Southeast Asian nations such as Myanmar and Vietnam are emerging as the next global factories as manufacturing majors move out of China due to rising costs. Thailand with its natural geographic locational advantage is bracing to become the logistics hub in ASEAN

Thailand, the second largest economy in ASEAN after Indonesia, is an upper middle-income country with an open economy, a GDP of $529 billion that posted 4.1 per cent annual growth in 2018, improving from 4.0 per cent in 2017. Private consumption and total investment increased by 4.6 and 3.8 per cent respectively. Export value grew by 7.7 per cent while inflation averaged 1.1 per cent and the current account remained in a surplus of 37.7 per cent of GDP. The Thai economy grew between 3.3 per cent to 3.8 per cent in 2019. A newly elected government, continuation of world economic growth, the expansion of government expenditures and the acceleration of public investment in key infrastructure projects are contributors to growth.

An export-dependent economy, Thailand exported a total of $249.8 billion worth of goods in 2018. The United States is Thailand’s number two export market (11.2%) after China (11.9%). The top ten export items include computers (17.2%), electrical equipment (14%), vehicles (12.2%), rubber (6.2%), plastics (5.8%), gems (4.8%), mineral fuels, (4.2%), meat/ seafood preparations (2.6%), organic chemicals (2.5%), and cereals (2.3%).

Thailand is the biggest exporter of natural rubber in the world with a 36.8 per cent share of the global export market that is worth $12 billion annually. It is also the second largest raw sugar exporting market with 9.3 per cent market share. The country stands second-largest exporter behind India, with a 21.9 per cent market share in rice exports. India is the largest with 26.7 per cent market share. Thailand is the largest automotive producer in ASEAN countries and is also the trading bloc’s leader among countries supplying electronics and its components. Thailand is the leading producer of electric appliances.

Being one of the world’s most visited countries, tourism is vital to the Thai economy. In 2018 direct receipts from tourists contributed about 12 per cent of the country’s GDP and indirect revenues could make the figure closer to 20 per cent.

