Deprived of automation and thriving on rather uneconomical modes of logistics the Indian cement sector has for long been burdened with high logistics cost. The sector now seems on its way to optimise its logistics value chain.

The Cement Industry in India is more than a century old and is now second largest globally behind China in terms of installed capacity, production and consumption which is playing an important role in development of infrastructure in the country. Ask the industry experts what is driving the industry growth? And they are quick to count a bouquet of projects on their fingertips. In fact programmes such as housing for all by 2022, Make in India, creation of 100 smart cities, dedicated freight corridors, Swachh Bharat Abhiyan, water transport, concrete road projects etc. will make sure that all the production units function at their peak capacity. Increased allocation to infrastructure projects in Union Budget 2018-19 and the North-East, which is witnessing a construction boom, point at the growing demand for cement. There will be a vast requirement of cement and cement industry will be one of the most important contributing factors for the success of these projects. Housing and real estate sector is the largest consumer of cement in India, followed by infrastructure and industrial development sectors.

“Indian cement Industry has seen a fair amount of annual growth as India embarks on a massive investment in housing and infrastructure building. Capacity building, manufacturing excellence, overhaul of supply chain efficiencies and cost reductions along with market expansion including tapping rural markets are the major areas of focus for the industry. Growth in use of ready mix concrete especially in major urban metros and in infrastructure projects has given a fillip to increase in delivery of bulk cement. Slowly, India is moving the way the other major industrial countries have shifted to bulk cement from bag cement deliveries,” notes

JVB Sastry, Supply Chain Consultant, Emami Cement. Thus it may not be too ambitious to forecast India’s cement demand to reach 550-600 million tonnes per annum by 2025. Robust investments are being made by the existing players to expand their capacity. FDI inflow in the industry related to manufacturing of cement and gypsum products reached $5.26 billion between April 2000 and June 2018. Many multinational companies like lafargeHolcim, Vicat and others have invested in the Indian cement Industry. However, Ultratech cement of the Aditya birla Group has expanded its capacity to more than 100 million tonnes becoming the largest cement company in India. Vicat group has 2 production units – Bharathi Plant in Kadapa District of Andhra Pradesh with 5 mtpa capacity and Kalburgi plant at Kalaburagi District of Karnataka with 3 mtpa capacity.

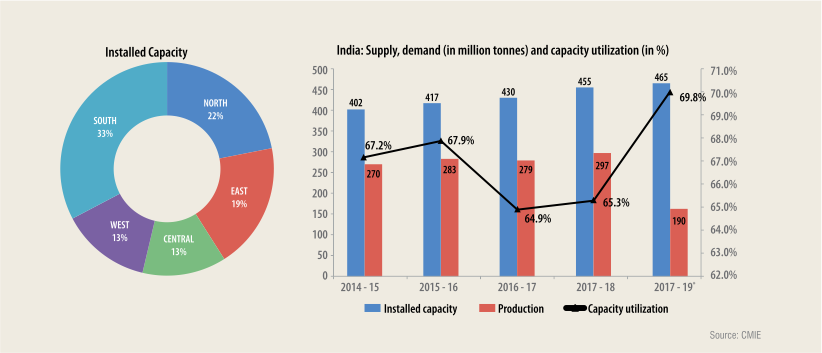

Sharing more insights into the market JVB Sastry further reveals, contrary to the large size of our country, growing population and rising middle class, the per capita cement consumption in India is less than 200 kg, compared to over 1,000 kg in China and 500 kg as the global average. The total installed capacity of Indian cement industry is about 510 million tonnes and the production capacity stood at 502 million tonnes per year (mtpa) in 2018. Production during the year 2017-18 was 297.71 million tonnes (mt) and during 2018- 19, it was 337.32 mt. Production during H1FY19 stood at 162.4mt, 14.4 per cent higher than 142 mt recorded in H1FY18. At present the capacity utilization is low and idle capacity of the cement production is around 170 million tonnes which comes to around one-third of total cement making capacity, underlining the recent trend of slowing activity in the housing sector and infrastructure development.

