eKYC enables customers to submit their KYC details just once to ODeX and share the same with multiple stakeholders. This provides a considerable saving in terms of cost and time for all the parties involved

KYC is one of the widely adopted processes by global businesses and organizations for identification purposes. For over two decades now KYC has been used by financial institutions across the world to set in place a framework for customer identification and for deciding whom to do business with. In India, logistics industry has to comply with the KYC norms set by statutory bodies – and thus each stakeholder is compulsorily required to collect, validate and maintain the KYC of all their customers.

Over the last 2 years, ODeX has developed an eKYC solution that enables customers (consignees, shippers, forwarders, agents) to submit their KYC details just once to ODeX and share the same with multiple stakeholders (shipping lines, NVOCC’s, forwarders, CFS). This provides a considerable saving in terms of cost and time for all the parties involved.

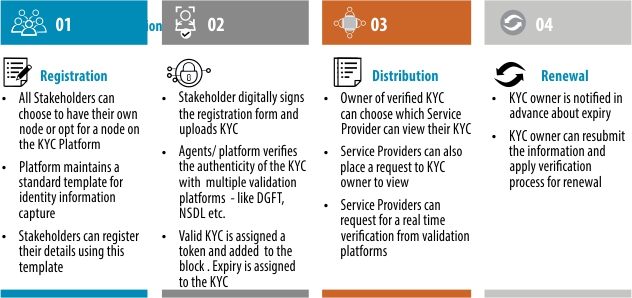

ODeX eKYC platform provides self-attestation of organization data, digital signature, document verification and third-party verification service provision. Customers can now confirm their identity remotely with zero hassle while delivering required proof to service providers in compliance with KYC regulations.

The challenge

Identity management for customer organisations is a repetitive unproductive activity. Multiple versions of KYC with different entities results in long verification timelines and extensive data and information shared with multiple entities. For service providers it is high verification costs – from $10 to $100+ and complex and lengthy verification process. Stakeholder also have to bear the costs of multiple data storage infrastructure and data management costs – a cost that is expected to increase substantially with regulations like GDPR coming into effect.

The solution

Distributed ledger technology (based on BlockChain) – has the potential to reduce risks, cut costs and streamline the KYC processes completely. ODeX eKYC facilitates the accessibility and organization of KYC data by leveraging the distributed ledgers and the programmability of smart contracting. In the context of KYC compliance, the total resources required for compliance can be reduced to the barest minimum.

The system will have the 3 nodes maintained by ODeX eKYC platform as consensus building entities or validators. These three categories of nodes are as below: • Data issuers – Owners of KYC data. They may or may not be regarded as trusted entities. They provide their KYC/AML data to trusted entities in exchange for an attestation.

- Data validators – Regarded as trusted entities. They receive data from issuers; review, confirm and attest to its validity and existence.

- Data consumers – Organizations that require the use of KYC data. They review attestations, determine usability, and request Data from holders.

Data entity

The system will store all the relevant hash of details of the following in the Block Chain (not all may be applicable, and more may be added to the list):

- Organization Name & Type of business • Address

- Company Number Details

- Tax Details (PAN & GST)

- Import Export Code

- MTO License • CHA License

- Data Consumer Access

It is recommended that data issuers attach scans of the KYC documents issued by regulatory authorities, and digitally signed by the data issuer. The application is in pilot phase and will be made live soon.