Vedanta Resources Ltd’s plan to set up a USD 10 billion fund to acquire state-owned firms has attracted interest from sovereign wealth funds and the corpus will be floated once the government invites price for firms such as BPCLNSE -2.25 % or Shipping Corporation of India (SCI), its chairman said. Metals and mining magnate Anil Agarwal’s group has expressed interest to acquire government stake in Bharat Petroleum Corporation Ltd (BPCL) and SCINSE -3.77 %, worth over USD 12 billion.

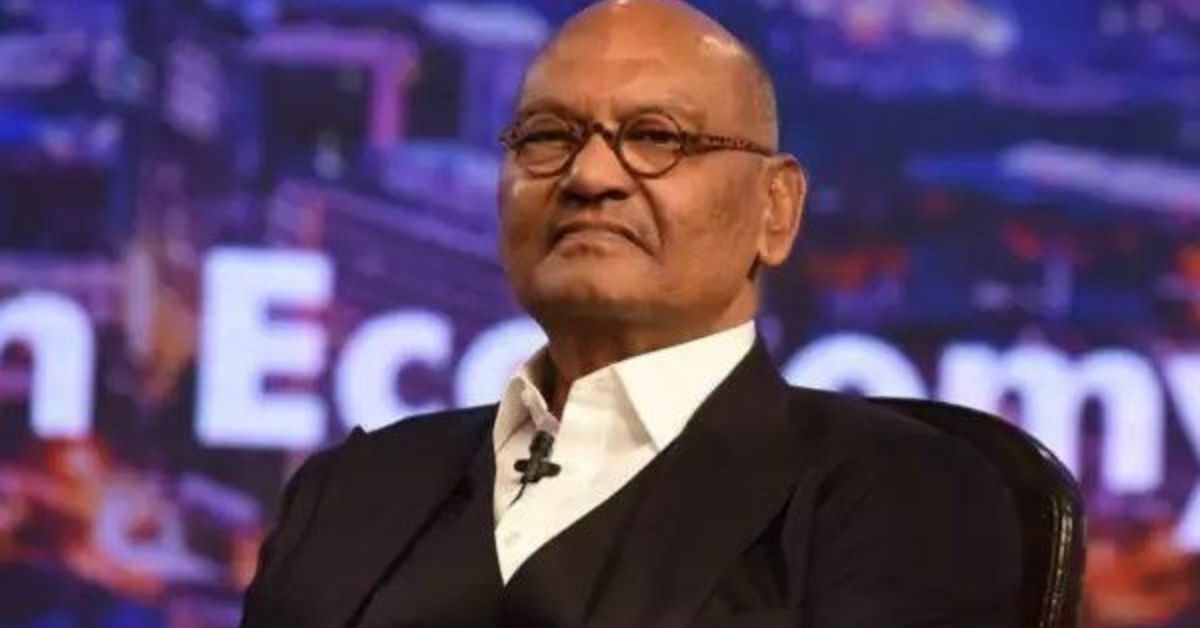

“We are creating a USD 10 billion fund,” Agarwal said in an interview.

The fund will be made of Vedanta’s own resources and outside investment. “We have a tremendous response for this, especially from the sovereign wealth funds,” he said.

The idea is to create a fund with a 10-year life span that will use a private equity-type strategy, buying into companies and boosting their profitability before seeking an exit.

Agarwal had previously stated that Vedanta would team up with London-based firm Centricus to create a USD 10-billion fund that will invest in stake sale of public sector undertakings.

Centricus oversees USD 28 billion in assets.

“They all want me to be the chairman,” he told PTI in the interview.

While Vedanta has completed due diligence of BPCL, the government earlier this month postponed invitation of the price bid for sale of its stake in SCI. The government has not indicated any date for invitation of price bids for BPCL or SCI.

“As soon as the government starts coming out with a disinvestment programme, in no time we can raise. Nobody wants to put in money and pay fees and other costs. All is ready and as soon as the government activates the bidding process, we will move forward. Money will not be a problem,” he said.

Agarwal, who turned a tiny scrap metal business into London-headquartered Vedanta Resources, made a fortune buying state companies and fixing them. In 2001, it acquired Bharat Aluminium Company Ltd (BALCO), followed by the acquisition of the loss-making Hindustan Zinc in 2002-03.

In 2007, it acquired a 51 per cent controlling stake in Sesa Goa Ltd from Mitsui & Co and in 2018 Vedanta snapped up Electrosteel Steels Ltd (ESL), pipping suitors like Tata Steel.

He is now seeking to repeat that success, betting he can spot gems among the dozens of companies being put on the block by Prime Minister Narendra Modi’s government to raise record proceeds.

The entrepreneurial dynamism in India “can be harnessed to unlock incredible transformation in the public sector”, Agarwal said. “We believe that this strategy can, and will, play a crucial role in the country’s ongoing industrialisation.”

Vedanta is also exploring opportunities for zinc, gold and magnesium mines in Saudi Arabia.

Source : Economic Times