The foreign trade of Nepal is tangled in multiple issues plaguing since decades – be it inadequate infrastructure, Customs procedures, transhipment issues, trade finance and export product quality concerns.

The exim trade of Nepal has been down last year and through the first half of this year. Generally exports have been very slow and import restrictions by government have also decreased imports from third countries. Import and export with India has been slightly decreased. Nepal imported goods from 164 countries during the fiscal year 2021-22, valued at $14.63 million (Rs 1,920 billion). Of this, imports worth $9.14 million (Rs.1,200 billion) were from India alone, while the export was worth $1.18 billion (Rs 155 billion). It means the country’s trade deficit with India alone was over $7.96 billion (Rs 1,044 billion) last fiscal year.

In the FY22, Nepal handled 61,301 import containers, 1,030 export containers.

The COVID had a big effect to Nepal trade and the situation currently as well is not very good due to increase in logistics cost (specially ocean freights). The effect of pandemic has been very hard as the government was not prepared for smooth operations and easy connectivity at transit points beyond borders and within.

Recently, the logistics cost has increased and there has also been scarcity of empty containers. Such situation has led to cancellation of orders or less placement of orders as regards exports. But in case of imports, very little change is seen as demand of imported goods is high and customers are willing to pay the price.

The rail transit time has reduced with private railways operating but cost benefits have not been passed on to the Nepalese importers. The decrease in rail freight from Kolkata and Vizag has been enjoyed by shipping lines as terms of import is C and F or CIF and it is beyond the hands of Nepalese importers or freight forwarders. In such terms of dealing the upper hand is on the exporters in foreign countries where as liabilities are for the importers of Nepal.

Nepal is looking to enhance the logistic performance by adopting to Coordinated Border Management system as well as standardization of ICPs and ICDs through Standard Operating Procedures (SOPs). It is believed that this will enable all terminal operators remain in the same system and monitoring and evaluation will be much easier. Container terminal in the Western region (Dodhara Chadani) is being worked out and waiting for environmental approval.

Total Throughput (2021-22): 126,448 TEUs

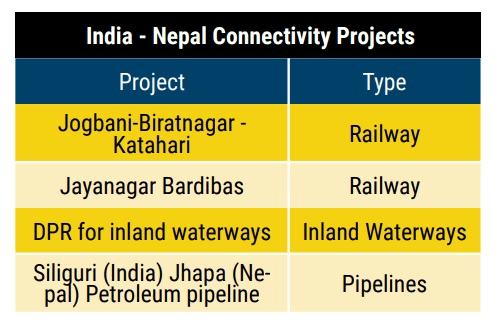

Nepal Government is also looking forward to establishing mini logistics centers in some small Customs points like Bhadrapur via Galgalia and Krishnagar etc. Some works on enhancing terminals of Biratnagar for Railway connectivity is also underway. Further study is being conducted to establish warehouses in all 7 Provinces as well as for Agro hubs. Policy for logistics is almost complete and laws and regulations related to logistics like warehouse act, MTO act (amendment) Cargo or Freight Forwarders, Good Carriers act, etc are underway.

The government has decided to set up the Nepal National Single Window (NNSW) and converge it with the regional single window to interchange data and information for paperless trade facilitation. Similarly, the Exim Code has already been implemented. Initiatives in customs modernization such as ASYCUDA World and ASYCUDA++ are also moving ahead side by side. Now all these initiatives need to be integrated with the regional mechanisms in order to ensure a smooth flow of logistics.

Electronic Container Tracking System (ECTS)

ECTS has been introduced to cut down the time and cost of moving containers from Indian ports to Nepal, while ensuring safety. Customs formalities, procedural compliance and paperwork are reduced, but at a much higher cost. The device is installed only after port formalities are completed, thus it does not reduce port formalities. The monitoring can be done only when installed by its agent and not the importers. It is functional up to Indian border customs and not beyond. It is just a mechanism to permit Indian counterparts to monitor containers and check diversion. Moreover, the containers are carried by Indian rail and loaded with two containers facing the door. As it is, chance of pilferage or diversion should be next to Impossible. The challenge is in linking this simple tracking system to international transshipment.

Major ICDs: Bhairahawa, Biratnagar, Birguj, KakarbhittaTatopai

Logistics infrastructure enhancements

Nepal is looking to enhance the logistic performance by adopting Coordinated Boarder Management system as well as standardization of ICPs and ICDs through SOP for terminal operators to monitor and evaluate the overall supply chain easily. Nepal Government is planning to establish mini logistics centers in small custom points like Bhadrapur via Galgalia and Krishnagar etc. Logistics policy is also shaping up that includes warehouse act, MTO act (amendment) Cargo or Freight Forwarders, Good carriers act, etc. German container carrier Hapag-Lloyd deployed a new Nepal-India inland freight service linking Birgunj ICD to the Ports of Kolkata and Visakhapatnam to offer greater flexibility to regional shippers. Develop- ing Siliguri in northern West Bengal will accelerate sustainable transit transport connectivity for the Bangladesh, Bhutan, India, Nepal (BBIN) sub-region. Nepal is just 700km from Kolkata but trucks take 7 days due to poor road conditions, it should be reduced to 3 days.

