Demand from housing, furniture, hospitality and handicraft remains strong, making India a potential market for imported wood products. Limited domestic supplies is driving demand for newer species of imported wood, but exporters should be prepared to start small and be patient

India is not only a major producer of tropical logs in the world, but also one of the largest consumers of wood products. Insufficient domestic production of wood products in India, triggered huge demand for imports. Growing middle class is more interested in luxury goods such as imported furniture. Consumers shopping online are well aware of furniture styles available globally such as kitchen cabinets, flooring, doors, bedroom and living room, kitchen furniture, and window frames. The penetration of e-commerce in rural areas is further fuelling demand for imported furniture. Over the next decade, India is expected to become the world’s next substantial wood fiber import market (second only to China). India is likely to remain, primarily, a log import market. Demand for softwood log imports is forecast to triple by 2021 and demand for teak log imports will more than double.

| India’s Wood Statistics by volume – 2018 | ||||

| Production Quantity

(x 1000 m3) | Imports Quantity

(x 1000 m3) | Domestic Consumption

(x 1000 m3) | Exports Quantity

(x 1000 m3) | |

| Logs(Ind. Round Wood) | 49517 | 4480 | 53989 | 8 |

| Sawnwood | 6889 | 863 | 7742 | 10 |

| Veneer | 295 | 402 | 692 | 4 |

| Plywood | 2537 | 151 | 2657 | 32 |

Meagre growth of forest and tree cover over a period of time and heavy demand are key factors driving the country’s appetite to import large quantities of wood products. The Country’s total forest cover is 7,12,249 sq km which is 21.7 per cent of the geographical area of the country. The tree cover is estimated as 95,027 sq km which is 2.9 per cent of the geographical area. The combined forest and tree cover of the country is 8,07,276 sq km which is 24.6 per cent of the geographical area of the country. The India State of Forest Report 2019 (ISFR 2019) assessment, shows an increase of 3,976 sq km (0.6 per cent) of forest cover, 1,212 sq km (1.3 per cent) of tree cover and 5,188 sq km (0.7 per cent) of forest and tree cover put together, at the national level as compared to the previous assessment i.e. ISFR 2017. The top five States in terms of increase in forest cover are Karnataka (1,025 sq km), Andhra Pradesh (990 sq km), Kerala (823 sq km), Jammu & Kashmir (371 sq km) and Himachal Pradesh (334 sq km).

Recorded Forest Area/ Green Wash (RFA/GW) in the tribal districts decreased by 741 sq km of forest cover. Total forest cover in the North Eastern region is 1,70,541 sq km, which is 65.1 per cent of its geographical area. The current assessment shows a decrease of forest cover to the extent of 765 sq km (0.5 per cent) in the region. Except Assam and Tripura, all the states in the region show decrease in forest cover.

The country has recorded a rise in Mangrove cover by 54 sq km (1.1 per cent) as compared to the previous assessment. The total growing stock of wood in the country is estimated 5,915.76 million cum. The average growing stock per hectare in forest has been estimated as 55.69 cum.

Total bamboo bearing area of the country is estimated as 1,60,037 sq km. There is an increase of 3,229 sq km in bamboo bearing area as compared to the estimate of ISFR 2017. Dependence on forests for fuel wood is highest in the state of Maharashtra, whereas, for fodder, small timber and bamboo, dependence is highest in Madhya Pradesh. It has been assessed that the annual removal of the small timber by the people living in forest fringe villages is nearly 7 per cent of the average annual yield of forests in the country.

India’s wood-based industries face a serious scarcity of raw materials and, increasingly, they depend on non-forest and external sources. The country is a major producer of wood-based products including pulp, paper, plywood, furniture, wooden handicrafts, and veneers. Its major export markets are the EU, US and the Middle East. India is currently the world’s 2nd largest importer of tropical logs.

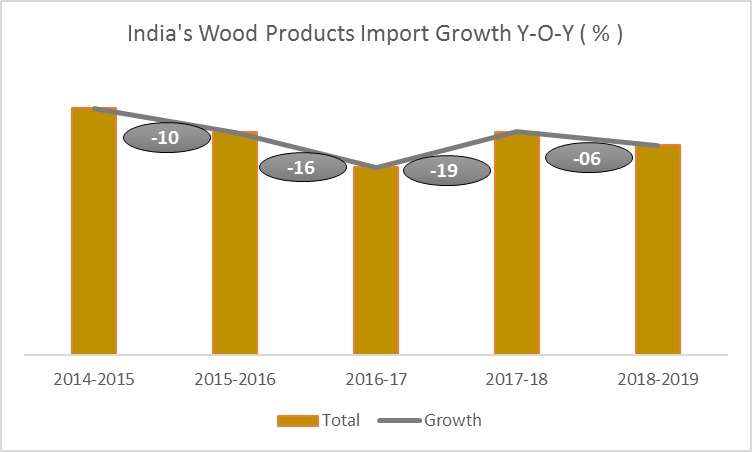

In value terms, India’s import of wood and wood products have witnessed downward trend starting from $ 2.7 billion in 2012 to $ 2.2 billion in year 2018. In value terms, overall Indian imports garnered a negative growth of 13.2 per cent in Nov 2019 versus same month last year. In the current financial year up to Nov 2019, total imports witnessed de-growth of 8.1 per cent against same period last year. In the month of November 2019, value of wood and wood related products registered a dip of 12.2 per cent when compared to same month last year which affected the overall imports during April to November 2019 with 1.5 per cent drop versus same period last year. The market share of US forest product imports has reached record levels in 2018, from a small base. Limited domestic supplies, coupled with booming retail furniture, handicraft and hospitality sectors is driving demand for newer species of wood.

The official wholesale price index for ‘all commodities’ (Base: 2011-12=100) for September 2019 declined to 121.3 from 121.4 for the previous month. The index for the group ‘Manufactures of Wood and of Products of Wood and Cork ‘ declined to 134.0 from 134.1 for the previous month due to lower price of composite panels and sawnwood.

Timber import trade is facing a struggle due to reduction in demand that forced several sawmills to cut production, while high rate of goods and services tax (IGST) and rupee depreciation have eroded their margins. Payment of integrated GST in advance has further added to the woes of the industry. Slowdown in real estate, high GST and depreciation in value of the rupee added to their current woes.

| Top Ten Timber Types Imported by Volume at Kandla in FY 2018-19 | |||

| S No | Timber-Name | Pcs | CBM |

| 1 | MERANTI | 318101 | 354892 |

| 2 | MORA LOGS | 62994 | 205979 |

| 3 | KAPUR | 82248 | 78930 |

| 4 | KERUING | 71671 | 55037 |

| 5 | NYATCH LOGS | 19016 | 37998 |

| 6 | BEECH | 11870 | 20067 |

| 7 | ARAU | 5145 | 15973 |

| 8 | NYTO | 6565 | 13021 |

| 9 | GAUTEMALA | 117376 | 5865 |

| 10 | KEMPAS | 13642 | 5526 |

The demand for wood and wooden articles has plummeted by 20-30 per cent, prompting sawmills and plywood makers to cut production in tandem with the decline in demand. Apart from demand reduction, high GST is something that is worrying the industry at present. 18 per cent IGST is levied on timber imported to the country. Trade is requesting government to reduce it to the rate to 5per cent.

Processing of wood products still dominated by small-scale or “unorganized” sectors, where the majority of wooden furniture, joinery, and other household products are made to order by small workshops or individual artisans. Larger design firms are increasing in number, to serve both the export and growing domestic market for wood furniture and wood interior items. Familiarity with woods other than those found in India and certain tropical hardwoods is low, however, the demand from various sectors such as housing, furniture, hospitality and handicraft remains strong. Nevertheless, the Indian wood industry, artisans, and other wood users are accustomed to teak and other hardwoods that are perceived to be more resistant to termites and decay. Consumers also have a strong preference for dark tropical woods. Teak is typically seen as a benchmark with respect to grade and price, as compared to other wood species. Until recently, the Indian plywood industry was dependent on Myanmar, Indonesia and Laos for its face veneer requirements but that today the industry is turning to African shippers.

Major imported wood species are meranti, teak, and pine. Domestic farmed and plantation timber includes teak, eucalyptus, poplar, spruce, pine, and fir. India imports small quantities of temperate hardwoods such as ash, maple, cherry, oak, walnut, and beech for commercial and home interiors and furniture, some of which is made for export. Wood imports are expected to continue rising, but the move away from logs and tropical woods will likely be slow. Even as Indians become aware of foreign woods, the perceived benefits of importing logs and the cost of foreign woods are often cited as reasons for maintaining the status quo. Nevertheless, India is a potential market for imported wood products, including American species, but exporters should be prepared to start small and be patient.

