The Israel-Hamas conflict, an ongoing issue since the 1960s, has recently escalated, resulting in significant casualties on both sides. This surge in hostilities has had repercussions on the global supply chain, affecting trade routes and logistics operations in various nations. This situation reflects the experiences of companies during the Russia-Ukraine conflict, which has been ongoing for several weeks now.

As Amit Chavan, Head of Logistics at Raychem RPG Pvt Ltd, remarks: “Hamas War is going to hurt our logistics operations and overall business. Our operations around Mediterranean has been scaled back substantially. We are keeping a close eye on the situation as it has been developing quite dynamically. Looking at the current situation, we anticipate a rise in fuel prices, increasing our logistics spend. Anticipating a high War Risk Surcharge.”

Furthermore, an interesting insight reveals the changing dynamics of this geopolitical turmoil. The cost to ship a 20ft container between JNPT, India, and Haifa, Israel, has surged from approximately $780 to $1350 (approx.). This significant difference in cost is primarily attributed to a new “War Risk Surcharge” nearly doubling freight costs.

The Challenge?

The ongoing Israel-Hamas conflict and the Russia-Ukraine conflict share an unexpected commonality – their impact on global supply chains. As these events unfold, trade routes and logistics operations in various nations are bearing the brunt of geopolitical instability.

➔ In particular, the Port of Ashdod, situated near the Gaza border, has been operating in “emergency mode” due to the risk of potential missile attacks, curbing its capacity to handle hazardous materials (HAZMAT).

➔ Moreover, companies based in and around Haifa are currently operating at near 8 to 11% of their usual capacity. As the conflict escalates, especially if it involves Lebanon, there’s a genuine risk of production grinding to a halt.

➔ In a recent development, analysts have raised concerns over the potential involvement of Iran and Lebanon in a situation that could disrupt the flow through the Suez Canal. This vital waterway is responsible for nearly 15% of global trade, including a significant share of crucial resources. Approximately 45% of the world’s crude oil, 9% of refined oil, and 8% of liquefied natural gas (LNG) tankers pass through this strategic maritime route.

Applying Russia-Ukraine Insights for Resilience!

Amid these challenges, businesses are actively exploring alternative solutions to safeguard their supply chains.

➔ Alternative Routing: One prevalent strategy involves redirecting shipments to alternative ports to ensure uninterrupted deliveries while managing rising costs. Drawing from experiences during the Russo-Ukrainian conflict, they’re applying similar tactics.

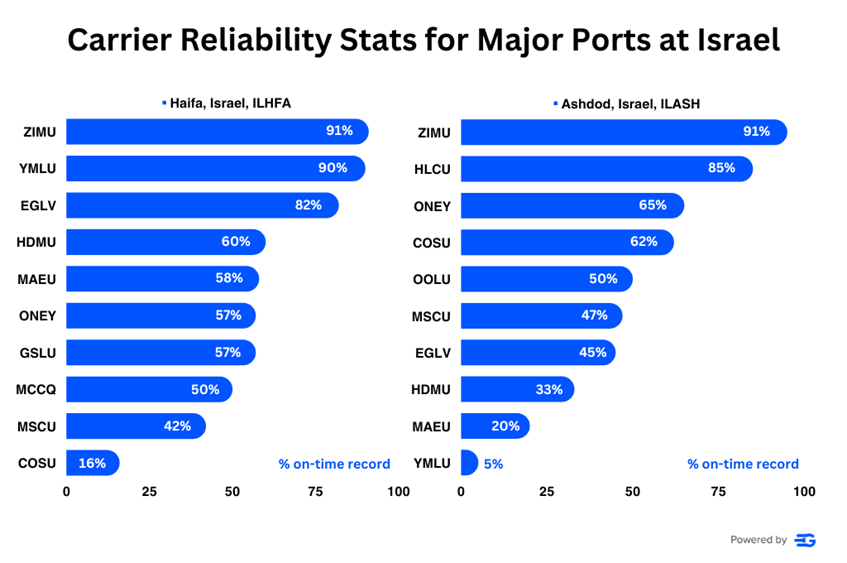

➔ Data Aided Carrier Selection: Choosing a reliable carrier basis on ground data can help supply chains stay on-course despite the conflicts and the ever changing circumstances.

Key carriers like MSC, Maersk, COSCO and OOCL continue to operate with added markup of War Risk Surcharges where more money may not always mean reliability in such times.

Carrier Reliability Data from GoComet

In conclusion, these developments underscore the critical importance of preparedness and adaptability within supply chain management. The ability to swiftly adjust strategies and find alternative solutions becomes paramount in the face of unpredictable disruptions. As the situation in the region continues to evolve, businesses both locally and globally remain vigilant, making strategic decisions to mitigate the impact on their logistics operations.