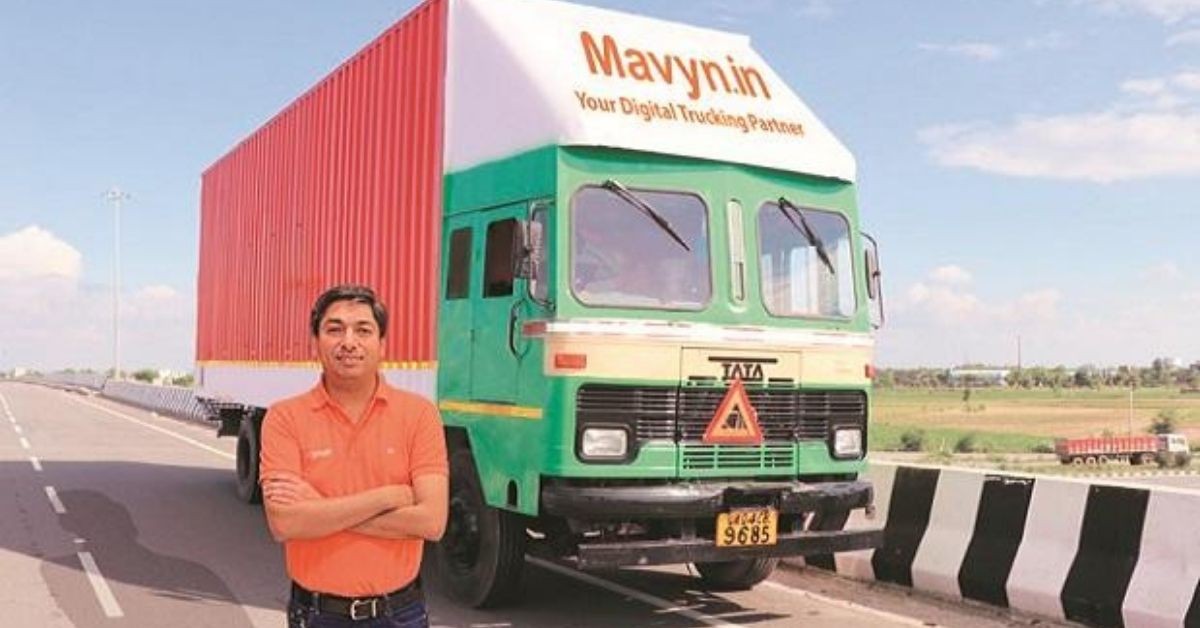

Sachin Haritash rode pillion on an employee’s bike to reach the first potential customer for Mavyn, the truck aggregator he had founded in January 2019. Coming from a family of transporters from Delhi and having worked in every department of the traditional road logistics business, Haritash had envisioned Mavyn as an “Uber of trucking” — a tech-driven logistics company where customers could book the consignments on an app, speed up deliveries and pay truck drivers within hours of the goods being delivered.

In the traditional logistics setup, bookings and invoicing are still done on paper; deliveries take at least twice the time; and drivers get paid according to the normal business cycle, which can stretch into weeks. Haritash’s model would minimise the industry’s intense dependence on the “human factor”, while also remaining profitable through increased efficiency and minimal working capital risk.

That morning, Haritash knocked on the door of a well-known company in the spices trade. But his proposal did not excite the man at the other end of the table.

“The moment he heard that there would be no paper LR (lorry receipt), he lost interest,” recalls Haritash. “After all, in the logistics business, paper LR is sacrosanct and I was asking this person to trust a company that worked through an app, on a paperless model.”

Mavyn never got that spice major as a customer. The meeting forced Haritash to rethink his approach and after a few weeks, he decided to reach out to start-ups and e-commerce companies, “since they were not steeped in old mindsets”. That’s how he bagged his first customer, an emerging e-commerce company.

