Sea-Intelligence analysts looked at developments in prices for Liquid Natural Gas (LNG) as a maritime fuel.

The IMO2020 regulations necessitated the need to reduce sulphur emissions; the choice was between Very Low Sulphur Fuel Oil (VLSFO), LNG, or scrubbers, as all were viable options, but it was entirely unclear, which was the “right” choice.

“As the market evolved, we first saw a spike in VLSFO prices, suggesting a good case for scrubbers. Then the premium dropped rapidly, and scrubbers seemed like less of a good idea. The premium then escalated once more, making the case for scrubbers,” noted a Sea Intelligence official.

With the Russian invasion of Ukraine, LNG prices spiked to extreme levels. Now, LNG prices are getting to a point, where it is cheaper than VLSFO. LNG should be compared to (VLSFO) prices, as LNG is a fuel which, like VLSFO, adheres to the IMO2020 low-sulphur regulation, without the vessel having to install a scrubber regulation, without the vessel having to install a scrubber.

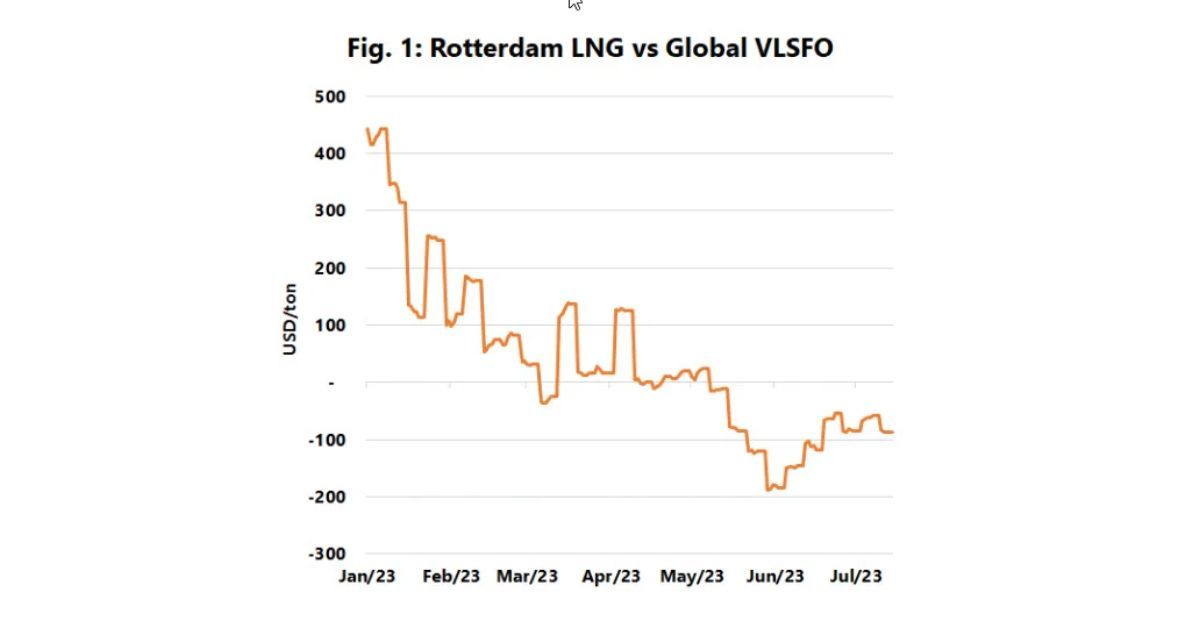

In the absence of publicly available global LNG prices, we have used Rotterdam prices as a proxy.

“The question is, of course, whether Rotterdam prices are representative of the global prices,” wonders Alan Murphy, CEO of Sea-Intelligence.

He went on to explain that “by comparing IFO380 prices in Rotterdam to the global average for IFO380, there is indeed a good match, although the fuel price at Rotterdam is typically lower than the global average. In the first half of July 2023, this price discount in Rotterdam was on average 34 US$/ton.”

He added, “The extreme LNG price spike in 2021-2022 ‘drowns out’ the more recent developments. To get a better view of those, Figure 1 shows the price difference between LNG and VLSFO in 2023. Even with the -34 US$/ton discount taken into account, it is evident that we are now in a situation, where the usage of LNG is financially advantageous compared to VLSFO fuel.”