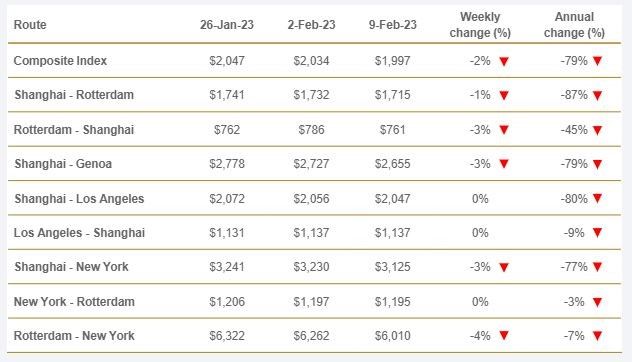

The Drewry’s World Container Index (WCI) annexed the psychological mark of US$2,000 on the downside for the first time since July 2020, post the first set of quotes reported in the aftermath of the Chinese New Year.

It must be noted, though, that similar quotes were seen in the WCI in early 2015 too. So, technically the rates are at a pre-pandemic level.

The Europe-US rates fell 4% for the week, touching US$6,000 well below the levels seen in 2022. After about five weeks all trade lanes reported a weekly loss in spot rates. The Shanghai-Genoa rates are now at a level identical to December 2019 even as the China-Europe and China-US rates keep extending their losses.

We had seen last year, how the rates for breakbulk were inching higher not just by virtue of breakbulk demand, but also owing to high supply chain disruptions in the container front, a portion of the global container cargo was booked on Breakbulk vessels. However, the clearing supply disruptions and space on board container carriers gradually trickled over to the breakbulk rates too. The Toepfer’s Multipurpose Index in its latest quote recorded US$15,137 losing over a third of its gains from the top.

It would be an interesting scenario ahead with Chinese manufacturing recording better monthly numbers since the December trough, and it remains to be seen if these transpire to arrest the fall in rates for the near term.

Below is Drewry’s assessment across eight major East-West trades: