In a bid to reduce the disparity of gas accessibility and LNG terminals that is now concentrated on the west coast, the Petroleum Ministry aims to add capacity on the east coast. The focus is to improve penetration of the piped gas network to boost demand in the eastern parts for domestic and industrial use. With Petroleum and LNG import on a growth trajectory, liquid cargo handling at eastern ports needs to catch up with west coast terminals to fuel oil and gas-based economic growth

Global oil trade routes are moving East, as China and India replace the United States as top oil importers. When it comes to consumption of petroleum products, India is an oil guzzling nation, and the country’s per capita consumption is only next to the US, EU and China. With a Y-o-Y growth of 5.3 per cent in FY2017- 18, and as high as 11.6 per cent in FY2015-16, the demand is not going to subdue any time soon. India fulfils almost all of its crude oil requirement from imports, and with consumption of 4.14 million barrels per day, its share is more than 4 per cent of the total world consumption and the second largest importer of oil in the world after China.

India is also import dependent for edible oil and various industrial chemicals to meet its requirement. No wonder the country’s liquid cargo imports is majorly driven by 256.3 MMT of crude oil and petroleum products, and about 15 MT of edible oil. Given the enormous volume, the country requires some mammoth infrastructure at sea and land to keep the economy well oiled.

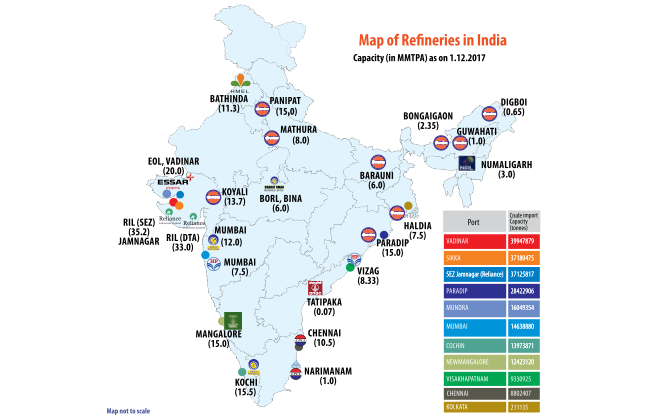

Imported liquid cargo is largely handled at seven port clusters, among which ports and terminals in Gujarat handle about 65 per cent of total crude import, followed by Mumbai, New Mangalore and Paradip handling 7-8 per cent each, and remaining ports Cochin, Chennai and Visakhapatnam handle 4-5 per cent each.

Market size

Liquid cargo is broadly divided into 3 segments: petroleum products and crude oil, LNG, chemicals and edible oil. Based on the economic growth and energy requirement, International Energy Agency has forecasted that by the year 2040 India’s economy will become 5 times of its current size and the most populous nation in the world, as a result it will have the highest energy demand in the world. India will alone contribute to about 25 per cent rise in global energy consumption, and a major part of the country’s energy requirement will be fulfilled from coal and oil. Demand for imported petroleum oil and LNG will continue on an upward trend.

Despite efforts by government and private agencies to increase domestic energy production, 30 per cent of India’s primary energy needs for domestic and industrial consumption are fulfilled from imported POL, LNG and coal. The country continues to struggle with oil production of just 700kb per day due to limited availability of the natural resource. With the current trend in the next two decades, India’s dependency on imported oil will grow to more than 90 per cent and by the year 2040 oil import is likely to touch as high as 9.3 mb per day.

India has annual refining capacity of 235 MMT of which 194 MMT of products are consumed domestically, while the rest is exported. India is also a net exporter of Gasoline, Naptha, Jet fuel and Gas oil. The country is in the process of increasing its refining capacity to around 310 MMT by 2023. As a result there is also scope in handling liquid cargo export.

Infrastructure gaps

Volume contribution from liquid is about one-third for most of the major ports and in case of some private ports there has been a steady growth, and combined volume of liquid and container has overtaken bulk. But still the segment is battling with some major infrastructure shortcomings.

Sharing some of the concerns pertaining to the liquid cargo transport, Dinesh Donadi, Terminal Manager (Haldia), Reliance Industries stressed that ports need to give priority berthing to liquid cargo carriers. Vessels have to wait for more than a week to get a berthing, and it happens at most of the ports in India, unless an industry has a dedicated port like Reliance Jamnagar unit. The market is more mature on the west coast as there is well developed network of pipeline and other modes of transport, but on the east cargo still moves through ports due to which storage capacity is required. Due to lack of pipeline network, petroleum and other products from Jamnagar unit come to Haldia by coastal vessels. Reliance also imports aviation turbine fuel from Singapore and Malaysia. The distribution network has still not reached an optimum level and there is scope for capacity augmentation and new terminals on the east coast.

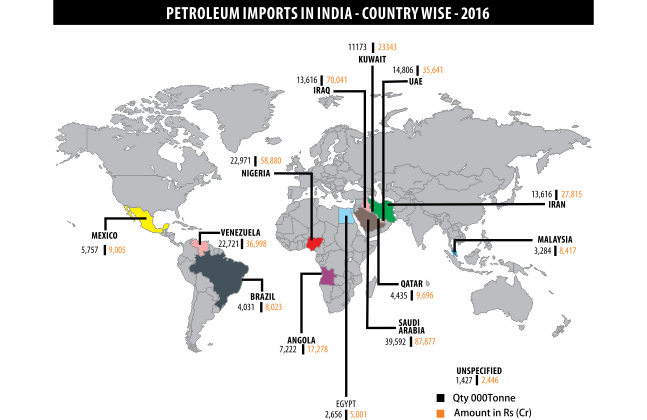

Though India imports majority of POL from the Middle East, Latin America, and Africa but Indian oil majors in a bid to reduce dependency on the Middle East have acquired equity stakes in overseas oil and natural gas fields in South America, Africa, South-East Asia, and the Caspian Sea region.

While the majority of oil refining capacity, and oil and LNG imports are located on the west coast but many of them are fast aging leading to slower discharge resulting in congestion and delays. The west coast has an annual refining capacity of 63.7 MMT which falls short to meet domestic demand. On the other hand refining capacity of 88.2 MMT by private players in Gujarat mostly caters to export market for products such as naphtha, motor spirits, and jet fuel to the UAE, Singapore, Saudi Arabia, USA, Kenya, and the Netherlands. East and north eastern parts of India, central and north have installed refining capacity of 49.4 MMT, 6 MMT, and 40.3 MMT, respectively. Consumption wise northern parts of India top the list with 55.89 MMT, followed by 52.15 MMT in west, 46.67 MMT in south, and 22.28 MMT in north-east and east in FY2017-18.

Out of the total volume of 932.57 MT of overseas cargo, liquid bulk cargo volume was 353.96 MT in FY2016-17 at major ports. At Indian major ports a vessel with liquid bulk has to tackle a pre-berthing detention of about 1.62 days and turnaround time of about 3.49 before it sails out. As a result an imported liquid bulk carrier is detained for about 5 days. Kandla which was once the default hub for chemical and other liquid cargo import is losing out to other ports because of lack of berths and delays in vessel turnaround time. Due to these factors occupancy level of liquid storage tanks at Kandla have come down affecting negatively its tanker tariff. On the contrary, in its neighborhood terminals at Hazira are flourishing due to efficient and modern facilities and in 2017 alone 410 liquid carriers were handled there. The growth of liquid cargo segment can be gauzed from the fact that ports like Hazira have 80 per cent occupancy level and are looking to increase capacity from 4.45 lakh kl to about 2.50 lakh kl tank in the coming 2 years.

Liquid bulk cargo is majorly demanded across 23 refineries and these refineries import about 4 million barrel of crude per day, and refine and supply to domestic and international markets. Though liquid cargo handling is pegged at CAGR of less than 5 per cent but the segment has the potential to grow at a much faster pace if capacity constrains at ports could be addressed. There are very small number of players who cater to the storage and transport needs of this niche but high volume and fast growing segment. If we leave apart the major refiners, the liquid bulk import and export is largely a trader-driven business where cargo volume comes in fragments and inconsistently. Speaking about the trends, T Venkataraman, MD, Goodrich Maritime said that instead of bulk shipments, demand for unitized form and ISO tanks is growing. Importers are more keen to bring parcels of smaller size on depotto- depot basis where parcel size of as little as 20 tonne is directly delivered to their factory.

