- Indonesia issued Presidential Regulation 10 of 2021, which liberalizes many business sectors for foreign investment.

- Dubbed the positive investment list, the regulation liberalizes over 245 business lines, including important sectors, such as transportation, energy, and telecommunications.

- Foreign investors are also eligible for various fiscal and non-fiscal incentives depending on their investments.

In the first of ASEAN Briefing’s Indonesia’s Omnibus Law series, we analyze Presidential Regulation 10 of 2021 (PR 10/2021) on business fields open to investment — also dubbed as the positive investment list. The regulation comes into effect on March 4, 2021.

PR 10/2021 replaces Presidential Decree No.36/2010 (Indonesia’s negative investment list) and is part of the government’s ongoing economic reforms through the issuance of the Omnibus Law.

The general principle under the positive investment list is that a business sector is open to 100 percent foreign investment unless it is subjected to a specific type of limitation. The regulation presents one of the greatest liberalizations in foreign ownership limitations in Indonesia since the negative investment list was first introduced in the 1980s.

Important sectors that had previous foreign ownership restrictions, which have now been lifted include, among others:

- Telecommunications;

- Transportation;

- Energy;

- Distribution; and

- Construction services.

The design of the positive investment list

The government has classified business fields into four categories.

- Priority sectors – 245 business lines open for foreign investment;

- Business fields that stipulate specific requirements or limitations — 46 business lines open;

- Businesses fields open to large enterprises, including foreign investors, but are subject to a compulsory partnership with cooperatives and micro, small, and medium-sized enterprises (MSMEs) — 51 business lines open; and

- Business fields reserved for cooperatives and MSMEs (not open to foreign investment) — 112 business lines.

Priority sectors

To classify as a priority sector, business enterprises must meet the following criteria:

- Must be labor intensive;

- Must be capital intensive;

- Must be part of a national project/program;

- Must be export-oriented;

- Must involve a pioneer industry (renewables, oil refining, metals, etc.);

- Must utilize advanced technologies; and

- Must implement research and development activities.

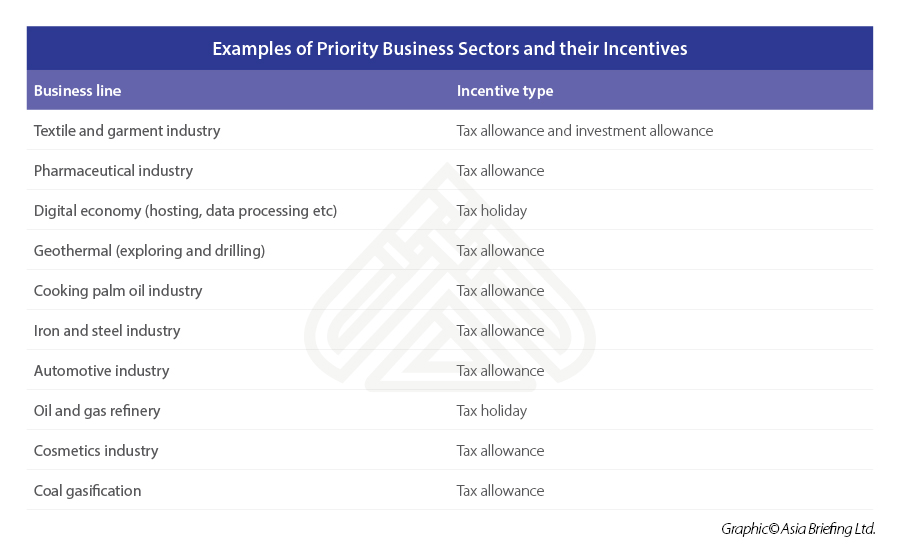

There are 245 business fields under this category that can be found under Exhibit 1 of the positive investment list. Moreover, businesses in priority sectors are eligible for a range of fiscal and non-fiscal incentives.

Fiscal incentives include a 50 percent corporate income tax reduction for investments between 100 billion rupiah (US$6.9 million) and 500 billion rupiah (US$34.9 million) for a period of five years and 100 CIT reduction for investments over 500 billion rupiah (US$34.9 million) for a period between five and 20 years.

In addition, there are tax allowances available in the form of a reduction in the taxable income of 30 percent of the total investment for six years, a special withholding tax rate on dividends of 10 percent, and tax losses carried forward for up to 10 years.

Examples of non-fiscal incentives are the provision of supporting infrastructure, simplified business licensing procedures, and the guaranteed energy supply or raw materials.

We explore a few examples of the prioritized business lines and their incentives below.

Business fields that stipulate specific requirements or limitations

Under this category, business fields are open to foreign investments but are subject to the following types of restrictions:

- Lines of business reserved for domestic investors;

- Lines of business subject to foreign ownership limitations; and

- Lines of business that require special licenses.

The foreign ownership limitations (bullet point 2) do not apply in the following circumstances:

- The investments are conducted in special economic zones;

- Investments are in the form of non-direct investments taken through the Indonesian stock exchange;

- Investments subject to more favorable treatment under a treaty between Indonesia and the investor’s country of origin; or

- Any investments approved prior to the issuance of the positive investment list. The positive investment list provides for this through a ‘grandfathering policy’.

Business fields open to foreign investors but are subject to a compulsory partnership with MSMEs

Business fields under this category are open to foreign investors or large-scale enterprises through a compulsory partnership agreement with an MSME.

There are 89 business lines for this category, and they cover businesses that are commonly carried out by MSMEs and/or sectors that have the potential to enter the larger supply chain.

The partnership arrangement can be in the form of operational cooperation, profit sharing, subcontracting, outsourcing, or distribution.

Business fields reserved for cooperatives and MSMEs

This category stipulates that the business fields are reserved for local MSMEs and are not open for foreign investments.

There are 89 business lines under this category, being:

- Business lines that do not use advanced technology;

- Are labor-intensive businesses, characterized by a special cultural heritage; or

- The capital for the business activities does not exceed 10 billion rupiah (US$701,000).