Growing trade in Southeast Asia

First, we need to identify tradable items in the markets across Southeast Asia. Even if we have exportable items, it will be quite difficult to export our products to markets such as India, Bangladesh and beyond, as their compliance and standards for domestic as well as foreign goods have gone up in recent years. With the changing context in trade and transit, we need to relook the overall strategy and give special focus to address the biggest constraints related to quality compliance and certification of products. Our endeavours in identifying and promoting exportable items through the Nepal Trade Integration Strategy (NTIS) haven’t born fruits. The goods exported from Nepal should not be supplied in raw forms. Oranges and betel nut, for example, should not be picked from the trees and supplied directly to the market after little or no value addition. Such items need to be well processed, sanitized, packaged and labelled before they are supplied to the market. The absence of accredited labs adds to our problems in exports.

Customs

Nepali importers have to clear five layers of customs at border points in Bangladesh, India and Nepal if they are to export goods originating from a third country from the Bangladeshi Port. Now there is a need for the countries to adopt automation and start using IT for customs and border clearance processes. This will harmonise the customs procedures eventually reduc- ing the cost of cross border trade in the region.

Trade finance

Three factors play key role in smooth transporta- tion of any logistics with the first being seamless movement of goods followed by flow of information and flow of finance. While we’ve been emphasizing on seamless flow of goods, the other two factors have been quite neglected. Even among them, the flow of finance is the most neglected one which is partic- ularly due to our existing foreign exchange control mechanism. We often face problems in transferring Indian currency to make payments to Indian suppliers because of the recurring shortage of INR in the do- mestic banking system. Similarly, we are required to carry out transactions with Bangladesh in US dollars. There is a need for establishing a mechanism which would enable traders to transfer additional money to suppliers and freighters during noticeable fluctuation in foreign exchange rates after receiving permit from the Nepal Rastra Bank.

Transshipment via Bangladesh Ports

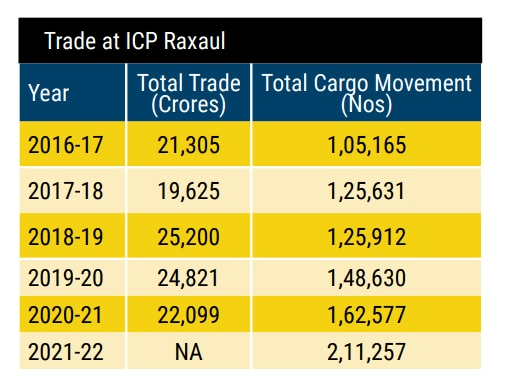

It is seen in many parts of the world that any transit providing country tries to have a hold on the delivery of the cargoes to the destinations. For instance, India’s transshipment mechanism requires us to use Indian trucks and railways to import goods. The problems are particularly created by the sluggishness in the logistics services being provided by Indian logistics service providers. At present, sometimes it takes weeks for Nepal-bound cargo containers to reach the ICP at Raxaul from the Kolkata Port. We have been importing goods from India on the Cost, Insurance and Freight (CIF) basis, wherein, costs of shipment, transit and insurance of goods are assumed by the suppliers. But once we start using the Bangladeshi port, Nepal-bound third country imports might not receive such coverage which will increase risks in our international trade.

Delivery at Terminal (DAT) is one of the ‘incoterms’ set and defined by the International Chamber of Commerce (ICC) in international shipment of goods. Under this, the supplier is responsible for the clearance of any consignment until it is received by the consignee. If Nepali importers can negotiate with their suppliers in DAT terms, the risks of demurrage and detention in transshipment of goods will be minimised.

Infrastructure

The major challenges are narrow roads due to hilly terrain, road maintenance issues, low capacity and old bridges. Lack of right vehicle type, handling equipment, maintenance stations and warehouse dry as well as cold. We also lack the distribution modalities of goods from one station to other, so heavy trucks within the city cause congestion . The cities lack intermodal transportation system.

The quality of service at inland ports/dry ports is not up to the standard as regards space management, handling equipment, cleanliness and pollution control, warehousing, labour management etc. Actually the ICDs were made with a very short vision of handling containerized cargo, but are made to handle more of loose or dirty cargo as the volume has increased. The ICP’s made with a purpose of immediate clearing with automated system has come into operation in a tra- ditional manner resulting into mismanagement, hap- hazard parking, lack of equipment like cranes and folk lifts. The customs duties being levied on the import of articulated vehicles should be reduced to enhance the inland delivery capacity of transport companies.

For more such insightful articles read our South Asia Container Market Report 2022 at the below link: