July 23, 2020: After lingering near the bottom of the emerging market rankings for three months, India moved up three notches to the middle of the league tables in June, the latest edition of Mint’s emerging markets tracker shows. India’s overall score in June was lifted by an upswing in India’s merchandise exports – as further relaxations in the lockdown enabled some pick up in manufacturing activity – and an improved stock market performance.

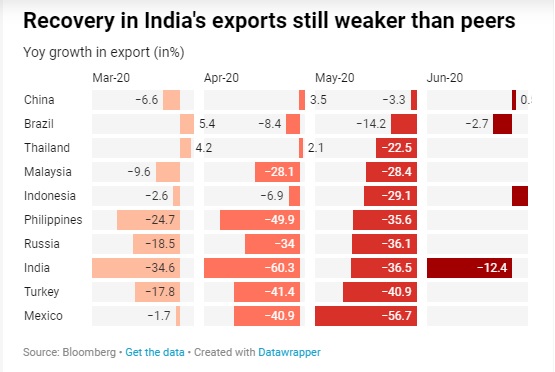

India’s merchandise exports increased for the second straight month in June after hitting a record low in April. But despite the recovery, exports still remain below year-ago levels. The contraction in India’s exports from last year’s level is sharper compared to the few other countries for which June data is available. Brazil’s exports, for instance, contracted 2.7% on year, in June, while exports from Indonesia (2.3%) and China (0.5%) expanded.

Even as the contraction in exports ebbed in India, its imports continued to contract at a sharp pace as domestic demand remained weak. It was the sharp contraction in imports rather than the mild recovery in exports that led to India’s trade surplus in June.

The Purchasing Managers’ Index (PMI) reading for India also showed an improved reading in June (47.2) compared to May (30.8). But it still signalled a contraction even as four other emerging markets reported an expansion (a PMI reading above 50). Turkey (53.9), Brazil (51.6), Malaysia (51.0) and China (50.9) saw manufacturing activity expand in June. India’s PMI reading was better than that of only three emerging markets considered in the tracker: Thailand (43.5), Indonesia (39.1) and Mexico (38.6).

Mint’s Emerging Markets Tracker, launched in September last year, takes into account seven high-frequency indicators across ten large emerging markets to help us make sense of India’s relative position in the emerging markets league table. The seven indicators considered in the tracker encompass both real activity indicators, such as the manufacturing purchasing managers’ index (PMI) and real GDP growth, and financial metrics, such as exchange rate movements and changes in stock market capitalization. The final rankings are based on a composite score that gives equal weightage to each indicator.

India’s GDP growth in the March ended quarter (3.1%) was higher than most peers and has helped India’s overall ranking. But it is likely that the June quarter will be far worse for India than some other countries, given the relatively higher stringency of lockdown in the country for most of the June quarter.

An S&P report dated 13 July said that pandemic will leave the Indian economy worse off than most other emerging economies. Over the medium term, i.e. till 2023, it expects India’s GDP gap, compared to the pre-covid GDP estimate to be 11%. This gap is expected to be about 6-7% for most of Latin America and 2-5% for emerging Europe and emerging Asia. The ratings agency also cut its 2020 GDP projection because of a sharp downward revision to India’s GDP, which it now expects to contract by 5% over the course of the fiscal year.

Despite the dire forecasts about the economy, India’s stock markets saw a sharply improved performance in June thanks to heavy investments by foreign investors. According to data from the Institute of International Finance (IIF), net foriegn portfolio flows into India stood at $2.5 billion in June, the highest so far this year.

India’s stock market capitalization went up 10% in June over the month-ago period, higher than most peers, Bloomberg data showed. Only three emerging markets saw a sharper rise in their stock market cap over the past month: Brazil (24%), Indonesia (12%) and Philippines (11%).

The rupee’s performance was lacklustre despite the rise in inflows as the Indian central bank absorbed a significant share of the inflows to build up forex reserves. India’s foreign exchange reserves touched the half-trillion-dollar milestone as a result. The rise in forex cover and the sharp drop in imports have driven India’s import cover to record levels, with forex reserves enough to cover 18 months of imports. This is the highest level of import cover India has had since 2004.

With covid-19 cases still rising in emerging economies such as India, the outlook for the coming months remains clouded. The trajectories of their economic recoveries would depend on how successfully they contain the virus, and how smoothly they transition from lockdown to the new normal.

Source: live mint