceedings were Anne-Sophie Zerlang Karlsen, Head Operations, Maersk Asia Pacific; Nakul Malhotra, Vice President Emerging Opportunities Portfolio, Wilhelmsen Group; Peter Schellenberger, Founder/Director, Novamaxis Pte Ltd; and Gert-Jan Panken, Vice President Direct Sales, Inmarsat.

Maersk’s Anne-Sophie Zerlang Karlsen began by acknowledging that the aim of delivering smooth, timely services and high levels of visibility remained some way from realisation. Yet while the onus is on container lines to improve the efficiency of their services, that is only part of the equation, she said: “In reality, it’s about collaboration, creating industry-wide standards for sharing data and being bold enough to trust each other. Shipping is not traditionally a trusting or sharing industry, so this is a big hurdle to overcome.”

Another obstacle to open data sharing, said Peter Schellenberger of Novamaxis, is outdated, fragmented IT. “Legacy IT systems don’t give us the functionality and visibility we need nowadays,” he said. “Our new owners – financial institutions and other stakeholders – need real-time information with full transparency and access, but legacy systems hinder integration with other services including best-in-class start-up solutions, and this is a huge problem.”

However, Schellenberger noted that the industry is “slowly coming together” in this respect, pointing to the Smart Maritime Council’s Standardised Vessel Dataset for Noon Reports, which, he explained, will allow “comparable information to be produced for both legacy providers and start-ups” while saving time and effort for vessel personnel.

Like data sharing, embracing digitalisation will require an initial leap of faith. Wilhelmsen’s Nakul Malhotra called for a “shift in mindset” within organisations, towards acceptance that technology is not here to replace seafarers but to “make their lives easier”. Based on their approach to digitalisation, he added, shipping companies can be divided into three categories: the “progressive” top 10%, which will allocate funds for innovation and take the greatest risks; the bottom 25%, which “won’t do anything”; and the middle 65% on which “the industry’s transformation is predicated”.

“The main challenge I hear from start-ups and solutions providers from outside shipping is that they’re investing significant time and effort but are working with the bottom 25%,” remarked Malhotra. “These companies have to be realistic about which part of the pyramid they’re working with.”

According to Schellenberger, an equally important consideration for solutions providers is that 70% of the addressable merchant fleet belongs to owners of just 2–15 vessels. “These companies need extra help as they don’t have access to global set-ups,” he said. “Service providers and start-ups may aspire to work with the biggest names in shipping, but their time could be better spent solving problems for the smaller owners that make up the majority.”

From the shipping company’s perspective, the benefit of investing in digital technology is as much for the end customer as it is for the business itself, explained Karlsen, who gave the example of Maersk’s smart, refrigerated containers that collect data to enable continuous monitoring.

“While our investment paid itself back in terms of operational savings, the real value of the product was unlocked when we started sharing the data with our customers,” she said. “This allowed the customers to track not only the location of their goods but also the temperature of the container, so if something went wrong, they could take action upstream in the supply chain to resolve the issue.”

Expanding on Karlsen’s comments, Inmarsat’s Gert-Jan Panken said: “We shouldn’t focus on the cost of investment but on the value that it can unlock. By investing a few hundred dollars extra in crew welfare, for example, owners can benefit from a more motivated workforce and smoother, safer operations. By investing in remote equipment health checks so they know when maintenance is due, owners ensure savings further down the line. A very promising development we now see among our customers is this shift in focus from cost to value.”

Highlighting another positive change from his interactions with customers, Panken added: “In the past, we mainly interacted with superintendents, whereas now, we more often engage with CIOs and IT departments. There is still room to grow, of course, but change is happening. Our increased engagement with customer representatives in the IT domain is clear evidence that now, more than ever, companies are embracing IT opportunities.” This, he concluded, will be key to enabling a connected supply chain.