Inefficiencies have remained a drag on the Indian textiles sector for long. Plugging in new technologies, streamlining production cost and developing favourable trade agreements with global markets can enable the industry significantly increase its share in the world market

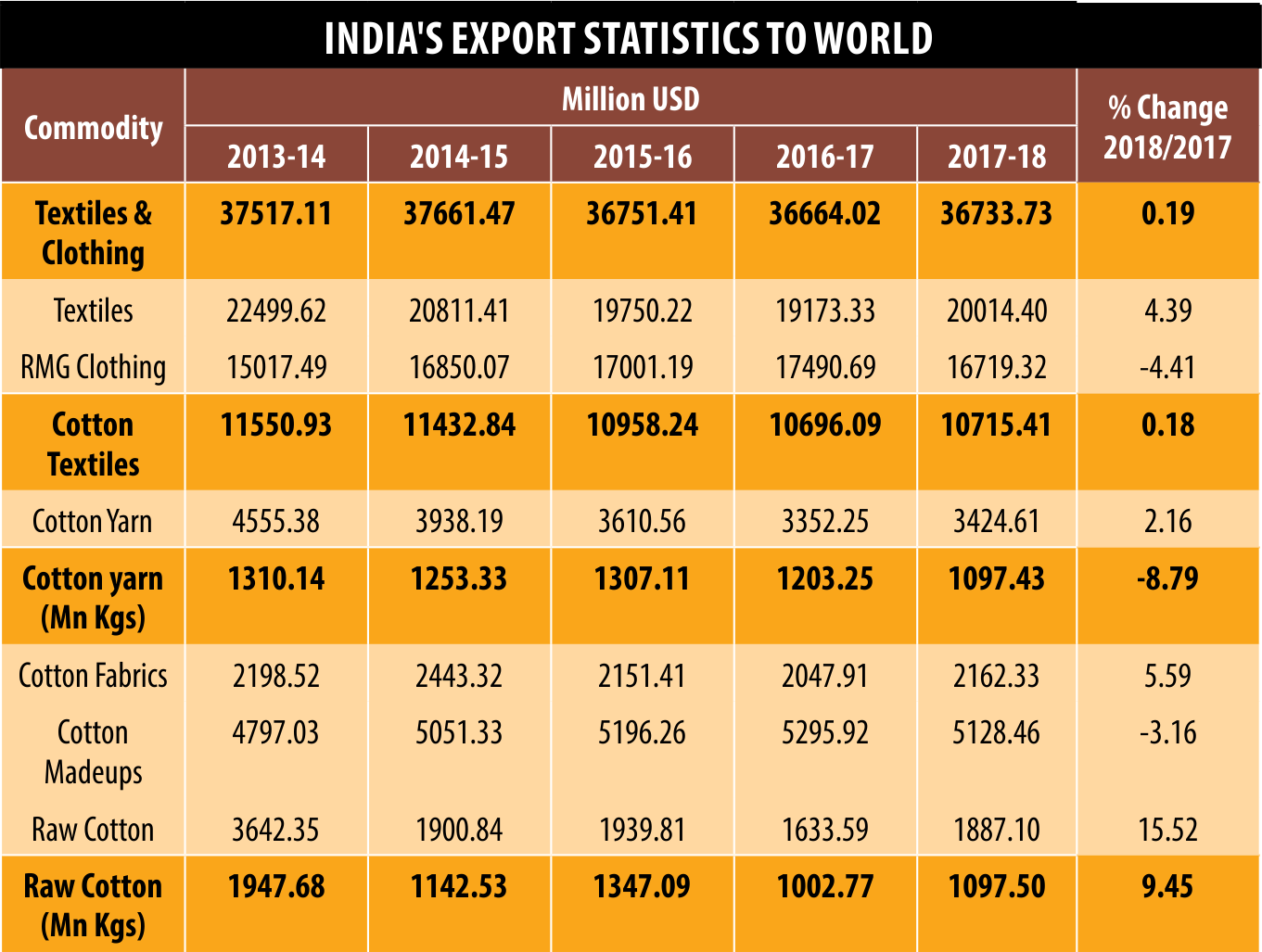

Textiles is the second largest industry in India after agriculture, in terms of providing employment as more than 35 million people earn their bread in this sector. Indian textile industry contributes about 7 per cent of the country’s total industrial output in terms of value, accounts for 2 per cent of India’s GDP and 15 per cent of country’s export earnings. The major textile production centres are in the states of Gujarat, Maharashtra, Tamil Nadu, Andhra Pradesh and Punjab. In addition, Telangana, Rajasthan, Madhya Pradesh and Karnataka also produce raw materials used in textile manufacturing. Ministry of Textiles has so for approved 59 textile parks in India. Currently 35 parks are in operation and 24 parks are about to complete. India’s overall textile and clothing exports during the year 2018 stood at $36.92 billion, a slight decline from $38.41 billion recorded in 2014. Exports of manmade fibre textiles valued at $6024 million in 2017-18, compared to $6219 million recorded in 2013-14. In FY2017-18 readymade garments topped the total textile exports posting $16,664 million in revenues. Textile yarn occupied the second position with revenues of $5,487 million, followed by fabrics that recorded export revenues of $4,349 million.

India’s share in the global textiles exports is not more than 5 per cent, which is very minuscule compared to China’s share of 38 per cent. Other competitors include the US, Turkey and South Korea. Much smaller players like Bangladesh and Vietnam have a share of 3 per cent in global exports and are increasingly threatening India’s exports. Indian textile exports are cost competitive as compared to exports from China, Bangladesh and Vietnam. However, Free Trade Agreements and duty preferences for countries like China, Bangladesh and Vietnam in major markets like EU, Australia etc. make exports more viable for them as compared to India, reveals Dr Siddhartha.

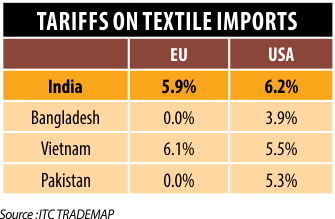

Indian government needs to carefully evaluate the various trade agreements with global markets. Our textile companies face higher trade barriers compared to other competing countries like Bangladesh, Vietnam and Pakistan in key markets such as the USA and EU. Average tariff on textile products faced by India vis-à-vis competing countries in EU and USA are as shown in table above. The Indian textiles industry needs to move up the value chain. India has a high share in global export market in upstream products, such as fibre and yarn (14 per cent each). However, India has a low share in value-added downstream segments. Most of the textile exports take place through Mundra Port, Pipavav port, Mumbai Port Trust, JNPT, Tuticorin Port, Visakhapatnam Port, Kandla Port, Chennai Port and Kolkata Port.