Speaking about capacity constraints, Sajith Sreedharan, Deputy Managing Director, BMT Consultants (India), underlined, “Significant increase in bulk chemical (including petrochemical) trades has placed substantial pressure on port infrastructure which was already lacking capacity, including for storage. Utilization rates for infrastructure in major ports (mainly storage) is 80-90 per cent as opposed to a more normal 50-70 per cent. There is a need for additional capacity. In general, this includes specialist berths which usually have far lower utilization rates and specialized handling equipment and storage.

The major gap is integrated berth and storage capacity, and this gap is often caused as their owner and operator of the storage are different. Chemicals and specialty chemicals are particularly affected.”

Liquid cargo is very complex. A typical liquid chemical carrier can sail with 20 different varities of products, hence a port needs to have the required infrastructure to deal with it simultaneously. Chemical major Sasol used to bring 13-14 different chemicals in one vessel from South Africa to Kandla for about 23 receivers but later it shunned the port because of delays in discharge. Typically in case of trader-driven specialized chemical segment it is imported in parcel size of 500-2,000 metric tonne, and requires storage facility for 1-2 months at the port. Some of the other complexities of the trade are that turnaround time of a vessel also depends on the pumping capacity of a vessel. Products like edible oil are high volume but low margin commodity, so in a bid to keep a check on freight cost older vessels are hired for haulage which have very slow discharge rate as compared to chemical carriers. And it leads to longer unloading time.

Large industries like Haldia Petrochemicals despite having own pipeline network for distribution and storage facility are constrained by challenges at ports. Ashok Ghosh, Head (Plant & EVP), Haldia Petrochemicals, sharing his experience says that Haldia has draft limitation, which restricts the size of vessels. Due to this 50,000 dwt vessels carrying feed stock carriers are called at Visakhapatnam from where it is transferred in smaller vessels of 25,000-30,000 tonne capacity to Haldia. Various liquid jetties have different types of limitations at Haldia such as it can handle cargo only in the range of 2,000-6,000 tonne, and the jetties are highly congested leading to higher waiting period and demurrage. Due to inefficiency freight cost for raw material import goes upto $55-60, and a draft of 13-14 metre could help direct vessel call and a saving of about $30/tonne, and the amount is significant since the capacity of the units is 2 million tonne of naphtha. The plant aims to double its capacity from 2 million to 4 million ton but due to the port capacity restriction, the expansion is not possible. The company is now exploring option to set up a unit at a new location like Andhra Pradesh or some other place in south which has a market potential for its products such as polymers.

The bright spots

One of the areas which require capacity creation is LNG facility at ports. Currently, India is the fourth largest LNG importer in the world. The country under various schemes is targeting to avail gas for domestic and industrial use. Cross country pipelines are under implementation and it will directly boost gas consumption as a result LNG import will grow. Currently, India imports 10 million tonnes of chemicals and petrochemicals, which is likely to grow to 46 million tonnes by the year 2030.

Moreover, in a bid to ensure energy security, national gas grids are under execution at various locations, and doubling of pipeline network from 15,000km to 30,000km is under implementation. While western parts of India have made significant progress in piped gas distribution, the next wave of growth in consumption will be from the east, south and northern parts of India. Ports on the east coast need to chip in to meet the requirement.

PCPIR: The ambitious target that India has set for itself is to provide gas to all households and this requires significant investment in LNG and POL handling capacity at ports. Among the 4 approved PCPIR projects, apart from Gujarat, the project in Andhra Pradesh is making steady progress. The other two states Odisha and Tamil Nadu are also working in the direction of faster realization of projects.

Hence, the ports on the east coast need to be ready to embrace some exciting times in liquid cargo business. In a bid to reduce the disparity of gas accessibility and LNG terminals that is now concentrated on the west coast, the Petroleum Ministry aims to add capacity on the east coast. The focus is to improve penetration of the piped gas network to boost demand in the eastern parts for domestic and industrial use. With Petroleum and LNG import on a growth trajectory, liquid cargo handling at eastern ports need to catch up with west coast terminals to fuel oil and gas based economic growth.

