Being the natural gateway to the European markets, owing to its geographic location, Latvia is also an entrepreneurial hotspots and one of the favourite investment destinations for the world

Located in Northern Europe along the Baltic Sea, Latvia is a green and modern country with a rich cultural heritage. The country’s strategic location between Scandinavia and Russia has made it an international crossroad for trade, commerce, and cultural exchange since ancient times. In World Bank’s 2018 Ease of Doing Business ranking Latvia is ranked 19th among 190 countries. So it’s no wonder that Latvia is one of Europe’s entrepreneurial hotspots, ranking 3rd after Estonia and Sweden. In terms of total early entrepreneurial activity in Europe, it is the 1st. Latvian GDP is forecast to grow at 3.5 per cent in 2019, which is faster than the EU average of 2per cent. The country is also one of the favourite investment destinations recording a FDI stock of €15.1 billion, which is 51.2 per cent of GDP. The largest inflow of FDI is in financial intermediation 24.3 per cent, followed by trade 14.4 per cent, real estate (13.3 per cent) and manufacturing (11.8 per cent). Most of the FDI comes from EU member states (80 per cent, including 50 per cent from euro-area countries). In 2018 the largest FDI amount was from Sweden (17 per cent); Russia (11 per cent), Estonia (10 per cent), the Netherlands (7 per cent), Cyprus (7 per cent), Lithuania (6 per cent), Luxembourg (6 per cent).

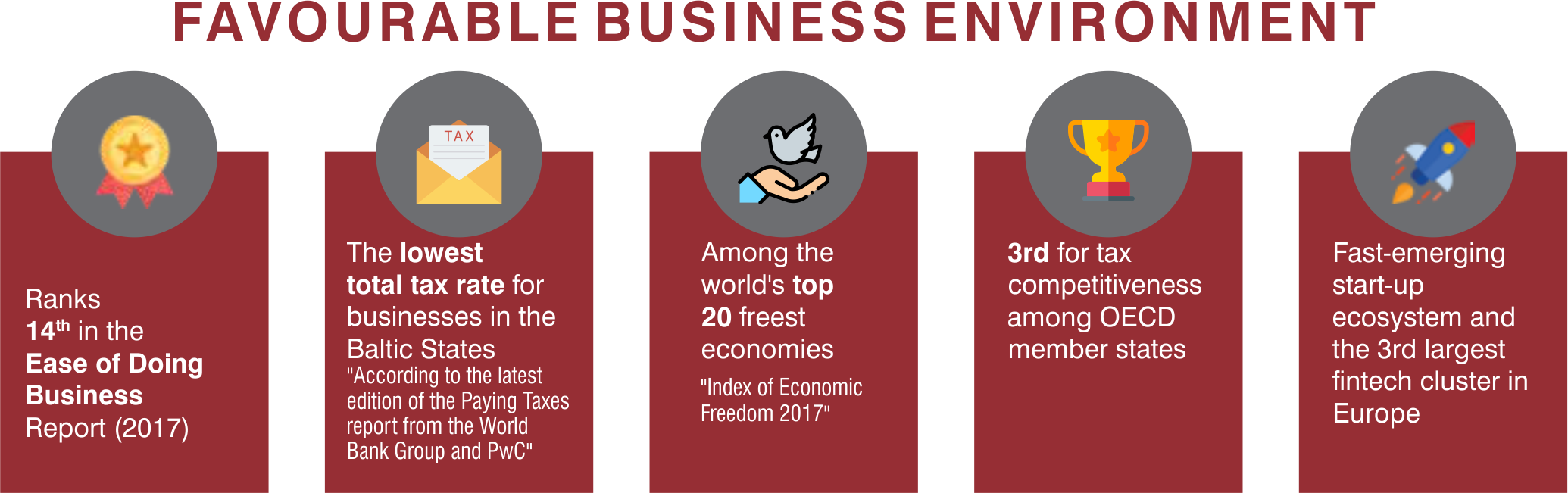

Favourable Business Environment

A major contributor to the growing investment in Latvia are the wide array of incentives, including support via EU Structural Funds and a business-friendly environment with appealing tax rebates – 0 per cent tax on reinvested profits. Advantage of EU membership privileges enable free movement of goods, services, capital and labour, and euro-area location. According to a 2018 survey, 55 per cent of existing investors intend to increase their investments in Latvia. The EU is the major trade partner to Latvia accounting for 75 per cent of total turnover by value of goods. Significant export markets include Lithuania, Estonia, Russia, Germany and Sweden, while imports mainly come from Lithuania, Germany, Poland, Estonia and Russia. Export are mostly agricultural and food products (mainly cereal products), wood and its products, machinery and equipment, transport services, financial services, travel services and IT services. Import include machinery and equipment, food products, fuels, chemicals, and vehicles, textiles, transport services, travel services.