Timber Special Economic Zone in Kandla

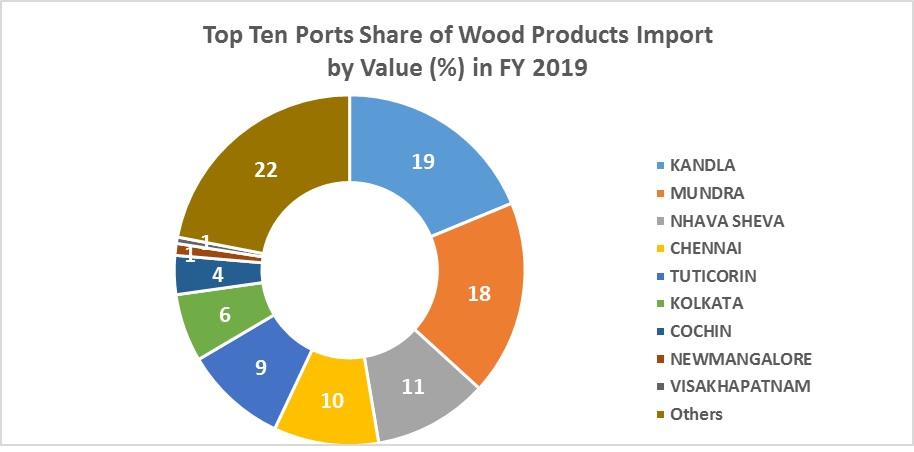

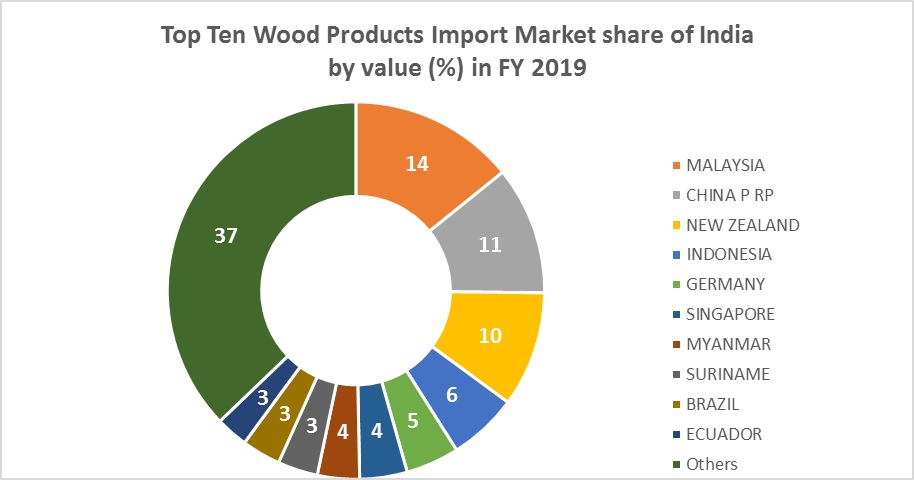

India imports its timber majorly from Kandla, Mundra , Nhava Sheva, Chennai, Kolkata, Tuticorin and Mangalore Ports in both bulk and container vessels coming from Malaysia, China, New Zealand, Indonesia, Germany, South America, Far East, Papa New Guinea, Solomon Islands and Africa. The traders import Pine, Teak, tropical hardwoods, Walnut, Cherry, Hickory and Beech from these countries.

Most of the logs are handled at Kandla because it is considered as gateway to Western India and can dispatch cargo up to Uttar Pradesh, Punjab, Haryana, Bihar, Madhya Pradesh and Andhra Pradesh because of better hinterland connectivity with rail and road. Cargo handled at Tuticorin and Mangalore Ports can serve only Tamil Nadu and Karnataka. Timber is the third largest commodity imported at Kandla after coal and fertilisers. The Kandla Timber Association was established to promote the development and growth of the timber industry in the port town of Kandla and its adjacent areas. Given this large quantity of cargo handled, the Gujarat government accorded permission for four taluks in the Kutch district to be declared as a special timber imports and conversion zone. Kandla imported 3.8 million CBM which is equivalent to 19 million pieces of timber in FY 2018-19.

