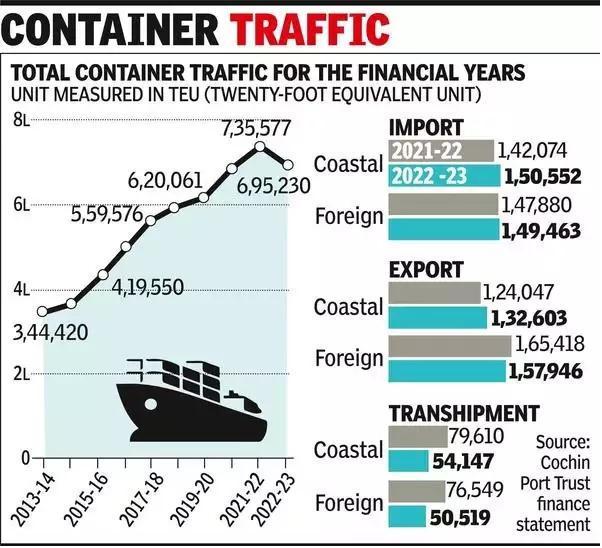

For the first time in the last 10 years, the International Container Transhipment Terminal (ICTT) here has registered a fall in container handling. From 7.35 lakh twenty-foot equivalent units (TEUs) in 2021-22, it has come down to 6.95 lakh TEUs in 2022-23.

The ICTT was developed with a vision to boost India’s container transhipment and check rising outflow of transhipment containers to Colombo. ICTT registered the decline despite the Union government’s efforts to develop it into a successful international transhipment hub of the region. Incidentally, Cochin Port Authority (CPA) had planned to attract transhipment business from Colombo Port in view of the economic and political uncertainties in Sri Lanka last year. It seems the steps from CPA did not help ICTT to attain growth.

Meanwhile, responding to the poor performance of ICTT, a senior official of CPA said that the port has recorded growth last financial year.

“We cannot comment on the reasons for the decline in the number of containers handled by ICTT, as it is managed by DP World,” said the official.

C D Nandakumar of Cochin Port Employees’ Organization has pointed out that the fall came at a time when all other terminals in India increased the cargo throughput. “It is surprising that 85% of cargo handled by the terminal is domestic. This plight comes at a time when DP World is making big claims about the terminal’s growth,” he said.

“The team which is managing ICTT has continuously failed to attract vessels that can dock here. The port is spending Rs 140 crore to maintain the current depth of 14.5m. Besides, Rs 60 crore per year is granted as concessions towards vessel-related charges (VRC) to shipping companies by the port to make the terminal competitive,” he said.

Meanwhile a statement issued by ICTT says that, with larger vessels, the requirements of a transshipment hub have drastically changed.

“A deeper draft, related infrastructure and competitive marine charges as is being offered by competing transshipment ports is needed. An increase in draft by the port authority will result in India’s cargo being loaded on direct mainline vessels destined to global destinations which will in turn enable better transits and efficient costs for our beneficial cargo owners making Indian exports and imports more competitive. ICTT has grown by over 5% CAGR (Compound Annual Growth Rate) in the last 5 years which is higher than the south Indian average growth,” the statement said.