Transit and logistics industry

Ports The country has three major ice-free ports including Liepaja, Riga, and Ventspils with depth or capacity of 12m/12.4mt/year, 16m/63mt/year, and 17m/43mt/year respectively. The cargo turnover in Latvia ports was 66,174.9mt in 2018. The type of cargo handled by the ports included dry bulk (chemicals, coal), liquid bulk (crude oil, oil products) and general cargo. Riga, and Ventspils act as free economic zones, while Liepaja is part of Liepaja Special Economic Zone (SEZ) with tax advantages for investments. All ports are equipped with necessary infrastructure including tanks, warehouses, cranes, and communication infrastructure as well as operating service providers, agents, customs brokers, and banks.

FAVOURABLE BUSINESS ENVIRONMENT

Railways

Latvia has a joint 1,520 mm gauge railway system and a unified system for organising rail freight transportation. The rail freight volumes constitutes about 54 per cent of the country’s total land transport volume. The railway system features single infrastructure, single rolling stock, unified information exchange system, single documentation, and there is no need to customs clearance on the border. The rail freight transportation offers the CIS and Asian countries with a direct access to Latvian ports in the EU. About 97 per cent of the rail freight is transit traffic mainly from Russia and Belarus to Latvian ports using east-west transit corridor. The total volume of railway cargo handled in 2018 was 49,265.6 mt of which 39,416.6 mt transited through ports. The freight handled by railway include coal, oil products, food products, chemicals, fertilizers, timber, metals, and containers.

Ever since 2017, a container train line has been linking Latvia with China. It takes less than 15 days for a train to cross the route, while it is around 45 days for sea transport. Latvia along with Poland, Lithuania, Estonia, and Finland, is destined to become an important regional transport hub with the new railway infrastructure project “Rail Baltica” which will integrate the Baltics into the European railway network.

Aviation

Latvia’s Riga International Airport is one of the top five Europe’s fastest growing airports. It served 7 million passengers and about 28,258 tonnes of cargo in 2018. It has largest destination network that allows to reach 85 million consumer market in Europe and Scandinavia using multimodal logistics solutions by air, land, sea and rail.

Over the next five years, different investment projects like expansion of passenger terminal and connection to Rail Baltica railway station, building of a new cargo platform and developing cargo logistics center in cooperation with investors, will allow Riga International Airport to increase passenger service capacity to 10 million passengers per year and double the cargo turnover. The country has two smaller airports located at Liepaja and Ventspils.

Latvia may be small, but it offers a multitude of opportunities in engineering and technology, as well as a special start up programme, making it ideal for Indians considering a European foray. H.E. ARTIS BERTULIS Ambassador, Republic of Latvia

Warehouses

There are wide range of customs warehouses, logistic centers, forwarding companies available in Latvia. Import through customs warehouses means entry of goods into EU without paying customs duty (done by warehouses) and VAT (postponed until the final sale in another EU country) on borders. A multifunctional warehouse and processing zone complex is currently under development in Riga Freeport. Known by name Bhandar warehouse project, it is being implemented by SIA Kundzinsalas Ziemelu Projekts (KZP) and its subsidiary company SIA Bhandar. The purpose of the project is to create a distribution hub for storing goods of Indian origin for further distribution in Russia, CIS and the EU countries. The total area of warehousing planned is 30,000 square meters. A technological project of an A class warehouse with the area of 6,000 square meters including additional neighbouring open cargo areas is currently completed. The targeted commodities for storage and distribution in a first phase include peanuts, raisin, spices, tea, coffee, rice, etc. The warehouse is planned to handle, consolidate, store electric equipment, drugs and pharmacy products, dry fruit and nuts, etc. Using Bhandar warehouse in Riga, warehouse users – producers of agricultural and food products, exporters from India – possibly could obtain warehouse rent payment support through Indian Government organisation support scheme.