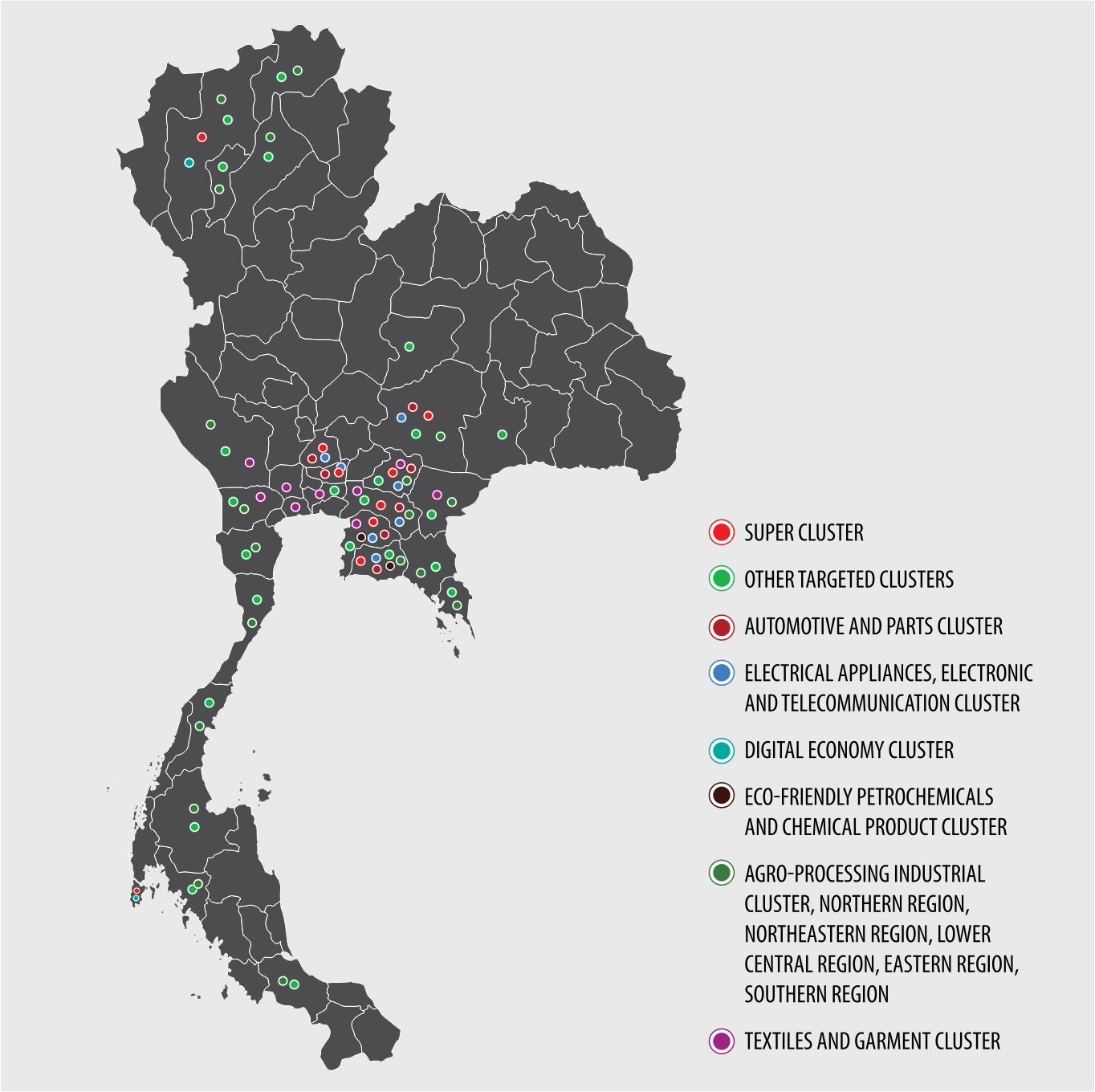

Industrial clusters

Under the Cluster Policy, the government has targeted to develop 2 types of clusters: Super Cluster and other targeted clusters.

Super Cluster includes clusters of businesses using advanced technology, and future industry, e.g. Automotive and Parts Cluster, Electrical Appliances, Electronics and Telecommunication Equipment Cluster, Eco-friendly Petrochemicals and Chemicals Cluster, Digital-based Cluster, Food Innopolis and Medical Hub.

To promote investment in super clusters the Board of Investment in Thailand has announced 8-year corporate income tax exemption and an additional 5-year 50% reduction. Import duty exemption is offered on machinery.

Other targeted clusters include Agroprocessing Products Cluster, Textiles and Garment Cluster. To promote investment in other clusters the Board of Investment offers 3– 8 year corporate income tax exemption and an additional 5-year 50% reduction. Import duty exemption on machinery.

Automotive and Parts Cluster are being developed in 7 Provinces: Ayutthaya, Pathum Thani, Chonburi, Rayong, Chachoengsao, Prachinburi, Nakhon Ratchasima.

Electrical Appliances, Electronics and Telecommunication Equipment Cluster are being developed in 7 Provinces: Ayutthaya, Pathum Thani, Chonburi, Rayong, Chachoengsao, Prachinburi, Nakhon Ratchasima.

Eco- friendly Petrochemicals and Chemicals clusters will come up in 2 Provinces: Chonburi and Rayong.

Digital-based Cluster are being promoted in 2 Provinces: Chiang Mai and Phuket.

Agro-processing products targeted areas are in different regions where raw materials are available:

- Northern Region (Chiang Mai, Chiang Rai, Lampang and Lamphun): vegetables and fruits, herbal products

- Northeastern Region (Khon Kaen, Nakhon Ratchasima, Chaiyaphum, Buriram): livestock, tapioca, sugar cane, maize

- Lower-Central Region (Kanchanaburi, Ratchaburi, Phetchaburi, Prachuab Khiri Khan): Sugarcane, pineapple, rubber

- Eastern Region (Rayong, Chanthaburi, Trad): fruits, rubber

- Southern Region (Chumphon, Surat Thani, Krabi, Songkhla): palm, seafood, rubber

Textile and garment clusters are targeted in 9 provinces: Bangkok, Kanchanaburi, Nakhon Pathom, Ratchaburi, Samut Sakhon, Chonburi, Chachoengsao, Prachinburi, Sa Kaeo.

Logistics

Thailand is the main ASEAN transport point and also a logistic hub. It is located in the Mainland Southeast Asia. It has Myanmar, Laos, Cambodia and Malaysia as its neighbour countries. Many foreignbased manufacturing companies want to set up their production in Greater Mekong Sub-region (GMS). They are particularly targeting Vietnam and Myanmar as their manufacturing location to reduce product cost for Asian countries. It is the result of raised product cost in ASEAN countries like China. The search for alternative manufacturing bases in Southeast Asia, however, has not diminished Thailand’s role as a regional manufacturing powerhouse, while it also fulfils the role of a key logistics hub for Indochina.

Thailand’s principal mode of carrying its international trade is the use of marine transport. Road transport comes in second and is continuously growing in importance. Thailand is widely acknowledged as having the most extensive road transportation network in all of Southeast Asia with more than 390,026 kilometers. The Department of Highways continues to improve and expand the country’s roadways. They has developed the concept of a 20-year Intercity Motorway Development Master Plan for the period 2017 – 2036, comprising 21 routes with a total length of 6,612 km.

There are total 13 highways within the ASEAN highway network which are connected to Thailand and its neighbouring countries. This is the highest among the ASEAN. These are most important economic corridors because they are the backbone of Great Mekong Subregion (GMS) transportation infrastructure pushing Thailand to be road transport hub of the region.

