Importers from London to Warsaw will soon face higher shipping costs, longer delays and an obstacle course of sanctions to navigate as Russia’s widening assault on Ukraine complicates the movement of cargo between Europe and Asia.

President Vladimir Putin’s invasion, and retaliatory steps designed to paralyze the Russian economy, are heaping new disruptions on supply chains that never recovered from unprecedented shocks caused by the pandemic. Beyond the devastating human toll, the war threatens higher costs for fuel, grain, industrial metals, and other raw materials used in Asian-made consumer goods headed for Europe and beyond.

Mediterranean Shipping Co. and A.P. Moller-Maersk A/S, the world’s biggest container carriers, halted bookings for Russian freight, with Maersk on Wednesday warning customers, “this is a global impact, and not only limited to trade with Russia.” Not a good signal for European economies already facing energy spikes, product shortages, clogged ports and the highest inflation since the inception of the common currency more than two decades ago.

“There is still substantial disruption in the supply chain,” said Jennifer Hillman, a Georgetown University professor and a former U.S. trade official. “There is an effort to build resilience but that will take time. With Russia invading Ukraine, we don’t have time.”

Aside from their commodity exports, Russia and Ukraine aren’t big global traders. Russia is the world’s 16th-largest goods exporter, led by petroleum, coal and gas. Ukraine ranks 48th, led by shipments of grain and iron ore, according to 2020 data from the World Trade Organization.

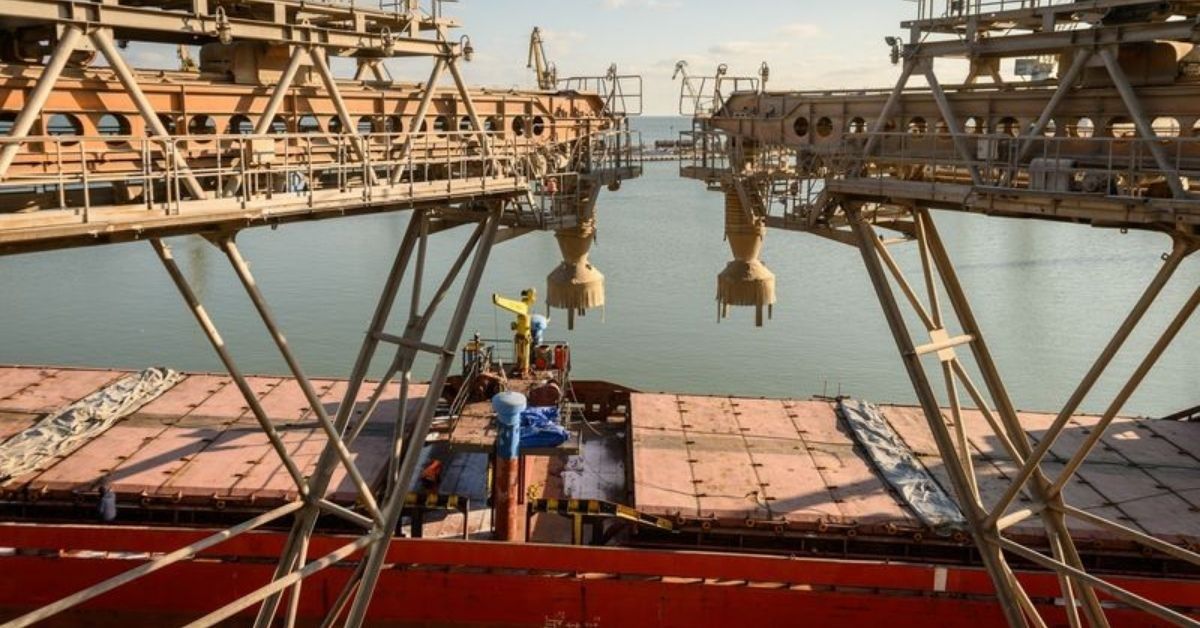

But they are situated along one of the world’s oldest trade lanes, one that China has sought to use for its Belt-and-Road initiative and a route where much of the airspace is now restricted. Meanwhile, container ships can’t access Ukrainian ports and many are trying to avoid Russia’s.

Currently, there’s little if any spare ocean freight capacity to move globally traded goods to absorb even an isolated, regional shock, said Jan Hoffmann, the head of trade logistics at the United Nations Conference on Trade and Development.

“There is no slack in the system so anything that holds up ships anywhere will lead to less capacity,” Hoffmann said.

For cargo between Asia to Europe, that leaves Russia’s rail network — behind only the U.S. and China with its 54,000 miles (87,000 kilometers) of track — as another possible option.

Both Maersk and DB Schenker, the logistics unit of German national railway operator Deutsche Bahn, offer intermodal services — by sea from Asia, then on Russian rail lines to Europe — but even those are coming under new restrictions and sanctions concerns.

“Shying away from sanctions is a key risk,” said Peter Sand, a chief analyst at Oslo-based Xeneta, a freight market-analytics platform. “That means higher prices for bulk shipping, which will make it more expensive to trade and ship around the world.”

There’s anecdotal evidence of train disruptions already. Networking equipment maker Zyxel Communications Corp. has stopped shipping from China to Europe by rail as the conflict threatens to snarl a key land route.

Zyxel, a maker of routers and switches controlled by Taiwan’s Unizyx Holding Corp., suspended freight through the link operated by China Railway about three days ago, President Karsten Gewecke said.

In Asia, some international shipping companies are adjusting their schedules and the conflict means disruption to the delivery of goods is inevitable, according to Gary Lau, chairman of the Hong Kong Association of Freight Forwarding and Logistics.

“The longer the tension lasts, the greater the impact on the entire European logistics chain,” Lau said.

Manufacturing executives such as Ricky Chan, whose Hong Kong-based company makes automotive parts including door handles and mirror shells for global clients, said the crisis may add to transportation constraints that the company was already juggling before the crisis began.

“For our business in Europe, we may face a longer lead time for our logistics,” said Chan, chief executive officer of Jing Mei Automotive, whose manufacturing facilities are based in Guangdong and Hebei.

Even before the crisis began, Bloomberg Economics estimated logistics constraints for China’s manufacturers appeared to be the most severe on record. The United Nations estimates around 41% of global exports are sourced from Asia, making it the world economy’s factory floor.

“This is a moment when corporations will stop taking their supply chains for granted and consumers will begin to understand the costs and inconvenience to satisfying their demands,” said Chris Rogers, a supply chain economist with Flexport Inc. in London.

Transporeon, a logistics platform with offices in nine European capitals, said a protracted war would mean that flights between the Far East and Europe might be rerouted via the U.S., ramping up delays and costs. The pain will be especially acute for U.K. importers, which would suffer more than those in other European countries due to limited capacity at cargo hubs.

Still, the disruptions in air freight may be less than the diversions and congestion on the ground. Though the average flight time has increased compared with the previous two months by about 3%-4% on average, that only translates to about a 20-minute delay, according to Flexport data. On one route, the time rose 8% or about 45 minutes.

“That’s more jet fuel, more carbon emissions and backups at either end at airports in Asia and Europe,” Rogers said. “The rough conclusion is that there’s an impact but it’s not transformative to how air freight is working.”

Source : Bloomberg