Kandla has been such a successful zone for receiving and processing timber because most consignee yards are located in the 10-15 km radius from the port minimising transport costs for the importers. More than 60 per cent of all timber imports go to Kandla as the region supports a strong ancillary industry supported by processing plants, saw dust and firewood industry where by-products are used in several fibre board, block board and packaging industries minimizing wastage and maximizing usage.

India remains a key potential market for imported hardwood & softwood logs, lumber and veneer, including American species, but progress in market development is slow. There is a flourishing tourism and hospitality industry across India with the number of hotel chains scaling up the number of properties to smaller cities as air connectivity is growing, providing opportunities for more leisure and business travel.

Another emerging sector with potential is the Indian wooden handicrafts and furniture manufacturing. Increasing certification requirements, restricted and deteriorating quality supply of domestic species is driving Indian trade to look at viable alternative hardwood species not only for domestic furniture and interiors market, but also for re-exports of value added products (handicrafts and tools). Indian exporters of wooden handicrafts and other wood products increasingly face strict traceability norms in the European Union and United States, which is affecting their trade. The norms require disclosure of the source of timber to discourage illegal logging globally. The US hardwood industry is well placed to provide lumber, as most of the hardwoods are sustainable and legally harvested.

Finally, the increase in the overall construction activities including large residential complexes, buildings under affordable housing schemes, business parks and recreational zones are also driving demand for new species of wood.

Log import captures highest share of 42 per cent in overall wood imports, registered negative growth of 15 per cent compared to last year. This year, the import of logs decreased by $196 million. The logs import has been decreasing year on year since last 5 years starting from $1880.45 million. Logs dominate Indian imports, but the share of log imports has come down from 83 per cent in 2007 to 48 per cent in 2018. A favourable tariff structure has supported log imports, but the poor/inadequate level of processing by domestic sawmills has prompted the Indian trade to import higher volumes of lumber versus logs in recent years. The share of US lumber in total exports to India has risen from 3 per cent in 2007 to 42 per cent in 2018. Export of logs presents its own set of challenges like frequently changing Indian phytosanitary requirements, and inconsistent moisture levels due to varying temperatures during transit. This leads to defaults, non-compliance and detention at the ports.

While traditionally a tropical hardwood market, log export restrictions in Myanmar, Malaysia, and other tropical countries have forced Indian manufacturers to look for alternate wood supply sources. A large number of Southeast Asian countries/suppliers of tropical woods are increasingly imposing temporary or permanent logging bans in natural forests following periods of heavy deforestation and over-logging. These bans coupled with the export restrictions of logs and lumber to encourage more processing activities in their own countries are forcing Indian buyers to explore alternate options. As such, a shift is taking place both in imported hardwoods to softwoods, and from logs to lumber. Imports from Malaysia and New Zealand constituted almost 30 per cent of total imports of forest products in 2017. Imports of round logs were the highest in 2017 valued at $637 million mostly from New Zealand (Radiata pine) and Malaysia (Meranti), followed by $367 million worth of teak logs from Ecuador, Costa Rica and African countries.

Second major wood product by value share, Sawn timber imports registered 9 per cent growth in FY 2019 after a big jump of 44 per cent growth in last year. Import of sawn timber has increased by $36 million (9 per cent growth) reaching to $441 million in 2018-19 from $406 million last year. It is noted that rising trend in sawn timber import is continuous phenomenon for India market since 2014-15, and the import value has almost doubled. The data shows the growing potential of imported sawn timber demand in Indian construction and furniture sector. Southern India receives good quantity of imported sawn timber, and traders advocate the growth of imported sawn timber due to its good sawing and kiln quality. Hardwood sawn timber is imported from Malaysia, Vietnam, Myanmar, America and African countries, whereas softwood sawn is shipped from Canada, Europe, American countries.

Particle board imports recorded highest growth of 24 per cent in FY 2018-19 among all other major wood products. Another wood product which is being affected badly is high/medium density fiber board by 6 per cent downfall in FY 2018-19.

The decrease in GST, import duties for wood imports coupled with favourable tariff structure, improvement in domestic sawmills and establishment of southern timber clusters/zones can ease out the contemporary challenges of the industry.