The GMS road network includes a southern economic corridor inclusive of Thailand, Cambodia and Vietnam; the east-west economic corridor linking Myanmar, Thailand, Laos and Vietnam; the north-south economic corridor which runs from southern China through Laos and Myanmar, and into Thailand; and the southern coastal economic corridor also connecting Thailand, Cambodia and Vietnam. All major cities in Thailand are accessible by land, with all-weather highways and intercity roads linking them to the road network covering the whole country, as well as the Asian Highway and the road networks of neighbouring countries at border crossings.

Major highways which link Thailand with other GMS include the R12 trade route linking Thailand to Vietnam and Southern China; the R9 route connecting the Pacific coast of Vietnam to the western side of the Indian Ocean; the R3 route linking Southern China to mainland ASEAN and further south to Malaysia and Singapore; and the R1 route stretching from Myanmar to Vietnam. All of these road links pass through Thailand, and they have significantly boosted border trade between Thailand and its neighboring countries. In particular, the commodity trade significantly benefits from these road link system that not only connect to its neighbouring countries, but also further to other countries like China, India and Bangladesh.

New road projects announced in 2020

The Thai Department of Highways plans to spend 124 billion baht during the next 12 months on the below projects: There will be a 16 kilometre eastern bypass around Nong Khai, just south of Vientiane and the Laos border to ease traffic congestion and link the main highway to Laos. A 22 kilometre highway will link the eastern economic corridor and U-Tapao airport. A 25 kilometre motorway will link Bang Khunthian district, southwest of Bangkok and Samut Sakhon’s Ban Phaeo district to help relieve congestion for east west traffic travelling south of the main metropolis.

The fifth Thai-Lao friendship bridge connects Bueng Kan province in Thailand, east of Vientiane, and Bolikhamsai province in Laos. The bridge is designed to be 16 kilometres long.

A 24 kilometre outer ring road for Nakhon Ratchasima.

A 26 kilometre four-lane road between Phang Nga and Surat Thani’s western Ban Ta Khun district.

Towards the west of the main city, there’s a 109 kilometre motorway which will link Nakhon Pathom and Phetchaburi’s Cha-am district.

Rail logistics

The demand for rail logistics in Thailand, though growing, tends to be constrained by the declining investment. Agricultural products such as rice, coconut and sugar, and secondary merchandises such as machines and consumer products depend largely on truck transportation. As a result, very few portions of these cargoes are transported by rail. Petroleum products is the only commodity largely transported via rail.

Inadequate utilisation of rail potential

Railway freight transportation typically concentrates in specific locations. As for container transportation, for example, almost all service is dominated by the transportation between Bangkok and the ESB. Petroleum products are mainly transported between Northern region and the ESB, while cements are mainly transported between Saraburi province and the Northern region. The limitation of service area with specified commodities narrows down the freight transportation market. Railway transportation yet mostly intends to capture large-scale clients, for example, those requiring container service. This consequently results in losing future business opportunity of freight service expansion.

Quality of rail infrastructure

SRT (State Railway of Thailand) operates freight service with old locomotive and wagon. Shortage of rolling stock for freight service is usually experienced. Moreover, there are approximately 620 rail stations and stopping locations in Thailand, but only a minimal share is available for bulky freight transportation. In total, 292 out of 620 rail stations deal with freight services. However, only 55 stations involve largevolume transport with more than 10,000 tons of freight. Only 10 largest rail freight stations deal with more than 75% of the total freight volume in the country.

Rail projects in-progress

Thailand now has five different projects that it plans to use to connect its rail network with neighbouring countries – Cambodia, Indonesia, Laos, Malaysia, Myanmar, Thailand and Vietnam.

In the South, the country plans to extend its south-bound rail route from Narathiwat’s Sungai Kolok to Malaysia’s rail system in Padang Besar, in order to connect Thailand to Singapore’s railway system.

In the Northeast, Thailand, along with Laos and China, is developing a joint high-speed train system, which will lessen the time needed to travel from Thailand to Kunming and Beijing through Laos. From Beijing, train passengers will be able to travel on to Russia and other European countries.

In the East, Thailand and Cambodia are connecting their rail systems from Sa Kaeo’s Aranyaprathet to Cambodia’s Poipet. In the West, Thailand and Myanmar are negotiating a proposal to link up their rail systems from the Three Pagodas Pass, a mountain pass connecting Kanchanaburi’s Sangkhla Buri to Myanmar’s Payathonsu, to Myanmar’s Dawei.

In addition to these four projects, Thailand and Malaysia are also discussing a plan to bring back the Sugnai Kolok-Pasir Mas rail route for the sake of economic development and border trade.