Backed by and carved out of the Chetak Group, which has decades of experience in providing logistical solutions to the automobile industry, Mavyn now has more than 8,000 trucks, over 40 partners and operations in 34 districts across India. Among its customers are e-commerce companiesAmazon, Flipkart and Myntra; traditional businesses such as Hindustan Unilever and Marico, J K Tyres and Bridgestone etc. The company expects to clock revenue of Rs 36 crore and net profit of Rs 2.4 crore in FY21. Haritash says the lean company structure helped keep the employee cost at just 3 per cent this fiscal and it will further reduce to just a percent of the top line in four years.

Haritash’s experience at that spice major was quite a common occurrence in India’s highly fragmented and cost-intensive road logistics industry even two years back, though other and bigger aggregating platforms had already entered the market.

A 2019 study by Deloitte Touche Tohmatsu (“A time of reckoning: Road Logistics in India”) found that the sector was historically plagued by entrenched interests of a network of middlemen and small operators, leading to inefficiencies in the way shippers’ demand for truckswas matched with supply. Making matters worse was the negative perception about the truck driving job. It was considered one of the worst jobs in the country, featuring low pay, high risk of fatality and no respect in society.

The Deloitte study pointed out that in 1991, there was one driver per truck in India, but now at least one in four trucks(27 per cent) lies idle due to lack of drivers. And driver shortage is expected to touch 50 per cent by 2022. Tech-enabled trucking platform solutions were essential if India wanted to address this shortage effectively.

Rajesh Yabaji, co-founder of India’s largest trucking platform BlackBuck, wrote in a blogpost last year that while the majority of the trucking industry continued to work offline, some broad structural shifts were taking place. For instance, demand for a larger pool of carriers had led people to adopt digital discovery platforms; data-backed pricing insights were being preferred for freight; and shippers were moving to e-documentation and digital payment methods to reduce the heavy dependence on manual intervention in the trucking industry.

Even so, the share of aggregators is estimated to be just 2 per cent of the $110 billion road logistics industry.

Yabaji’s BlackBuck has over 600,000 trucksand operates in more than 15,000 cities across India. According to the company’s website, it is backed by investors such as Accel Partners, Flipkart, Sequoia, Tiger Global and Goldman Sachs. Clients include Coca-Cola, Reliance Industries, Amul, ITC and HUL.

Both Mavyn and BlackBuck follow the asset light model, which means neither owns a single truck. In the last few years, multiple truck aggregating platforms have come up. Some have been successful in receiving several rounds of funding, too. Deloitte pegged the investment in such platforms between 2014 and 2019 at $500 million.

Another industry disruptor, GoBolt, follows a hybrid model, since it owns a part of the trucking fleet on its platform. It was started by long-time friends Parag Aggarwal, Naitik Baghla and Sumit Sharma in 2015. Aggarwal and Baghla were logistics industry veterans and were previously handling logistics for GSK Consumer. Sharma said GoBolt follows a hybrid model since it owns 30 per cent of the over 10,000 trucks on its platform at present.

The smaller fleet owners (with 1-10 trucks) typically did not have strong access to companieslike Amazon or HUL earlier. GoBolt has aggregated these truck owners on a single platform and provided them means and skillsets to serve these bigger companies. GoBolt trains the drivers and vendors to use technology.

Artificial Intelligence is also being deployed. Sharma says AI has helped them plan for different loads, identify the right truck size, right vendor and the most efficient route for a delivery. “We have seen 10-15 per cent direct cost benefit due to the use of these practices,” he says.

Consequently, the speed of delivery and transit time have improved, too. Typically, a truck would travel 250-300 km a day but on the GoBolt platform, it covers up to 1,000 km a day. A typical transporter would operate a truck with a single driver in a 12-hour shift; GoBolt uses two drivers in 24-hour shifts for faster deliveries.

Now, with hopes of economic recovery and greater emphasis on technology to minimise human contact, the aggregators are poised to take a larger share of the pie.

Source : Business Standard