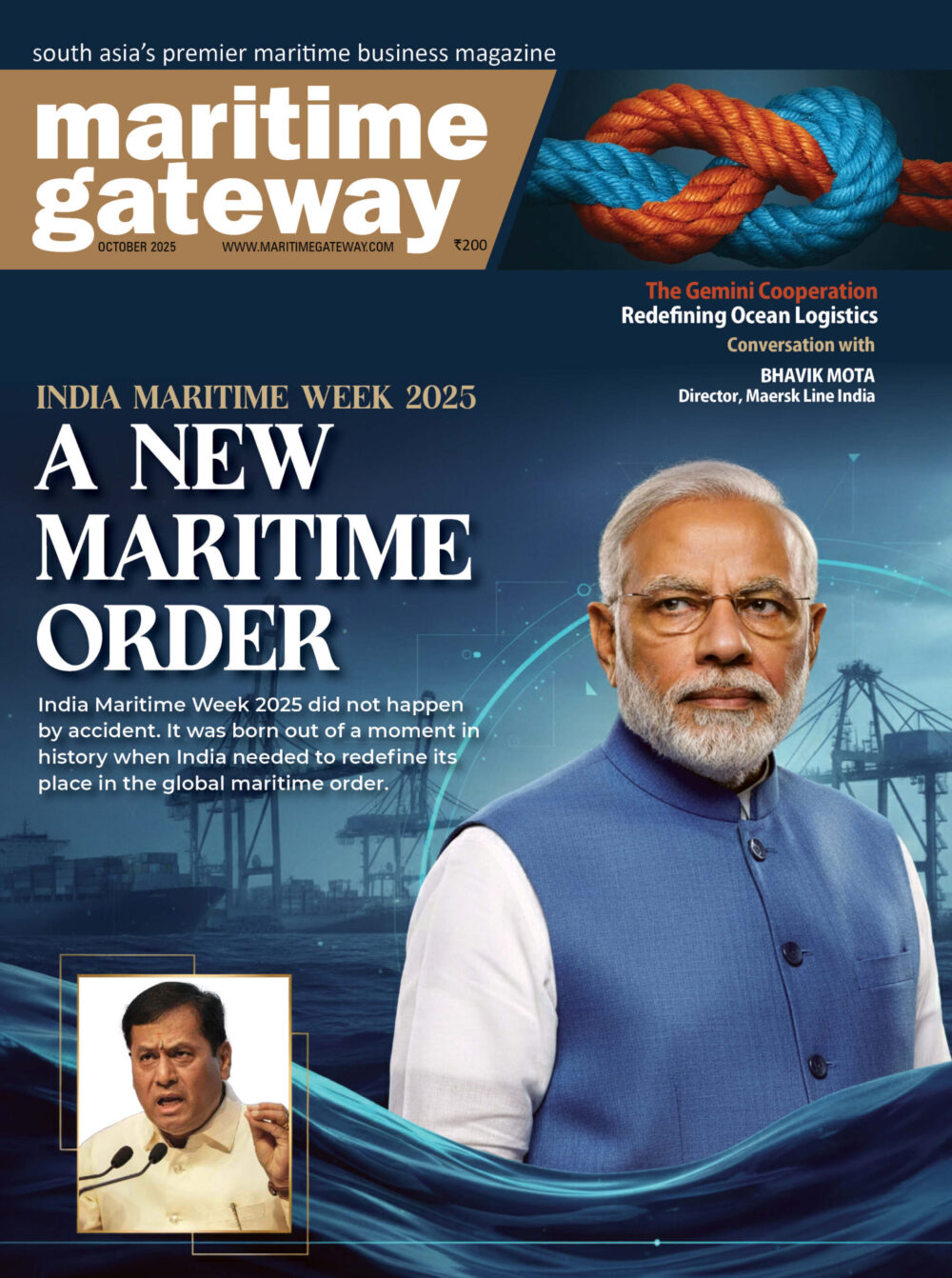

Indian IT industry is facing certain issues in importing hardware. MG spoke to the Software Technology Parks of India and a few of its big leaguers to understand the pain points. Read on to know more…

The Indian software industry’s annual exports of services account for $120 billion from five key metros of the country. What is your guesstimate on the amount of hardware and other equipment they would require to export this value of services? A lot, you’re right. And most of their imports of electronic equipment come by sea. MG spoke to the Software Technology Parks of India and a few of its big leaguers to understand if the sailing has been smooth. Here’s where the industry needs help:

Clearance at Customs: Software companies need two approvals from the Customs and the Central Excise Department to import equipment in to India. Once the STPI authorises import of a certain quantity of equipment, the two government monitoring agencies are expected to clear the Bill of Entry and issue a clearance to ensure the import is not held up. However, delay by either agency causes the importer to bear inventory costs and pay a huge sum for insuring and storing equipment.

Industry suggestion: Can these two approvals be given at the time of import and be cleared at the bonded area?

Industry suggestion: If the documents can be made digital, clearances by and from all parties can be sought within the free period to avoid payment of demurrage.

Import of used equipment: The government has currently restricted import of used equipment enforcing the anti-dumping law and the customs objects to such imports. Software firms have to obtain clearances from the Ministry of Environment and Forests before any equipment is imported. However, imports are allowed under specified cases which are made known only at the time of import if the firm asks for clearance stating the purpose.

Industry suggestion: By law, if used equipment is imported for a short duration for a specified project, import of such products should be allowed. It would help if the Customs makes know the procedure stating the permissible limits – quantity and value, payment of excess duties can be avoided.

Import of Hardware: For any outright purchase of hardware for use by the industry, such an item should appear in the Customs list of equipment. In the absence of the item not being part of the usual list, the Customs asks for a technical write-up from the importer, holding the equipment in the bonded area until it receives a satisfactory reply. This causes delay in projects leading to time and cost overruns, notwithstanding the inventory charges.

Industry suggestion: The STPI and Customs should work together in listing all possible equipment that is cleared for imports so as to not withhold any equipment. Any statement required should be obtained directly from the STPI as the nodal body and not the shipper.

GST: The announcement of this taxation has eliminated the requirement of many a document required by the Central Excise Department and introduced a few fresh ones. The industry hopes there is a clear list of documents to be submitted to the Customs for import-approval to hasten the clearance procedure.

[/vc_column_text]