Source: Business Standard

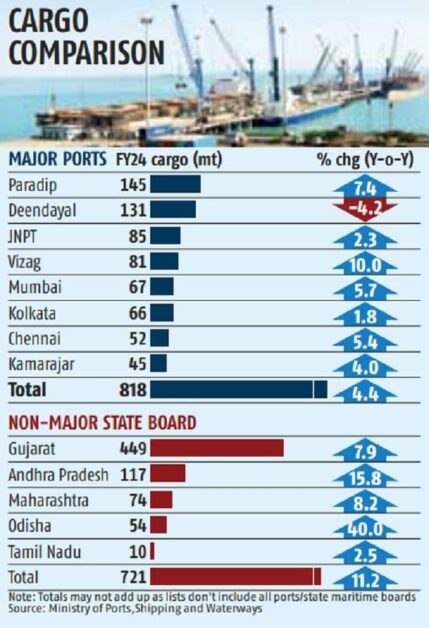

At 721 million tonnes (mt), non-major ports saw their cargo increase by 11.18 per cent year-on-year in the previous financial year. In contrast, major ports ended FY24 handling 818 mt of goods.

Major ports are those owned by the central government through the Ministry of Ports, Shipping and Waterways, while non-major ports are owned by state governments and private players.

The growth for non-major ports was primarily led by thermal coal, which accounts for 7 per cent of the total volumes of these ports. At 51 mt, thermal coal cargo grew by 53 per cent in the previous financial year. Iron ore, after a subdued 2022-23, also grew by 44 per cent in FY24. For major ports, growth primarily came through crude oil (5.05 per cent up), thermal coal (up 4.72 per cent), and iron ore (28 per cent).

While private ports under the Gujarat Maritime Board registered a combined growth of 7.9 per cent, the traffic handled by the Deendayal Port (Kandla) conversely saw a 4.2 per cent contraction in its cargo volumes at 131 mt. This was driven by a nearly 5 per cent contraction in its overseas cargo.

While policy factors such as export bans on non-basmati rice may have played a part, officials believe that the port may well have lost cargo to its private peers as well. Major private ports such as the Mundra Port, Pipavav, and Hazira come under the Gujarat Maritime Board.

The Kandla Port also lost its tag as the largest cargo-carrying major port in India, as Odisha’s Paradip Port handled 145 mt of cargo, against Kandla’s 131 mt. On the private sector front, Adani Ports and Special Economic Zone, which announced its January-March and combined FY24 results on Thursday, saw a 24 per cent growth in its cargo volumes and a 28 per cent increase in its revenue. The company, which closed FY24 with 419 mt of cargo, expects volumes to grow to 500 mt in 2025, particularly owing to acquisitions such as the Gopalpur Port. The Centre had announced in the FY24 Budget that it will focus on coastal shipping in public-private partnership mode.

The shipping ministry spent a large part of last year ironing out policy issues with the finance ministry and identifying projects for viability gap funding. In the interim, private ports have cashed in on the growing potential of coastal shipping. While coastal shipping grew by only 1.97 per cent last financial year for major ports, private ports saw a 15 per cent rise in their coastal cargo.

In September, this growth was 20 per cent. A Mumbai-based sector expert said that industry and shipping lines are opting for private ports for trade purposes due to better efficiency parameters delivered by the latter.

This is evidenced by the fact that container cargo, which is a proxy for the trade of finished goods, grew by 6.6 per cent for major ports, while it grew by 17.4 per cent for non-major ports. Several acquisitions in the private port space and redevelopment of state-government ports with private parties may widen this gap in growth going forward, as the new ports will unlock further capacity.