A major advantage that India enjoys in this sector is the presence of the entire value chain – from fibre, yarn, fabric and apparel – apart from the availability of cheap and abundant labour. “Indian textiles are known throughout the world for their quality. India ranks number one in terms of supplying cotton yarns to the world and the global market share is approximately 26 per cent. Fabrics and home textiles are also known for their finishing and printing qualities,” informs Dr Siddhartha Rajagopal, Executive Director, TEXPROCIL.

Obsolete technology

The textiles industry in India is highly fragmented and mainly dominated by small scale and unorganised players – small and medium-sized enterprises (SMEs) make up around 80 per cent of the industry. These SMEs find it difficult to invest in the latest technological innovations. In fabric manufacturing and processing, these units use secondhand machinery that is imported. Dismantled looms in China find their way into India and it is no surprise that Chinese machines make up nearly one-third of textile machinery imports into India. Shuttle-less looms that help weave fine fabrics make up only two lakh of the nearly two million looms in the country – a clear indication of Indian inefficiency.

Rajagopal

Executive Director

TEXPROCIL

“Indian textiles are known throughout the world for their quality. India ranks number one in terms of supplying cotton yarns to the world and the global market share is approximately 26 per cent. Fabrics and home textiles are also known for their finishing and printing qualities.”

According to one estimate about 60 per cent of the spindles operational in India are more than 25 years old. Only 18 per cent of the total number of looms operational in the country are automatic looms as against the world average of 62 per cent and 100 per cent in the United States. It is here that technology upgradation schemes will help Indian players to increase both their productivity and competitiveness.

To support the industry government announced a special package for garments and madeups sectors, offering Rebate of State Levies (RoSL), labour law reforms, additional incentives under ATUFS and relaxation of Section 80JJAA of Income Tax Act. The rates under Merchandise Exports from India Scheme (MEIS) have been increased to 4 per cent from 2 per cent earlier for apparel, 5per cent to 7per cent for made-ups, handloom and handicrafts w.e.f. 1st November 2017. In the textile value chain, production and export of fibre, yarn and fabric is being strengthened and made competitive through focused schemes: Powertex for fabric segment, Amended Technology Upgradation Fund Scheme (ATUFS) for all segments except spinning, Scheme for Integrated Textile Parks (SITP) for all segments, etc. Market Access Initiative (MAI) Scheme has been introduced to support exporters. Further, Government has enhanced interest equalization rate for pre and post shipment credit for the textile sector from 3 per cent to 5 per cent w.e.f. 02.11.2018.

