Danish maritime data analysis company, Sea-Intelligence noted that it was expected that box carriers would utilise Chinese New Year (CNY) as an opportunity to cancel a large number of sailings in order to restore supplies. However, this only occurred within one to three weeks of CNY, leaving shippers with a very short window to effectively arrange supply chain contingencies.

This pattern appears that will be maintained eight weeks after the Chinese New Year, according to the Sea-Intelligence report.

The capacity anticipated to be deployed in those eight weeks on the Asia-North America West Coast will be about 353,800 TEUs per week, 221,700 TEUs per week on the Asia-North America East Coast, and 314,900 TEUs per week on average on the Asia-North Europe.

All of these statistics are the highest for the individual trade lanes, and they reflect a considerable rise not just over 2021, but also over the pre-pandemic baseline of 2017-2019.

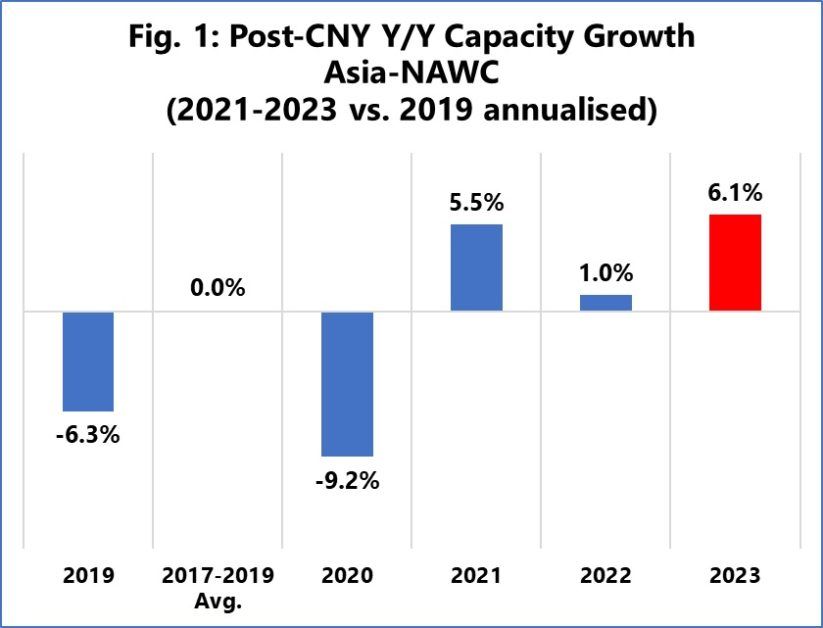

The figure above depicts the year-by-year capacity growth rate for Asia-North America West Coast, with 2021-2023 displayed as an annualised growth rate over 2019 (a standard year-over-year growth rate would be deceptive given the large fluctuations in capacity over the epidemic years).

The yearly growth rate of 6.1% is not only the highest, but it is also much higher than the pre-pandemic norm. With a yearly growth rate of 10.2%, Asia-North America East Coast is comparable. Only Asia-North Europe’s growth rate of 3.2%, however, is in line with the pre-pandemic baseline.

According to Alan Murphy, CEO of Sea-Intelligence, absent any demand growth, it is very likely that the shipping lines will continue to blank sailings to keep capacity closer to pre-pandemic levels.

He also pointed out that it is very likely these decisions will be taken closer to departures, once again leaving shippers with very little time to plan proper contingencies.