Of the total production capacity, 98 per cent lies with the private sector and the rest with public sector. The top 20 companies account for around 70 per cent of the total production. Around 210 large cement plants account for a cumulative installed capacity of over 410 million tonnes, while over 350 mini cement plants have an estimated production capacity of nearly 11.10 million tonnes. Of the total 210 large cement plants in India that manufacture all types of cement, 77 are situated in the states of Andhra Pradesh, Rajasthan and Tamil Nadu. The largest limestone (an essential raw material for cement) producing states are Madhya Pradesh, Rajasthan, Andhra Pradesh, Gujarat, Chhattisgarh, Tamil Nadu and Karnataka.

Exports

India is also a major exporter of the commodity mainly exporting to Middle East, Sri Lanka, Bangladesh, Myanmar, Nepal and countries on east coast of Africa. For instance, Bharathi Cement exports to Sri Lanka on regular basis and sometimes to countries like Bangladesh and Myanmar. We generally use Chennai seaport and Krishnapatnam seaport, informs M Ravinder Reddy.

High logistics cost

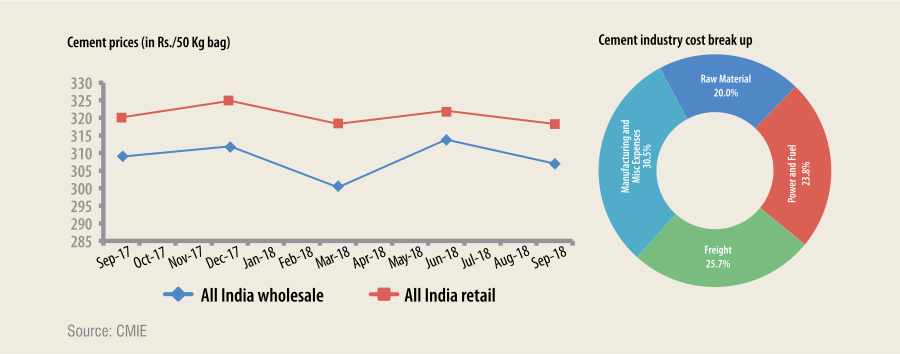

Owing to its commodity nature, cement has high transport freight weight adding to the total cost. In spite of being a logistics intensive sector – both in terms of sourcing raw material and moving cement to the market, the industry has not focused much on cost-efficiency of logistics. Elaborating on the logistics cost, M Ravinder Reddy, Director Marketing, Bharathi Cement Corporation Pvt Ltd said, “If we combine both inward and outward logistics, it contributes to more than 35 per cent of total cost of cement. We manage it very efficiently by bringing synergy between inward movement (logistics for procuring raw material) and outward movement (Logistics for moving cement). We have a dedicated fleet of 300 bulkers and truck which carry 50 per cent of inward and outward movement. We also have our own specialized bulk cement rake and bulk terminal for movement of bulk cement.”

He further adds, “We use mostly road logistics. Share of road in our total logistics is 75 per cent, rail share is 20 per cent and only 5 per cent is by sea. This is because of our market and distance to serve these market. Our average distance to serve the market is only 300 km and with lower distance road is more economical.”

“Cement industry is a logistics intensive sector and inefficient logistics has also contributed to the idle capacity of the plants,” said Ashish Nainan, Research Analyst, Care Ratings. He added that around one-third of the cement plants are located in the southern region marked with inadequate demand to utilise the installed capacity. Now transporting cement to the northern parts of the country is not a cost-effective proportion. Cement plants have to be located near the limestone plants as higher logistics have resulted in the inefficiency of many cement plants in the past, some of which have already gone bankrupt, points out Ashish Nainan.

Smaller cement plants with lower production capacity often find it difficult to procure rakes or wagons, an economical mode of logistics compared to road. Further it is uneconomical to transport this bulk commodity over long distances, which makes it a product of local sales.

