Automotives manufactured in India have good acceptance in global markets. Logistics infrastructure needs to be improved along with growing expors, shares Sushil Kumar, Senior Advisor, Society of Indian Automobile Manufacturers

Q How were the automotive exports from India in 2018? In which category do you see exports growing rapidly – passenger vehicles or commercial vehicles? Majority of exports happen from which ports?

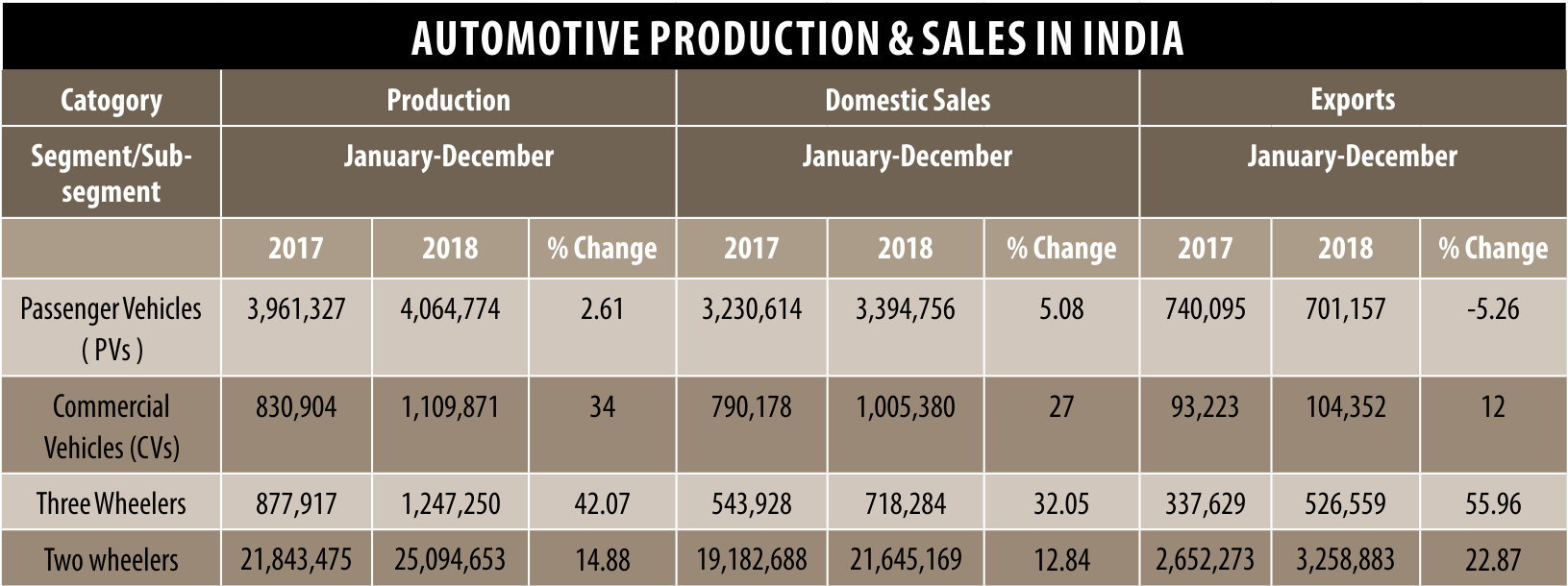

Highest growth has been in the three wheeler sector followed by two wheelers and commercial vehicles. We are expecting the trend to be maintained in the next year as well. Two wheelers are expected to have a rapid growth in exports. Indian commercial vehicles also have a very good acceptability in world market being of superior and sustained quality standards. They are also suitable to climates that are similar to those in India. Exports are taking place from several ports depending upon the quantity being exported and of course the destination country. Majority of exports are from Chennai, Mundra, and JNPT ports.

Q How has been your experience in moving automotives from both government owned and private ports in India?

Automotive sector has fairly good experience working with both govt owned and private ports, govt owned ports are good in providing compliant infrastructure and scalability. The govt ports would have standard procedures as well as standard rates of operation. There is hardly any flexibility to accommodate any difficulties through negotiations.

Private ports provide flexibility and ease of operations. The tariffs are negotiable and can be adjusted to the export loads both in terms of type of vehicles and quantity

Q What are the gaps in infrastructure and services offered at Indian ports in moving automotives? Exports by Ro-Ro Vessels face an infrastructural issue in that they are comparatively larger ships and call at limited ports as they requires heavy infrastructure and scale to manage the operation. Smaller ports are not available for such exports. A larger vessel would need larger number of vehicles to be accumulated. Yard availability and documentation is one of the bigger challenges faced at port in moving automotives. Ports need to have accumulation area for parking vehicles for exports. This also needs associated support of adequate lighting and security. Exports in containers have relative ease in operation and pose no major issues in exports.