High production cost

It is really paradoxical that in a country where wages are low and cotton is internally available, production cost is high. In spite of having the largest area under cotton cultivation (about 26 per cent of the world acerage), India falls short in production of long- staple cotton which is imported from Pakistan, Kenya, Uganda, Sudan, Egypt, Tanzania, U.S.A. and Peru.

The major costs involved in the production of textiles are the costs associated with raw materials, processing (like dyeing, finishing, printing), packaging and logistics. “Two important raw materials for textile industry are cotton/natural fibres and manmade fibres (Viscose staple fibre, Polyster staple fibre, and Acrylic staple fibre). India is one of the largest exporters of cotton and price of cotton has increased by almost 6 per cent from April 2017 to `118.2 per kg. in December 2018. Prices of two important manmade fibres i.e. VSF and PSF have also increased by approx. 11 per cent and 50 per cent, respectively during the same period. Prices of this first essential raw material, particularly for manmade fibres, are on a higher side in India as compared to neighbouring competitive countries,” informs Sanjay K Jain, Chairman, CITI.

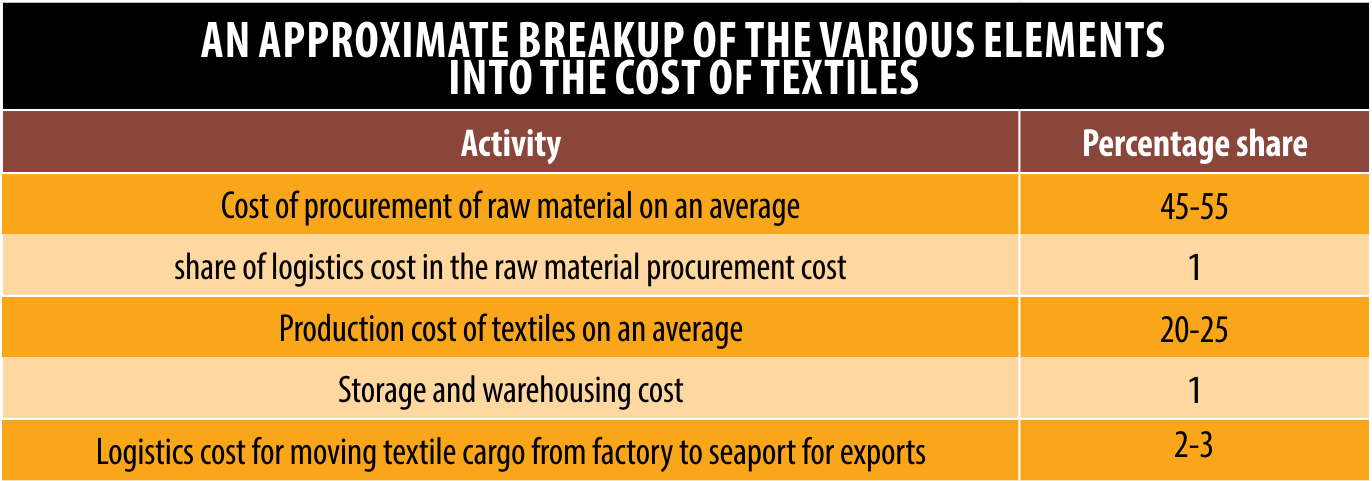

Mills in Southern India procured 20,000 containers of cotton bales last year. Each 40 foot container can accommodate 170 bales. About 50-60 lakh bales were procured from Gujarat. Raw material costs vary due to the volatility of the prices in the basic fibre itself. Depending on the scale and area of operation like spinning or weaving, the average raw material cost is approximately 45-55 per cent of the final sales of the product.

Power supply

Textile mills face acute shortage of power supply, frequent power cuts and load shedding affect the industry badly leading to loss of man hours, low production. Further, labour and electricity costs are quite less in African countries like Ethiopia and some of the Indian textiles companies are making investment there, reveals Sanjay K Jain, Chairman, Confederation of Indian Textile Industry (CITI).

Low productivity of labour

An Indian factory worker, on an average, handles only 380 spindles and 2 looms as compared to 1,500-2,000 spindles and 30 looms in Japan. If the productivity of an American worker is taken as 100, the corresponding figure for U.K. is 51 and for India only 13. Also, industrial relations are not very good in the country. Strikes, layoffs, retrenchments are the common features of many cotton mills in the country.

