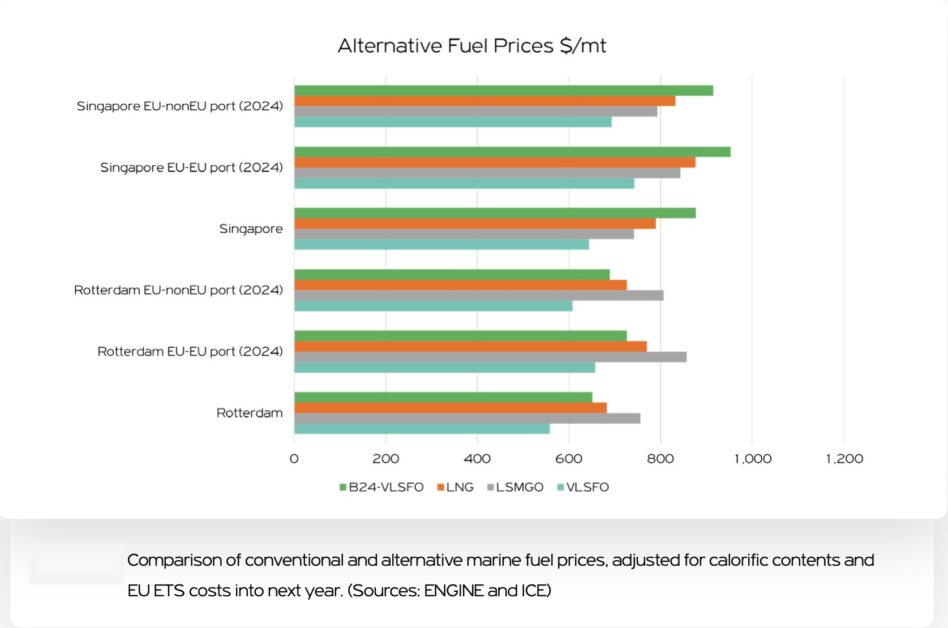

Bunker platform ENGINE has compiled a report in partnership with Freight Investor Services in which prices are compared for conventional bunker fuels, LNG and biofuel blends, and then adjusted for calorific contents and potential European Union emission trading scheme (EU ETS) costs into next year.

The authors of the report claimed in a release that with their research they can now approximate true fuel choice costs “more on an apples-to-apples basis”.

The report suggests that Rotterdam looks like an attractive place to bunker LNG for dual-fuel ships that would otherwise have bunkered low-sulphur marine gasoil to consume in emission control areas (ECAs).

While in Singapore, LNG will compete more head-on with very low sulphur fuel oil (VLSFO) to win over dual-fuel vessel customers, and LNG prices look uncompetitive.

Among lower-carbon fuels, B24-VLSFO, a biofuel blend, is attractively priced against LNG with government rebates in place in Rotterdam, but not in unsubsidised Singapore.

From January 1, shipping will be included in the EU ETS. As a result, vessels visiting EU ports will be required to offset their applicable CO2 voyage emissions through the purchase of an equivalent number of EU Allowances (EUAs).

The new regulations were branded as “bullshit” and “a complete waste of effort” by one of Greece’s largest shipowners, George Procopiou, while speaking at an event in Cyprus in October.

“We always go to the shipyard, and we try to improve — through air lubrication and new engines, for example. Although our ships are 11 years old, we order a huge number of assets because the new models are 35% or 40% better in consumption. These are the little steps. The rest is just bullshit,” Procopiou said.