Q What issues do the automotive manufacturers in India face with first and last-mile connectivity? Non availability of rail siding at or near the manufacturing plant presents an issue of loading vehicles on auto rail rakes. The vehicles have to go through multiple handling and besides increasing costs it can lead to damage to the vehicle as well. There is also difficulty due to uncertainty in the time of rake availability and the travel time. This leads to movement between port and plant. There is a limited window for movement and hand over of the vehicles at the port as well as the rail terminals. The above issues lead to higher transportation costs for both first and last mile.

Q What are the key parameters based on which automotive companies select a port?

Following are the main aspects that would influence port selection: Vessel schedule – Vehicle OEMs need to ascertain vessel schedules calling at a given port and this would help choose a port with suitable vessels calling at convenient schedule. Proximity to plant – OEM would prefer a port nearer to the plant which would reduce time and cost of vehicle transfer. Shorter the distance better it is from all points of view. Infrastructure – like availability of a suitable yard corresponding to the vessel size. Facilities for customs clearance, stevedoring service, and operational ease. Lower econometric cost also is a factor.

Q How do you see inland waterways as an option for moving automotives at lower cost?

Inland waterways provide a good alternative for clean and efficient alternative to rail and road. It however still has a long way to go in India before regular commercial use. Facilities such as suitable loading unloading stations with adequate facilities to handle automobiles, proper vessels need to be put in place.

lobally inland waterways have been a good alternative and have led to reduction in costs. Situation in India would also follow however a lot of development needs to be done before commercial operations for vehicle transportation becomes a reality.

Q Automotive manufacturers seem to be moving long distances for connecting to the desired port. How can the inland logistics cost be controlled?

Inland logistics costs can be controlled with better transport management by the service providers. Presently single stack trains are in use for containers. Double stack usage would lead to cost reduction. The rail operators would need to have better load management. Induction of Dedicated Freight Corridor would also be a game changer of sorts as it would be able to handle triple rake loading.

Usage of Coastal shipping and inland waterways in applicable areas can also provide a solution. Both do have their drawbacks and these need to be ironed out. The road sector holds the most promise through improvement in operational efficiency. The daily vehicle running at present is very low. The transporters need to improve the daily running substantially and come closer to global norms ie more than 500 km per day.

Q High-speed, multimodal connectivity to manufacturing plants in the hinterland is also a critical requirement. Do you see good multimodal connectivity happening? What are the pain points in multimodal logistics?

We do see movement in this direction and multimodal connectivity can happen in the future though it seems a bit away at present.

The pain areas would be lead time, multiple handling for multimodal movement, consequential damages and coordination with different stakeholders. Govt taxation would also need some clarity for multimodal as compared to uni modal transportation.

Q Considering the long-term growth of automotive exports from India. In which locations do you feel dedicated Ro-Ro terminals and ambient parking space is required?

Ambient parking space would be required in automobile clusters in North, South and West. These would need to be located with proximity to plants. They would also need to be interconnected and also act as delivery hubs.

Ro-Ro terminals would need to be developed at ports that can also have adequate parking space for accumulating loads.

Q How do you rate Indian ports in terms of expertise, technical know-how and implementation of best practices for handling automotive cargo?

There is no exclusive terminal at any port today to handle the current automotive traffic and lot of work is required to be done in this area, lot of investment would be required however because of low volume global level investment is not coming. Currently there is hardly any port that can go for exclusivity for automobile traffic.

Q What are the common lapses in services offered by logistics service providers and seaports while moving automotive cargo?

There is a lack of expertise in handling automotive cargo, the cargo is sensitive in terms of being damage prone and theft prone too. It needs to be provided proper security. There is also need to upgrade and have efficient and time saving lashing/choking devices. Lack of design innovation in trailers/automotive carriers due to investment/cost issue. Innovative designs can enhance productivity and thus lead to savings in logistics costs.

Q Few automotive companies tried to move vehicles through coastal shipping, but after few voyages it stopped. How was the experience and what are challenges in moving automotives through coastal shipping?

The trials saw higher lead time, delay in delivery to dealers resulting into inventory blockage and higher interest costs. Some of the reasons are lack of coordination with different modes of transportation, load optimisation on ships etc. Added to these there are limited coastal services from limited port to limited destinations. It thus has very limited application at present. The Govt is willing to help if the shipping operators can identify the issues that need to be addressed so that suitable services can be made available to Automobile OEMs for coastal shipping.