Buyer-driven commodity chains Industries with large retail chains, big brand marketers, and trading companies often operate through decentralized production networks, mostly located in third world countries like India. So the main leverage here lies with the retailers and brand merchandisers at the marketing or retail end of the supply chain. Indian apparel industry largely consists of manufacturers who are into package supplying to foreign buyers. This lowers the bargaining power that Indian apparel sector has on global cues in the industry, thus preventing its unrestricted growth.

Impact of GST GST

is a multi-stage tax levied on every value addition and has created distortions in the textile and apparel sector. Post GST, the man-made fibre yarn is taxed at 18 per cent, while the fabric is taxed at 5 per cent. The small businesses which buy yarn and produce fabric are directly impacted by this imbalance, affecting their sustainability. In addition, delays in reimbursement of input credit, has impacted liquidity of the sector.

Chairman CITI

Duty drawback rates

Effective October 1, 2017, the duty drawback rates on garment exports were reduced. Duty drawback is the duty refund that a business gets against what it paid for importing the raw material. The sudden fall in the duty drawback rates impacted the price competitiveness of textile and apparel exports.

High costs of capital

Compared to other Southeast Asian nations, India has one of the highest costs of capital, which directly increases cost of production, severely hampering the country’s competitiveness in the global market. The current lending rate in India is between 11 to 12.5 per cent, while China, Vietnam, and Turkey, offer capital at a rate of 5 to 7 per cent only.

High logistics cost

“Logistic costs play an important role in transporting textiles across India as well as in exports, and on an average it is about 7-8 per cent of the cost of production,” says Dr Siddhartha. “Huge amount of job work is involved in conversion of cotton to yarn, yarn to grey cloth, grey cloth to fabric for dying, bleaching and printing, fabric to embroidery other value addition etc. Approximately, 70 per cent of value addition activities are being carried out by way of the job work through inter- industry movement of goods and services and inter dependence of organized and unorganized sector in the textile industries and hence logistics has become more challenging,” reveals KMG Ganesh, Joint Secretary, South India Mills Association.

Spinning mills in Tamil Nadu consume about 40 per cent of the total cotton produced in the country, but only 2 per cent of this cotton is cultivated in Tamil Nadu and the balance requirement is bought from states like Gujarat, Maharashtra, etc. This adds to the additional cost. When the yarn produced in Tamil Nadu is transported to weaving centers like Bhiwandi, Sholapur, the cost of yarn is going up without any value addition happening in the process. The increase in diesel prices further add to the logistics cost. On the contrary, countries like China and Vietnam manage to maintain their logistics cost low in the international cotton trade. The average cotton transportation cost between Gujarat and China is far less than $200 for a 40-foot container having a capacity of 170 cotton bales each weighing 170 kgs (i.e., less than `100 per bale).

During the peak cotton season the cost of moving a bale of cotton through road between Gujarat ginning factory and spinning mills in Tamil Nadu is about `1,000 per bale. The transportation cost for imported cotton from countries in West Africa to the spinning mills in Tamil Nadu is around `400 per bale. The industry can opt for moving cotton through rail or coastal shipping, but the cost difference between these various modes of transport is about 10-15 per cent. It takes 3-4 days to move cotton from Gujarat to Tamil Nadu by road, but the same journey by sea takes around 15 days.

KMG Ganesh, Joint Secretary, SIMA adds, “The cost of logistic/ Kg yarn is around Rs.6.5 for transportation form CBE to Colombo. However, in respect of CBE to China the logistic cost is around `4.0/ Kg which is economical and viable. Currently, the ocean freight charges and the port handling charges are high compared to other countries particularly Sri Lanka. The Tuticorin Port has mother vessels calling, but it has only two terminals which is not sufficient to handle the entire port activities.”

“In India cost of transportation is high which is around 1per cent of FOB value of exports. These costs are embedded since they are not refunded by the government and adversely impact on competitiveness of our exports,” says Ronak Rughani, Chairman, SRTEPC. “Another concern is increasing and volatile fuel prices, poor quality of roads. In a month logistics cost account for about $30 million in the total cost of synthetic textiles exported.”

Cabotage relaxation

“The Cabotage rules were one of the factors preventing Indian ports to act as trans-shipment hubs and exporters had to wait for empty vessels to load their goods. With a relaxed Cabotage, there will be cost savings for this industry besides improving competitiveness and ensuring smoother coastal to coastal movement,” expects Dr Siddhartha.

