India’s beef exports have dropped to the lowest level in almost a decade, impacted more by a decline in demand from Vietnam than by local restrictions on trade and slaughter of livestock, trade data show.

The value and volume of beef exports have fallen below levels recorded in 2012-13. India exports buffalo meat, or carabeef, as the slaughter of cattle is prohibited given that many Indians consider cows sacred.

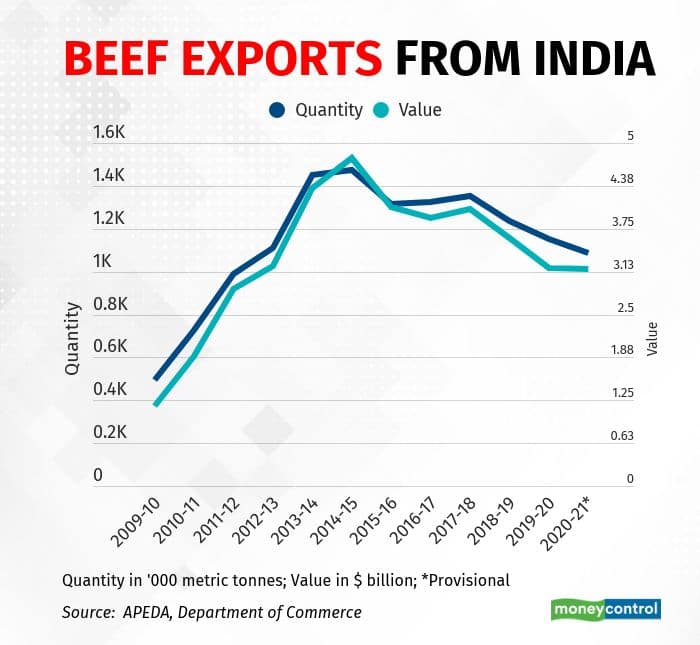

Beef exports were valued at $3.17 billion in 2020-21 compared with $3.2 billion in 2012-13, according to trade data published by the department of commerce. Beef shipments had peaked in 2014-15, when meat worth $4.78 billion left Indian ports, accounting for 1.5 percent of the country’s total exports. The share of beef in India’s exports is now a little above 1 percent, a level that it has maintained for the past three years.

Vietnam was the top destination for Indian beef for several years and helped the country become the largest exporter of beef while also contributing to its fall from that position. Some reports suggest Vietnam was used as a transhipment port for a sizeable portion of the meat shipments from India.

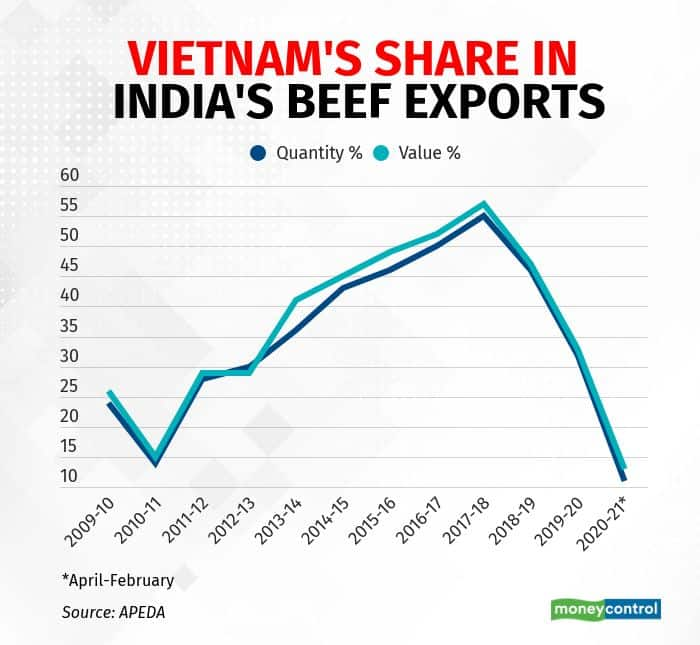

Vietnam’s share in India’s beef exports by volume climbed to a peak of 55 percent in 2017-18 from 28 percent in 2017-18%, while in value terms, it swelled to 57 percent from 29 percent during this period.

Vietnam now accounts for about 11 percent in volume terms and 13 percent by value, according to data published by the Agricultural and Processed Food Products Export Development Authority. The fall in exports to Vietnam was offset by an increase in exports to other destinations, and that prevented a big fall in trade volume and value in 2020-21.

As demand from Vietnam and other countries in South East Asia, West Asia and Africa grew, India’s beef exports grew in high double-digits and peaked at 1.47 million metric tonnes in 2014-15, more than doubling since 2010-11.

The slide started soon after as domestic protests by the cattle protection lobby grew strident. After dropping to 1.31 million tonnes in 2015-16, exports were little changed in the following two years and began declining again in 2018-19 as imports by Vietnam started falling.

The US Department of Agriculture estimates that India’s share in world beef exports by volume fell from 21 percent in calendar year 2014 to 12 percent in 2020.

Rise to the top & fall

India’s rise in the global beef export market started in calendar year 2010 when the world began to bounce back from the financial and economic crisis of 2008 and demand for relatively cheap meat grew. That year, the volume of beef exports from India jumped 51 percent to 917,000 metric tonnes, according to the USDA.

India closed in on Australia, the second-largest exporter then, and widened its lead over New Zealand, the fourth-largest, as exports from the two Southern Hemisphere countries barely grew that year.

India displaced Australia to become the second-largest beef exporter in 2012 and two years later dislodged Brazil to take the top position.

The next few years saw Indian authorities impose restrictions on the movement of livestock and increasing attacks by cow vigilantes. As global economic growth moderated, world beef exports slowed in 2015 and 2016, with both India and Brazil reporting a decline in their exports. Yet, India continued to be the top exporter.

India’s beef exports even exceeded basmati shipment in value terms from 2014-15 to 2016-17 after Iran sharply reduced purchases of the aromatic rice. Beef had the biggest share in farm produce exports by value in those three years.

The order changed in 2017 as global demand picked up with faster economic growth. Brazil made a more robust recovery and reclaimed its top position in beef exports. After the pick-up of 2017, India’s beef exports resumed the slide in 2018 and lost the second position to Australia.

India is back in the third spot and unlikely to face any competitive challenge.Trade data suggests that cow vigilantism may have affected domestic consumption more than exports. One indicator is the proposed revision of the wholesale price index series with 2017-18 as the new base year. The weight assigned to beef has been cut by 66 percent, implying that household and consumer expenditure on beef has declined since the last revision with 2011-12 as the base year.

Source : Money Control