Supply chain visibility and sustainability, on the other hand, have become less urgent objectives.

ASCM assembled a team of experts from a range of industries, institutions and geographies and tasked them with scrutinising and evaluating key trends.

While the overriding priority of increasing efficiency and effectiveness didn’t change through the pandemic and subsequent disruptions, currently there is a clear focus on digital transformation, said ASCM CEO Abe Eshkenazi,

“The top three trends are all focused on digital transformation,” he noted.

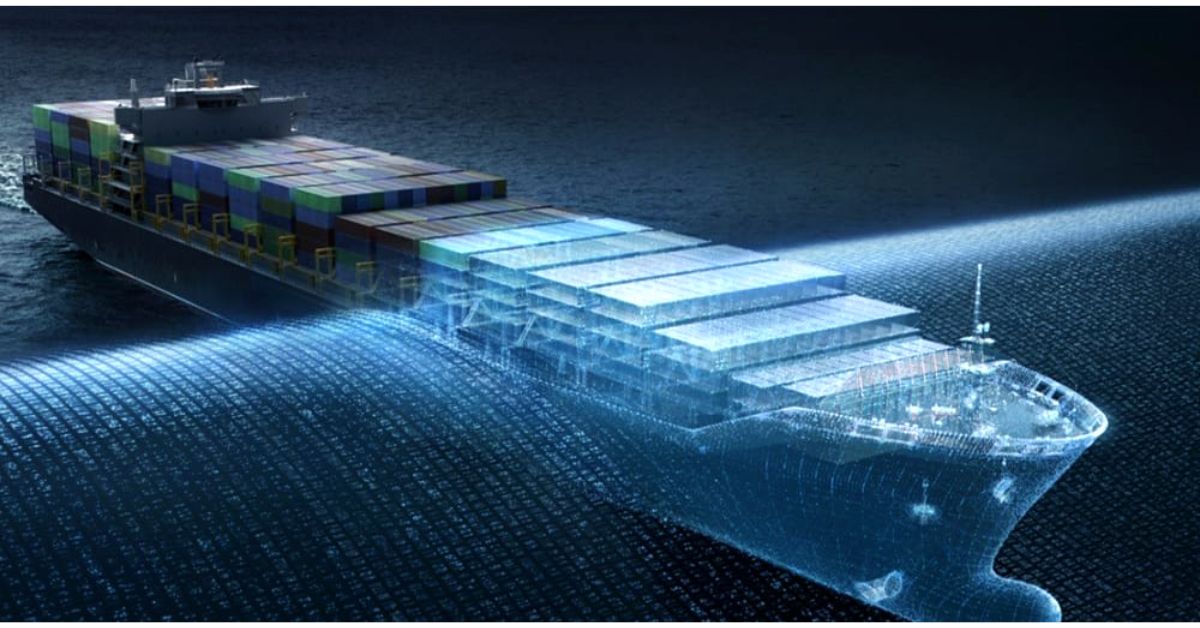

Establishing a digital supply chain tops the agenda for 2024, described by the panel as the base to enable leverage of the internet of things (IoT), artificial intelligence (AI) and other emerging technologies that rely on high-quality digital input.

“In the coming year more supply chain organisations will transform their networks into connected, intelligent, scalable and nimble digital ecosystems,” said Mr Eshkenazi.

Next on the list of priorities are big data and analytics, followed by AI. But companies will also invest in systems and people.

The recent travails of digital logistics providers have starkly illustrated the critical role of human expertise. New entrants into the workforce are usually comfortable with technology, but their proficiency on that side is not always matched by critical analytics and other traditional skills, noted Mr Eshkenazi. Companies have to provide a lot of re-training as the curriculum at many academic institutions does not match the expectations of employers, he added.

Meanwhile, supply chain visibility does not command the same sense of urgency as it had in recent years. If companies can make good progress on the current top three issues, they should be able to establish good visibility and supplement this with location intelligence to get essential context about the state of their networks, explained Mr Eshkenazi.

And, after AI, risk management is next on the list of priorities to tackle. ASCM’s experts noted that supply chain disruption had “become the norm”. Instead of addressing issues as they arise, more organisations will prepare for disruption through effective risk management, they predict.

This will involve identifying and assessing risks, effective stakeholder communication, developing mitigation strategies and testing and rehearsing plans.

This extends to cybersecurity, which ranks eighth on the ASCM list of priorities. The organisation warns that the alarming increase in cybercrime is likely to continue. Mr Eshkenazi noted that much of this type of crime occurred at the level of tier-two or -three suppliers, which tend to be smaller firms that lack the resources of OEMs and tier-one suppliers.

Wedged between disruption and risk management and cybersecurity on the list of priorities for the coming year came agility and resilience. As disruption has become a regular feature of today’s supply chain landscape, companies have to be able to predict, prepare for and respond to evolving demand and product and channel mix. This requires new tools, skilled employees and cross-functional teams to collaborate and solve problems, says ASCM.

The pandemic triggered a shift from the traditional just-in-time model to just-in-case strategies, added Mr Eshkenzi, adding that companies need resilience to withstand disruption, and agility to not only respond to it but make adjustments in order to benefit from changed circumstances.

Geopolitical conflicts have emerged as severe disruptions, catapulting interest in re-shoring to new and rising heights.

“This de-globalisation may result in improved security and resilience; however, it’s also likely to raise prices, limit choice and reduce innovation due to smaller market sizes,” warned ASCM’s experts.

Mr Eshkenazi said this would be a process of years rather than quarters, pointing out that China had a 30-year head start in developing manufacturing and supply chain infrastructure, while the locations drawing attention today were facing shortages in labour and warehousing.

Sustainability and circularity ranked just above geopolitics and the de-globalisation of supply chains on the ASCM list for 2024. While almost every survey shows companies identifying sustainability in their top three priorities, fewer than 50% have tracked their carbon footprint, and fewer than 40% have reported it, Mr Eshkenazi noted.

“Investment is not following the rhetoric,” he said, pointing to a number of reasons, from lack of definitions and metrics to other investment priorities.