According to Sea-Intelligence, when projecting the future fleet sizes of shipping lines, it’s common to add the current fleet size to the size of the orderbook. However, this approach oversimplifies the dynamics, as shipping lines engage in various strategies such as trading in the second-hand market and adjusting their use of chartered vessels.

A more comprehensive method involves analyzing the fleet adjustment strategies of individual shipping lines in recent years. Customers can better anticipate their future fleet sizes by considering how each carrier manages its second-hand tonnage and their preference for owned versus chartered vessels.

“If we were to use the more simplistic approach to predict the current fleet sizes, based on the actual fleet and orderbook from two years ago, for 8 of the 10 largest carriers, the actualised fleet growth turns out to be less than what the simplistic projection would suggest,” explains Alan Muprhy, CEO of Sea-Intelligence.

“This implies that the delivery of newbuilds typically leads most carriers to also shed capacity, by selling owned tonnage in the second-hand market or redelivering charter tonnage. Only MSC and ONE deviate from this, by also taking in additional tonnage,” adds Murphy.

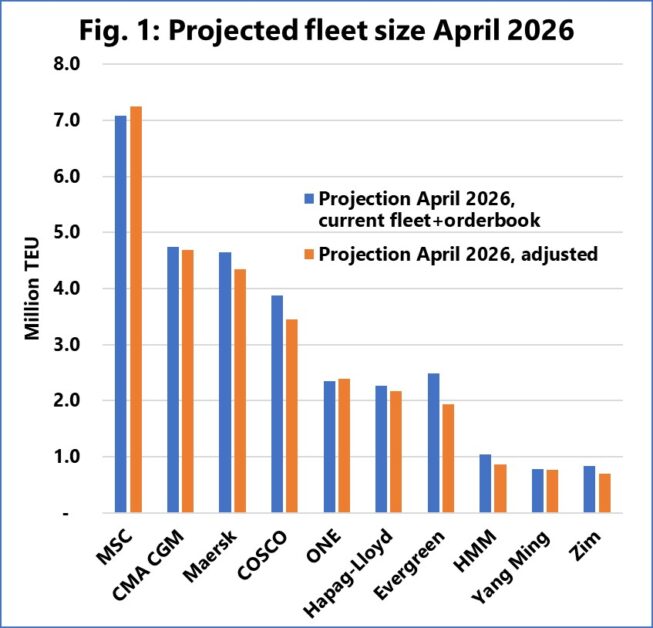

The figure shows the projected fleet sizes for April 2026 using both simplistic and adjusted approaches. The adjusted approach incorporates current tonnage strategies, assuming they will persist over the next two years. According to these projections, MSC is expected to significantly increase its size advantage over CMA CGM, which is forecasted to become the second-largest carrier, surpassing Maersk.

Additionally, it’s worth noting that Hapag-Lloyd recently unveiled its new 2030 strategy, with a key priority being to maintain a position within the top-five carriers. However, achieving this goal will necessitate a shift in strategy compared to the last two years, as failure to do so could result in a sixth-place ranking behind ONE.