Inbound movement of raw materials like limestone, coal, gypsum, bauxite and others have to be transported to the cement manufacturing plant and outbound transport of clinker to the grinding units and finished cement product to the markets are both critical. Since cement consumption is seasonal and somewhat skewed, storage of cement becomes necessary. Hence, transport, storage and onward movement of cement is essential and costly. Approximately, logistics costs constitute about 30 per cent of the total value of the finished product. Hence, cement companies focus a lot in selling closer to the plants, driving sourcing and logistics efficiencies and cost reductions. This has a direct bearing on the bottom line of the companies as the industry’s ability to pass on cost increases to the markets is limited due its commodity nature.

Sourcing of raw materials, need to send cement to market over long leads, multiple handling of cement bags, storage costs, not to speak of cost of damages, railway demurrages, tolls on highways, all these add up to the cost of logistics. Rural housing, remote location of projects, also increase the transport leads for the industry. At many rail heads and warehouses, labour unions and transport unions demand very high wages and freight charges. Pre-GST times required the industry to maintain warehouses at many markets. This has eased to some extent after the introduction of GST. Another cost factor is shortage of railway rakes. Ideally transport to long lead destinations will be economical if sent by rail. However, seasonal shortage of rakes has pushed the dispatches more to the costlier road mode. All these factors are responsible for high logistics costs of the cement industry.

Logistics challenges

There are many logistics challenges faced by the cement industry:

- Demand volatility creates problems in forecasting and making supply chain planning.

- Lack of integrated end-to-end planning, as the culture of functional silos is still a major operational challenge.

- Shortage of rakes, especially during peak season, which results either in production loss or movement by costlier mode which is road

- Most of the cement plants are located in hinterland near to limestone mines, and hence are dependent on surface transport for movement of raw materials and outbound cement.

- There is very low usage of river transport.

- However, in the recent years, the Industry has rationalised the logistics footprints by setting up clinker units near to limestone mines and grinding units near to markets/coastal areas. This helps reduce the logistics costs and also open up river transport to the cement industry which will bring in lot of economics

- Poor road infrastructure, vehicle movement restrictions on routes passing through villages and towns, add to delays and underutilisation of logistics assets, adding to cost increases

- There is hardly any mechanisation in handling of cement at warehouses. Manual labour is both inefficient and expensive. There have been a few efforts in semi-mechanization at a few warehouses, but have not scaled up till date.

- Road transport is still not very organised. In many interior places, transport is controlled by transport brokers, agents and single truck owners. Also, infiltration of local unions add to the complexity of dealing with them.

- Logistics safety is very critical but was mostly ignored by the cement industry till recently. There has been a sea change in the mind set and compliance after many companies from abroad have entered the Indian cement industry. A lot of work on supply chain safety and sustainability has begun in the cement industry.

- Use of hooks in handling cement bags is another major issue, as there has been not much of mechanisation in handling cement. This results in spillage and wastage besides loss of brand equity for many sellers.

Initiatives to improve logistics:

The industry has taken many initiatives to improve logistics:

- Introduction of bulk cement and ready mix concrete helped reduce bag cement percentage and associated costs and logistics challenges.

- RFID and GPS in plants and trucks has improved logistics information and customer service.

- Driver training and basic truck safety norms have brought in mind set change in logistics stakeholders towards safety.

- Model warehouses are being set up with clear safety and stacking guidelines. yy Pooling of sourcing by transporters is being encouraged to reduce the input/operational costs for truckers.

- There is a shift to large size trailers and trucks, so that per ton per km costs can be reduced.

- Post GST, direct to market deliveries have increased, thereby reducing physical warehousing and costs.

- Many cement companies are purchasing railway wagons for movement of clinker and cement. This will help reduce the dependence on railways for transport and the related uncertainties.