“Though the Ministry of Shipping is encouraging coastal movement, we literally find that it is very difficult at Tuticorin Port, the vessels have to wait for 2 or 3 days for container clearance. Further, during the cotton season, the availability of containers and the movement of container is also a bigger issue for transporting cotton from Gujarat to Tamil Nadu,” reveals KMG Ganesh. “Sea route is not that attractive because suppliers do not prefer it as they will get the payment only after 20-25 days. On the contrary movement by road takes a week and payment to the suppliers is faster. We procure around 50-60 lakh bales from Gujarat out of which 50-60 per cent comes by road. SIMA has been asking for sales tax exemption for using coastal shipping but still it is not happening. We have also requested for sea farer tax exemption in line with foreign flagged vessels.”

Warehousing required

“Many times when there is congestion at seaports or delay in shipping bill generation and customs clearance, transportation companies over charge shippers. Detention & demurrage charges further add to the cost. Therefore, adequate warehousing facilities closer to major ports would significantly help the exporters, says Rughani.

Thin profits

“This is mainly due to increasing cost of production in India and fierce price competition prevailing globally. In the MMF textile segment, huge ITC have been accumulated due to the Inverted Duty Structure in this segment because of which ITC is neither refundable nor utilisable. Under GST, duties paid on services and capital goods are not allowed refund. Further, several state duties & taxes being paid by the exporters on manufacturing fibres, yarns and fabrics are not refunded due to which production cost is very high in India as compared with any MMF textile manufacturing country in the world. Whereas, competing countries such as China, etc. has been giving multilayer subsidies at different levels from block to district to state level to its exporters making them more competitive globally,” reveals Rughani.

“The volume of exports are generally of basic commodities having low price elasticity. There is a pressure on profit margins due to compulsion on cost competitiveness arising out of elements like advantage of duty preferences to certain textile producing countries. This makes the textile industry to operate on thin margins,” shares Dr Siddhartha.

From procurement of raw material to production and export of textiles, the activities that majorly add to the rise in cost of Indian textiles is raw material procurement, says Dr Siddhartha. “As stated the raw material cost is one of the largest contributor to the final production cost during spinning and weaving. For spinning the input raw material is the fibre while it is yarn for weaving and fabric for home textiles. Bleaching, dyeing or other finishing activities like mercerising etc. add costs to yarn production while bleaching, dyeing, printing, finishing are the other major activities involved in production of fabric. For home textiles and additional activity is cutting and sewing.”

KMG Ganesh,

Joint Secretary, South India Mills, Association

“Approximately, 70 per cent of value addition activities are being carried out by way of the job work through inter- industry movement of goods and services and inter dependence of organised and unorganised sector in the textile industries and hence logistics has become more challenging.”

Expectations from the government

Government (Central as well as state) needs to refund all the taxes and duties which it collects from manufacturing and exporting units. And the refund needs to be quick and on a time bound manner. All the accumulated ITC needs to be refunded. Further, the duties paid on services and capital goods procurement and import need to be refunded as well. There should be specific production related subsidies for enhancing efficiency of the manufacturing companies.

Government should also provide support in R&D, product development & designing, Skill Development, marketing, etc.

The recent announcement by the government on the upward revision of rates under the Remission of State Levies (RoSL) Scheme for garments and made-ups will go a long way in helping the exporters overcome this disadvantage and to increase exports in major markets around the world. The government’s endeavour is to extend these benefits to exports of fibre, yarn and fabrics also in future for which a committee will be set up to examine if similar incentives can be extended to these segments, says Dr Siddhartha. India also needs to negotiate some significant and important FTAs with markets like EU, Turkey, Canada and Australia so as to increase its exports.

Advantage Bangladesh

As compared to India, Bangladesh enjoys lower labour cost as well as transportation cost. Bangladesh has also put in place an efficient Customs system as far as exports are concerned. Bangladesh is mostly exporting high value added garments unlike India. Despite, most of the garments exports from Bangladesh are taking place through air cargo, it is still profitable for Bangladesh due to GSP facility extended to Bangladesh by EU and USA.

Advantage China

China also exports mostly value added items such as active wear, garments, etc. Moreover, China has an efficient logistics and transportation facility for exports. They have dedicated roads and railway services for uninterrupted transportation of goods to ports for export. Further, most of the logistics and transportation expenses are also reimbursed by the government that helps their exports to be more competitive.

Advantage Vietnam

Vietnam has also put in place a very effective and efficient logistics and transportation system to ease out export activities. Vietnam has developed major sea ports with huge accommodative capacity for mother vessels and supplying vehicles/ trucks. Moreover, its Customs system is completely digitised with very less paper work.