Trade community and stakeholders in the shipping and logistics sector of Bangladesh pinpoint at critical issues that need to be immediately resolved to ensure unhampered trade and economic growth in Bangladesh and South East Asia

A promising country with plenty of opportunities in trade, Bangladesh is ushering new heights. However these bundle of opportunities have not been fully utilized. Bangladesh has been witnessing progressive growth but hampered by many bottlenecks over the years. In this background Maritime Gateway in association with Drewry has conducted an extensive survey to dwell upon and unveil facts collected from all stakeholders of shipping and logistics industry to bring to the notice of government, the pain points that need to be relieved.

Bangladesh has registered a volume of 2,566,597 TEUs in CY 2017 with a rise of more than 9 per cent year-on-year growth against CY 2016 volume by clocking CAGR of around 10 per cent during CY 2008- 2017. The country’s merchandise exports are majorly dominated by garments with around 80 per cent share. The country’s 90 per cent of the total cargo is being handled at Chittagong Port.

Shipping and logistics industry growth is majorly driven by investment in the improvement of port infrastructure, transportation, information technology (IT), storage, handling and custom clearance facilities…etc.

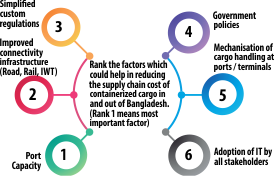

In a competitive world, reduction in logistics cost is of prime importance for all type of businesses. In mercantile trade businesses logistics components are vital starting from inland connectivity to cargo handling at ports to custom/legal procedures.

Bangladesh with ever rising garment exports is plagued by high logistic cost and time delays. The survey ranks the absence of adequate port capacity as a critical factor for the high supply chain cost of containerised cargo moving in and out of Bangladesh. Capacity constraint at the port, especially at the Chittagong port is so wretched that the export containers are moved directly from CFS to the quay crane hook. The second factor affecting the cost is port connectivity infrastructure like road, rail and inland waterway.

Now the question arises why capacity constraints have been hampering Bangladesh’s international trade? Why is it not being addressed? Through survey results, delay in decision making is the primary cause for this sorry state of affair at the ports. For example, The New Mooring Container Terminal (NCT) remained unutilised for years after the construction was completed in 2007 due to delays in decisions for the appointment of an operator and purchase of equipment. Apart from port congestion, delay in custom clearance was highlighted as key factor affecting importers and exporters of Bangladesh with additional cost.

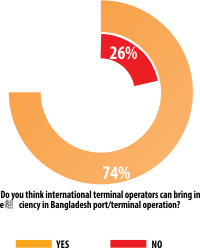

When asked whether international terminal operators can bring in efficiency in Bangladesh port/terminal operation? 74 per cent respondents supported that international terminal operators can improve efficiency. They also mentioned that PPP model of operating terminals is already a proven model worldwide and the same can help in Bangladesh. Expertise of well-established and well experienced global port operators will definitely boost the performance of ports and the customer-friendly approach, digitization, advanced cargo handling equipment’s which they use will append for betterment of ports.

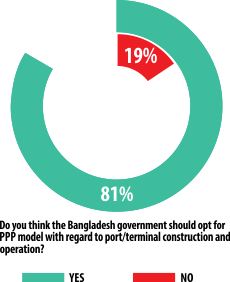

Opting for PPP model was chosen by many respondents for the quick turnaround at existing/upcoming ports and terminals in Bangladesh. 81 per cent of the respondent’s choice is to go for PPP model. The reasons mentioned are foreign investments will help Government to get money flow for the swift action in development of Projects. Few also expressed that delays in action, implementation can be eliminated in this model for betterment of trade.

Decision-making delays, lack of planning and political factors are considered as major reasons by respondents for the lag in logistic projects implementation. About 70 per cent of freight movement at Chittagong Port originates and is destined for Dhaka region and rest 30 per cent for Chittagong region. In case of Dhaka to Chittagong transportation, time taken by a truck should be ideally nine hours but mostly it takes more than a day, increasing the cost and time for shippers. These congestion issues deteriorate and create chaos in transportation of exim cargo.

Apart from the above mentioned reasons affecting shippers with additional cost, lack of mechanization at ports also plays a vital role in increasing cost for the shippers in Bangladesh. Installation of advanced cargo handling equipment can resolve the issues and improve the efficiency in port handling. Lack of direct port calls is also a concern, as Bangladesh is losing revenue to neighbouring countries due to its inadequate draft in welcoming bigger vessels. Siltation at river-based ports and high cost of dredging adds to the operational costs.

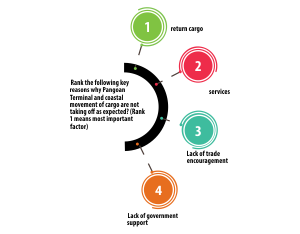

Lack of return cargo is the major reason highlighted by respondents when we asked about why Pangoan Terminal has not grown as per expectations? However the same reason is applicable to the country’s trade as there has been wide gap in between exports and imports. Vessel frequency and new services need to be improved at the terminal for the rapid growth of volume. One of the key reasons is lack of trade encouragement for this emerging terminal to serve the trade fullest.

Political challenges and issues ranked top in intra-regional trade barriers in south Asia. Hopefully all countries should step forward in resolving these barriers for the betterment of trade flow among all south Asian countries. Then the next challenge is connectivity issue among south Asian countries as regional ports are not well connected. High logistics cost also plays a major role in slow growth in intra-regional trade in south Asia.

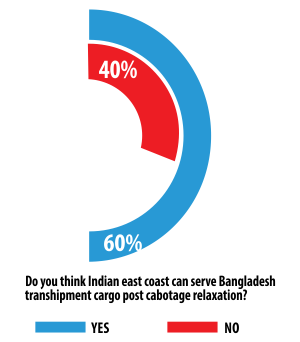

About 60 per cent of the respondents voted for Indian east coast to serve Bangladesh transhipment cargo. Indian east coast is strategically closer to Bangladesh ports and can help in reducing logistic cost, increase turnaround time, improve connectivity and promote healthy competition among transhipment hubs with competitive tariffs. However, shippers in Bangladesh are also concerned about high congestion issues at Kolkata and Haldia ports. A majority of respondents called for developing a deep draft port in Bangladesh to handle its own cargo more effectively.

Take aways:

Due to its locational advantage, Bangladesh can play a key role in south Asia regional trade and logistics. Improvements in intra-regional trade relations can augment exports and cut import costs. Bangladesh has increased its global market share by two fold in exports in the last decade. However, the potential is much higher. Bangladesh has enormous potential to increase trade with its neighbours as most of its trade with neighbouring countries is only less than half of its current potential. Key barriers like poor infrastructure, congestion issues, port calls, marinating draft, political issues, project implementation delays, lack of storage capacity, transport services, connectivity issues and clearance delays need to be addressed immediately to bolster Bangladesh to become more competitive regionally and globally.