- Shared transport network and warehouse space can go a long way in better fleet utilisation through return loads and better space utilisation in warehouses, thereby bringing in efficiencies and reducing costs.

Demand scenario

The industry has registered good demand growth in the last few years barring a few hiccups in a few quarters. Demand from housing, infrastructure are important demand drivers. During H1 of FY2019 construction activity picked up in the housing segment across western, eastern and southern region. Affordable housing scheme for rural and urban areas supported demand for cement in the housing segment. Northern and central regions witnessed higher activity in the infrastructure segment, especially with elections in Rajasthan, Madhya Pradesh and Chhattisgarh. Between April to August, 2019, around 34 infrastructure projects with an outlay of over `150 crore have been completed across major infrastructure sectors.

Two successive years (FY18 & FY19) witnessed steady demand from housing segment especially rural housing. Real estate segment witnessed stable activity and there are signs of improvement over H1FY18 which witnessed disruption due to demonetization, RERA and GST. Affordable housing in rural areas continued to boost the demand in housing segment and the same is expected to peak by the end of Q3FY19. However, the overall demand has not kept pace with the capacity addition. Hence, the overall capacity utilisation has dropped to about 70 per cent.

The demand has been growing by about 5-6 per cent annually. The recent quarter-1 of 2019-2020, has seen a drop in cement demand growth between 3-5 per cent. In the long run, massive investments that are planned in the infrastructure sector and the need for large number of housing units, especially in the affordable housing segment, will keep the cement demand high.

For FY20, expect a demand growth of eight per cent and given the limited capacity addition, this is likely to result in an improvement in the industry’s idle capacity utilisation in FY20. Eastern and central regions will lead the cement demand growth with emphasis on affordable housing and infrastructure. GST implementation has also helped demand by giving flexibility to manufacturing units to move cement to different markets.

We must bear in mind that cement is a cyclical commodity with a high correlation with GDP. The housing and real estate sector is the biggest demand driver of cement, accounting for about 65 per cent of the total consumption in India. The other major consumers of cement include public infrastructure at 20 per cent and industrial development at 15 per cent. The domestic cement production rose by around 13 per cent between April 2018 and February 2019 as compared to six per cent year-on-year growth in FY18, the rating agency ICRA said in its report. CRISIL Research expects the profit margin from the sector to be at a six-year high due to the recent price hikes the industry practiced in the April-June quarter, and the lower power and fuel costs.

Key features of the Indian cement industry:

- Oligopoly market, where large players have partial pricing control.

- Low threat from substitutes.

- Per capita cement consumption at 210 kg is currently the lowest among developing countries while the world average is 580 kg.

- Long-term cement demand growth rate is estimated at 1.2 times of GDP growth rate

Cement pricing

Cement prices have remained range bound even though demand has increased substantially. Northern and eastern regions, especially states like Punjab, Haryana and West Bengal continue to feature better price realisation and southern region continues to be the most competitively priced. Southern market with a 33 per cent share of installed capacity continued to record lowest prices, with an exception of Kerala where the prices have remained high due to very less installed capacity for manufacturing cement. During the first half of FY 2019, the overall trend of prices witnessed a slight decline for a 50kg bag of cement.

Cost drivers

Petcoke is used as feedstock for production of clinker. India imports around 45 per cent of its petcoke requirement and the remaining demand is met by domestic refineries. Petcoke prices have remained on the higher side (Rs.7,800 – 8,500/ tonne) and imported coal too has remained at $100 and above which has left less scope for manufacturers to offset feedstock costs. An upward movement in Dollar vs Rupee has further hiked the price of imported feedstock. Power prices from spot market too have remained high and non-captive power users had to pay heightened power tariffs as a result of scarcity of coal supply during peakdemand period. Fuel and power prices on an average for the industry have increased by 15-18 per cent during H1FY19 over the corresponding period in the previous year. The overall operating margin for the industry has declined by 3% y-o-y due to fuel, freight, currency and power cost impact.