India continues to stress on addition of capacity in Regasification LNG terminals and addition of about 83 MMTPA in the next 10 years to fulfil steady supply in the domestic market. While the work is under progress to increase capacity on the west coast, there are plans to install about 10 MMTPA on the east coast as well.

With increasing coverage and reach of natural gas infrastructure, there is an effort to bridge the imbalance in gas consumption between western and northern parts of the country and rest of India. Natural gas demand is projected to reach 746 MMSCMD in FY2029-30. Asian Development Bank backed Economic Corridor Development is another thrust area which will further fuel LNG consumption in the eastern parts of the country. Since the first phase of East Coast Economic Corridor (ECEC) focuses on the Visakhapatnam-Chennai Industrial Corridor (VCIC) covering 11 districts in Andhra Pradesh and Tamil Nadu, gas consumption is heading for a steady growth due to restriction on coal import. While ports on the east coast are adding container handling capacity to meet the requirement of production clusters, it is time to add LNG handling capacity to fulfill the energy requirement of anchor and ancillary industries coming up in the corridor. LNG re-gasification industry is likely to increase from 47.5 MMTPA by 2022 from a current level of 22 MMTPA.

Chemical: India being an agrarian economy, liquid chemical import for the agricultural sector and fertilizer units will continue to grow. Moreover, bulk organic and inorganic chemical constitute about 5 per cent of the liquid cargo imports in India. More than 60 per cent of India’s chemical-based units are located around Vapi-Baroda industrial belt, which has aided chemical handling at ports in Gujarat like Hazira. Majority of chemical in liquid form comes from the Gulf countries. Majority of chemicals are made from naphtha and other downstream products of petroleum oil, and India depends heavily on import from Iran and other Middle East countries. One day pre-berthing delay of a chemical carrier could lead to a loss of about $20,000 depending on the size of vessel. Apart from methanol, the CIF value for all other chemicals is in the range of $600-1,800.

Chemical import has a CAGR of about 6-9 per cent. Growth in plastic and textile like polyester yarn consumption creates demand for chemical. India still has a very low per capita chemical consumption due to which the growth in import is expected.

Edible Oil: India imported about 15.6MT of vegetable oil in FY2017-18 as compared to 15.4MT in FY2016- 17. Lower domestic supply keeps the momentum for import of vegetable oil. And the trend is unlikely to change since India’s agricultural sector is struggling at sub 2 per cent growth. Palm oil accounts for the highest volume among vegetable oil import, and a majority of it comes from Malaysia and ports on the east coast can tap this segment. Import in this segment has grown by 45 per cent in the last 5 years. India’s monthly requirement is about 18 lakh tons and the country maintains a stockpile for 30 days as it comes under necessary products. Edible oil import hubs are Kolkata, Kandla, and Mundra, and the basket includes refined and crude vegetable oils like soybean and palm oil, and crude sunflower oil. Soya oil is imported from Brazil and other latin American countries. Palm oil comes from Malaysia and Indonesia. Largest volumes of edible oil comes through Kandla.

Way forward

Liquid cargo is one segment where ports and terminals have been registering steady growth (CAGR of 0.38 per cent in the last decade). In case of major ports the share of liquid cargo has grown to about 38 per cent in FY2017-18 as compared to 33 per cent in FY2016-17.

India fulfills about 86 per cent of crude, 70 per cent of natural gas, and 95 per cent of cooking gas requirement through import, hence the demand for liquid cargo handling, storage and distribution at ports and hinterland will continue to register an upward trend. Apart from POL and LNG, edible oil and chemical imports are going to supplement further. While government-backed cross-country pipeline network is on the right track, there is an opportunity for more entrants from the private sector to complement with liquid cargo handling, storage and distribution. There is huge capacity constraint in transport of liquid cargo from shore to the factory or hinterland in a safe and efficient manner. Most the cargo is hauled by trucks, hence there is opportunity to tap this segment. Success lies in faster turnaround of vessels thus lowering or eliminating demurrage.