After an internal strategic review, it was decided last year to divest the copper mine, run a global sale process to bring in a capable operator and potential owner to evaluate and eventually restart operations at Mt Lyell

Vedanta Ltd has announced that its arm Monte Cello BV (MCBV) has entered into a term-sheet agreement to divest Mt Lyell Copper Mine in Australia. The Indian private miner made the decision to offload stake in the mine last year after a strategic review.

“MCBV, a 100 per cent subsidiary of Vedanta Limited, has entered into a term sheet agreement to divest Copper Mines of Tasmania (CMT) by way of an option agreement with New Century Resources,” Vedanta said in a regulatory filing today.

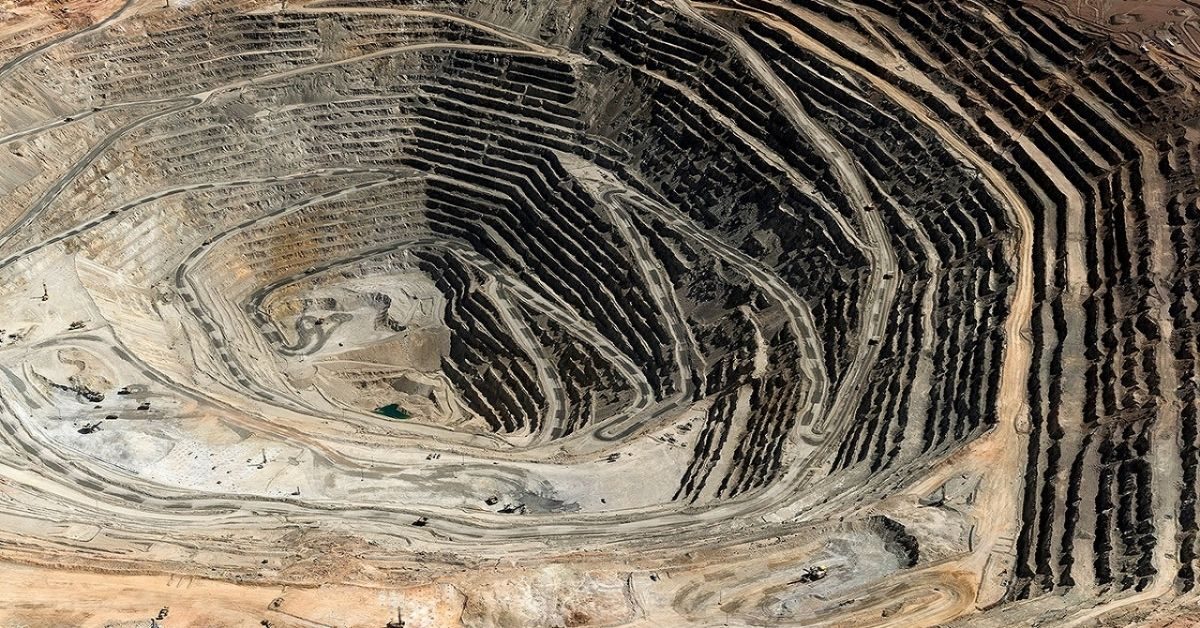

MCBV owns the Mt Lyell Copper Mine entirely, a small copper asset which has been on care and maintenance for the last five years and not strategic for Vedanta with its size and country presence.

After an internal strategic review, it was decided last year to divest CMT, running a global sale process to bring in a capable operator and potential owner to evaluate and eventually restart operations at Mt Lyell, creating value for the community, Tasmanian economy, shareholders and Vedanta, the company said.

Mt Lyell has been operational since the 1890s and was acquired by MCBV in 1999. Under Vedanta ownership, Mt Lyell was successfully operated for over 15 years. The mine was placed into care and maintenance in 2015 following two safety incidents and a depression in the copper market.

“The terms of the Option Agreement include a minimum expenditure commitment of $1 million over the two-year option period by New Century towards development and exploration, plus reimbursement of ongoing care and maintenance activities, with an option of right to terminate after 12 months,” it said.

The transaction is subject to full-form documentation, which are expected to be signed by the end of October 2021.

Source : Live Mint