A high-speed railway project connecting Thailand and China was initiated in 2017 and is scheduled to be completed in 2021. The first phase of the high-speed project, linking Bangkok and the northeastern province of Nakhon Ratchasima, is set to cost 179 billion baht ($5.4 billion) and would become Thailand’s first high-speed railway with a maximum speed of 250 km/h.

The second phase of the project, which will link up with a China-Laos line that is currently under construction, is allowing travellers to make the trip between Bangkok and the Lao capital of Vientiane in just four hours, and even travel all the way up to Kunming in China’s Yunnan province. The railway will make Thailand become a transportation hub in ASEAN countries. In future, the railway will be extended southward to Kuala Lumpur, Malaysia and Singapore, as part of the pan-Asia railway network spanning from Kunming through Laos and connecting Thailand, Malaysia and Singapore.

Thailand has recently extended an existing Bangkok-Aranyaprathet railway line which crosses eastern Thailand and ends at the Cambodian border. Bilateral trade between Thailand and Cambodia, currently estimated at $6 billion, is expected to grow with the line’s reconnection.

A series of rail networks are in progress for connecting Laos to dominant seaports in Thailand, Vietnam and Cambodia. The rail networks will serve both passengers and freight, particularly from China’s adjacent southern-most province of Yunnan. Merchandise will have global market access with the development of not only seaports in Vietnam and Cambodia but also primarily connecting Thailand’s already well-established Laem Chabang deep-sea port, which lies 670 kilometres south of Vientiane.

Maritime connectivity

The Port Authority of Thailand manages five major ports – Bangkok Port, Laem Chabang Port, Chiang Saen commercial Port, Chiang Khong Port and Ranong Port.

Bangkok Port

Bangkok Port is the largest river port in Thailand, Located on the left bank of the Chao Phraya River. The major role of this port is to consolidate and distribute general cargo and containerized cargo between Laem Chabang Port and Bangkok. The Port Authority of Thailand has begun a feasibility study to develop another container terminal in Bangkok Port and will discuss investments over a period of 2–3 years. It is projected that having another container terminal will increase the annual throughput of Bangkok Port from 1.5 million teu to 2.6 million teu. The port’s inland location limits access to ships with individual capacities of up to 1,800 teu. Larger container ships, therefore, tend to call at Laem Chabang, which is two hours from Bangkok.

| Container throughput at Bangkok Port (in teus) | |||

| Year | 2017 | 2018 | 2019 |

| Throughput | 1497919 | 1497444 | 1451131 |

Laem Chabang Port

It is the main international deep sea port of Thailand, located in Chon Buri province in the gulf of Thailand which is 200 km far from Bangkok Port. A consortium of PTT Tank Terminal company, Gulf Energy development and China Harbour Engineering Co. will increase the capacity of the port to 18 million teus per year.

| Container throughput at Laem Chabang Port (in teus) | |||

| Year | 2017 | 2018 | 2019 |

| Throughput | 7677279 | 8015880 | 8063983 |

Chiang Saen Commercial Port

Situated alongside the Mekong River at Chiang Saen District, Chiangrai Province, covers an area of around 3.6 acres (9 rais), facing the Mekong River, opposite the Democratic People’s Republic of Laos and adjacent to highway No. 1290 (Rimkong Road) connecting Chiang Saen and Chiang Khong Districts. The port can handle 120,000 tonnes per year.

| Container throughput at Chiang Saen Commercial Port (in Metric Tonnes) | |||

| Year | 2017 | 2018 | 2019 |

| Throughput | 207942.53 | 198185.97 | 254723.61 |

Chiang Khong Port

Situated at Chiang Khong Sub-District, Chiangrai Province. The port aims to upgrade the efficiency of import- export services and promote border trade among People’s Republic of China, Democratic People’s Republic of Laos, the Union of Myanmar and Thailand. The port can handle 15,000 tonnes per year

| Container throughput at Chiang Khong Port (in Metric Tonnes) | |||

| Year | 2017 | 2018 | 2019 |

| Throughput | 84874.99 | 78445.51 | 71467.93 |

Ranong Port

Situated on the eastern bank of the Kra Buri River, Pak Num Sub-District, Muang District, Ranong Province, covers an area of about 126 acres (315 rais). Container Berth with a 30-meter width and 150-meter length is able to accommodate 1 cargo vessel of 12,000 DWT at a time. The Port Authority of Thailand is pressing ahead with the development of Ranong Port as a logistics gateway between Thailand and India as both countries agree to promote a new maritime route in the Andaman Sea. The first phase of development will see Ranong’s Port handling capacity increase from 78,000 teus/ year to 300,000 teus/year by next year and to 500,000 teus/year by 2022.

| Container throughput at Ranong Port (in teus) | |||

| Year | 2017 | 2018 | 2019 |

| Throughput | 3067 | 2494 | 2275 |