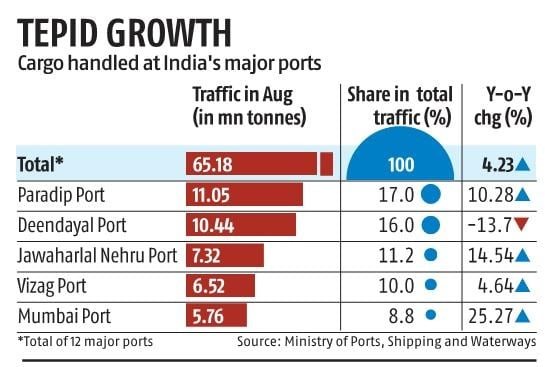

During the previous month, cargo handled at India’s major ports reached 65.19 million tonnes (mt). The overseas cargo handled at major ports increased by 6 per cent to 50.92 mt in August, according to provisional data from the Ministry of Ports, Shipping and Waterways.

So far, in 2023–24 (FY24), cargo growth at state-owned ports has been sluggish, with a just a 2.8 per cent increase.

“A combination of factors has played into this; coastal cargo movement for major ports has significantly decreased. Deendayal, Goa, and Ennore have experienced muted growth, with Deendayal even showing negative overseas growth,” said Jagannarayan Padmanabhan, senior director and global head of consulting — transport, logistics, and mobility at CRISIL Market Intelligence & Analytics.

Padmanabhan added that the ban on the export of non-basmati rice has also affected overall growth, although its contribution to the overall cargo mix is limited.

Meanwhile, cargo handled at non-major (state government-owned or private) ports in August reached 58.55 mt, showing an increase of 15.9 per cent compared to 50.52 mt the previous year.

While coastal shipping supply chains have significantly favoured non-major or private ports, data shows that overseas cargo handled at non-major ports in August also increased by 11.1 per cent to 46.84 mt, which is much higher than the growth of cargo at state-owned ports.

So far in 2023-24, traffic growth for non-major ports has been 6.8 per cent. The data reflects the concerns raised in the past about government-owned ports losing out to private ports despite capacity expansion efforts under programmes like Sagarmala.

“JSW Steel Dolvi Works production capacity increased from 5 million tonnes per annum (mtpa) to 10 mtpa last year. The inward movement of coking coal, thermal coal, and iron ore at Dharamtar Port in Maharashtra has increased, as evident from the coastal traffic of Maharashtra Maritime Board, with a year-on-year increase of 29 per cent during April–August,” Padmanabhan said.

He added, “Some of Tamil Nadu electricity board’s thermal coal cargo seems to have shifted from Vizag port to Gangavaram in Andhra Pradesh. This has contributed to a 55.2 per cent increase in coastal traffic at the Andhra Pradesh Maritime Board in FY24 compared to the previous year.”

Traffic at major ports in 2022-23 witnessed near-double-digit growth for most of the financial year.

An analyst at ICRA stated that the ratings and research firm expects cargo handling in FY24 to grow by 5-7 per cent. CRISIL expects cargo growth to be 6.5 per cent in FY24, according to Padmanabhan.